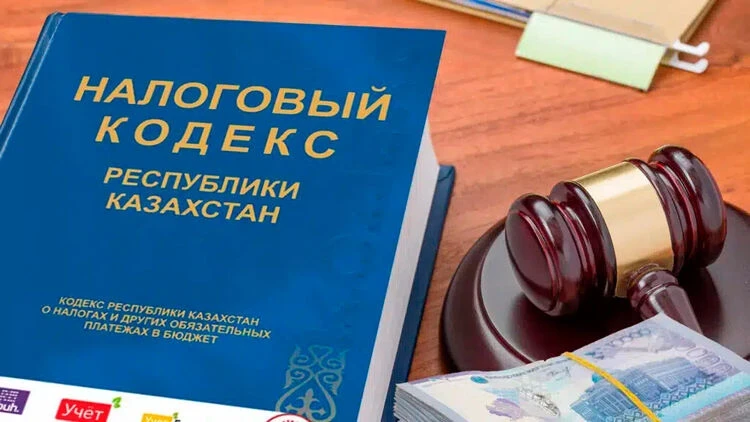

Starting January 1, 2026, a new Tax Code will come into effect in Kazakhstan, and preparations for it have already begun. However, many entrepreneurs in the country express concerns that the proposed changes will negatively impact the middle class and the economy as a whole. Some have even described this document as a "punitive book," claiming that it is part of a "global policy against small and medium-sized businesses."

What specific changes will occur in the tax system of Kazakhstan? The main innovations include:

- an increase in the VAT rate from 12% to 16%;

- stricter requirements for special tax regimes for small and medium-sized businesses;

- the effective exclusion of the possibility of interaction between large and small companies (large businesses will be required to pay taxes for small ones);

- an increase in excise taxes on alcohol and tobacco products;

- the introduction of an excise tax on energy drinks.

Why are Kazakhstan's entrepreneurs dissatisfied?

They argue that they will not be able to adapt to the new conditions and rising costs in a short time.Producers are already warning of a potential increase in food prices, which could range from 30% to 50%.

The tax pressure may have a serious impact on small enterprises in the catering sector, leading to the closure of many of them.

Pessimistically inclined experts predict the loss of thousands of jobs. Small business owners may be forced to take unpopular measures to reduce costs and sustain their operations.

Additionally, Kazakh entrepreneurs are concerned that their products may lose competitiveness outside the country, ceding positions to producers from Kyrgyzstan and Uzbekistan.

Kyrgyzstan is also closely monitoring changes in the tax legislation of its neighbors

If the VAT rate in Kazakhstan rises to 16%, it could lead to an increase in the prices of Kazakhstani products. In turn, this creates new opportunities for Kyrgyz companies, as local product prices will become more attractive to consumers.There is active discussion on social media about the likelihood that Kazakh companies, faced with high taxes and strict regulations, may consider relocating their businesses to neighboring countries. This would allow them to optimize costs and move to more favorable jurisdictions.

If this happens, Kyrgyzstan's economy could significantly strengthen, given that the country's tax system is more stable and focused on supporting local producers.

Regardless of how each country adjusts its tax legislation, both businesses and experts agree that sharp changes in tax policy pose regulatory risks.

This situation may reduce foreign investors' interest in the region, who view Central Asia as a single market.

Kyrgyz entrepreneurs currently have no clear plan: whether to wait for the Kazakh government to correct its mistakes or to actively expand the supply of domestic products to Kazakhstan.