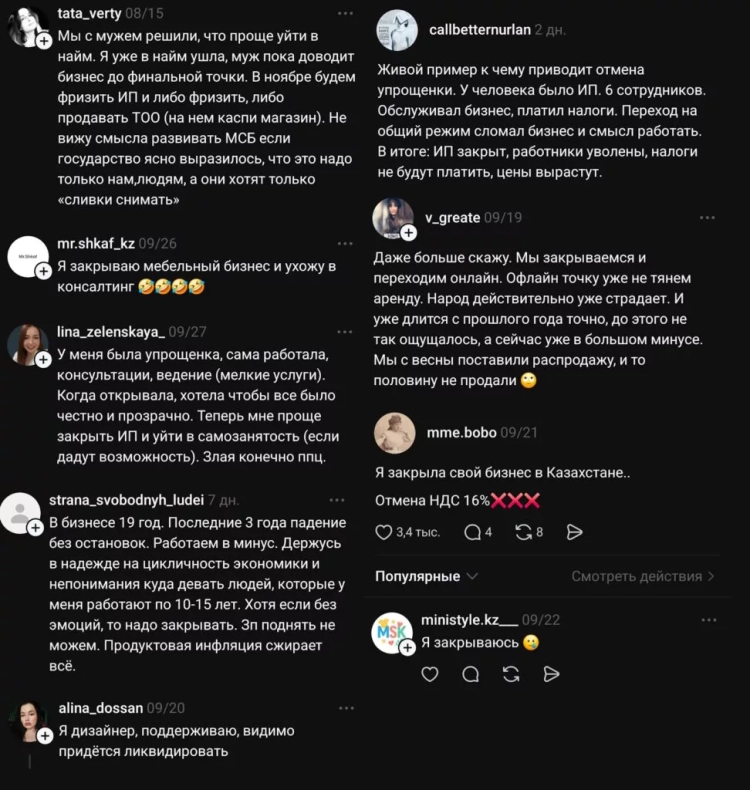

The expected tax reform in Kazakhstan evokes negative feelings among the population, especially among those who are not officials.

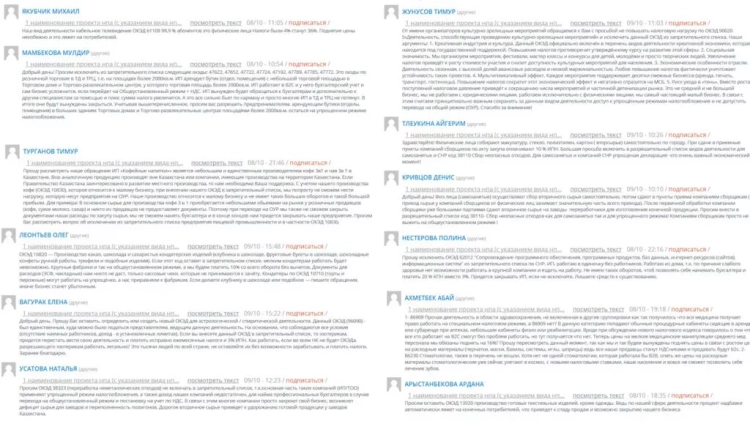

The publication Caravan.kz shares citizens' opinions on the negative consequences and how changes in the tax system are already affecting the country. This project has become one of the most discussed on the "Open PNA" portal, where it is almost impossible to find support for the proposed amendments among the comments.

There are other aspects as well.

Price Increase

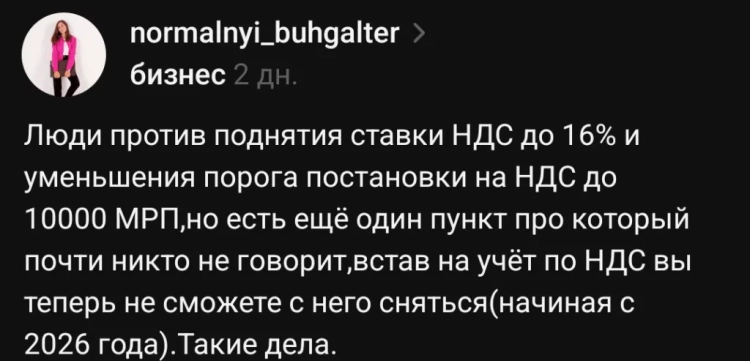

The main concern for most citizens, even those who are not engaged in business, is the potential increase in prices for goods and services.

The tax rate will increase from 12% to 16%, while the threshold for VAT will be lowered, and the simplified taxation system will cease to apply to many types of activities. This will lead to many companies being required to pay VAT and hire accountants to maintain proper documentation, which will ultimately affect consumers.

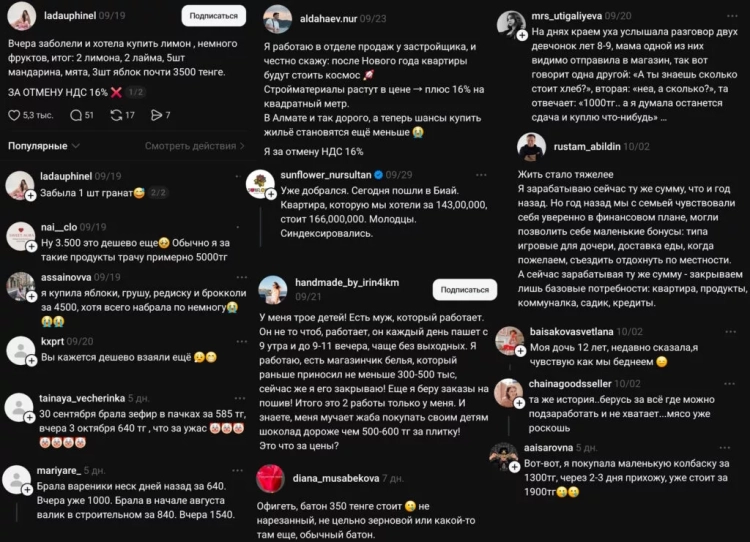

"As for the final cost: you overlook the fact that VAT is paid at all stages of production, logistics, and sales. This can lead to an increase in cost by 15-20%. For example, a basket of groceries costing 20,000 tenge may end up costing 25,000. And this applies not only to goods but also to services, which will ultimately contribute to inflation. Overall, this will bring nothing good."

"How can the increase in VAT and the lowering of the threshold not affect you if you are not an entrepreneur? Everything you buy is purchased from VAT payers. For example, the same chocolate you buy is from VAT payers, so they will raise the price. I can't sell cheaply when everything around is getting more expensive. Prices for everything will rise."

Price increases are already noticeable, and even children feel it.

Some citizens note that prices in Kazakhstan are becoming comparable to European ones, and they also mention Shanghai, which is one of the most expensive cities in China.

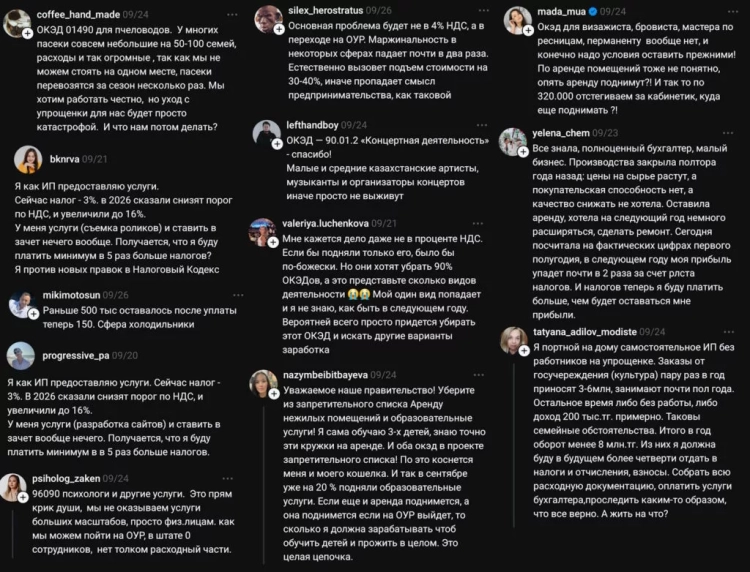

Problems with OKED

The initial list of OKEDs that will not be subject to the simplified tax regime consisted of many items, including socially important areas such as medical and educational services. Despite subsequent adjustments, many items remain on the list.

The reasons for choosing such OKEDs were explained by their focus on large businesses and B2B. This can be understood in the case of industries like space technology or heavy industry, but many other categories raise questions.

"We found ourselves on the list of organizations without simplified taxation. Educational services, correctional center. What are we to do? Colleagues, the situation requires a solution. We cannot raise prices, salaries are not increasing. Parents are already struggling. Our service consists entirely of salaries, and employees are asking for a raise due to rising food prices."

"My individual entrepreneur (correctional center for children with developmental difficulties) serves clients who seek help for their children. If the availability of services decreases due to tax changes, how will parents be able to help their children? How can we burden socially important activities with taxes?"

"This is a disaster. Even the production of wheelchairs for the disabled has been included in the list. There are many services needed by people with disabilities. This is just terrible."

"The responsibility for passing this law lies with us. The mining sector is exempt from VAT, while I, as a teacher, have to pay VAT from my small business. How could a law be signed that forces small businesses to pay taxes while large corporations do not?"

Mass Closures

Many entrepreneurs express concerns that their low margins will not allow them to continue their business. We are talking about hundreds and even thousands of small and medium-sized companies that may close.

This will lead to an increase in the unemployment rate and a rise in social payments. Tax revenues to the state budget will also decrease, as closed companies will stop fulfilling their obligations.

Reference from "Karavan": similar changes were made to the tax code 30 years ago, in April 1995. As a result, from April 1, 1995, to September 1, 1996, nearly a million individual entrepreneurs and partnerships closed in Kazakhstan.

There may also be an increase in the number of labor migrants, as trips to strawberry fields in Europe are becoming increasingly popular. Young people from Kazakhstan, unable to find decent work, will be forced to seek earnings abroad.

"Hundreds of thousands will be left without jobs. If now citizens choose between low-paying jobs while waiting for a more suitable one, in the future they will be fighting for any job. I am currently in Egypt and see men aged 30-40 washing dishes and sweeping floors, glad to have a job. The whole country will be trying to work abroad. We will compete with Kyrgyz and Uzbeks for the opportunity to deliver food to Russians."

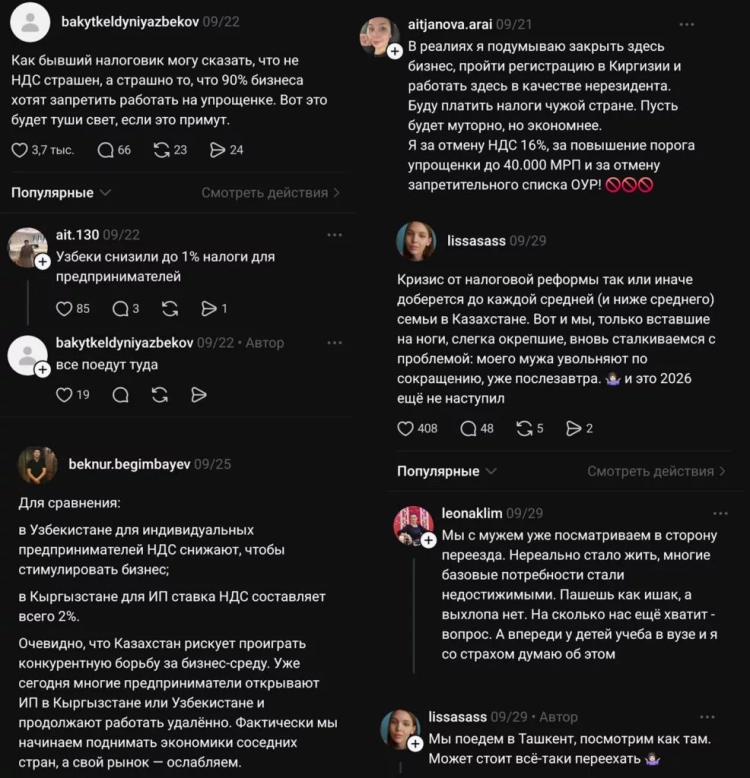

Many are considering relocating their businesses to other countries. Some have already received offers to move from foreign companies, especially in the garment industry.

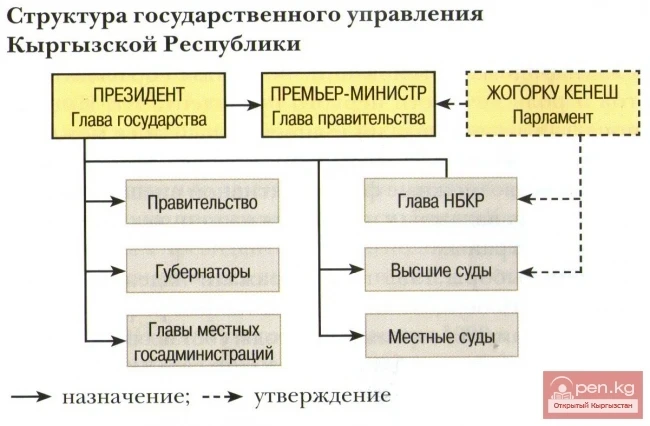

"Yes, they will play themselves out, and all entrepreneurs will transfer their enterprises to other jurisdictions. To Kyrgyzstan or Uzbekistan. The movement has already begun."

The prospects for the private sector look bleak.