A new update in the "taxpayer's cabinet" was presented at the State Tax Service

Previously, there was a possibility that users could submit a report to another district without having business registration there. Now, the system prevents such errors by not allowing documents to be submitted to an inappropriate district.

As part of this update, the system automatically checks registration data and directs reports to the corresponding district, which helps improve the accuracy and correctness of tax accounting.

If the taxpayer does not have registration in the district where they are trying to submit a report, the document will not be saved or sent. This restriction has been implemented to minimize the risks of errors in reporting and the need for subsequent clarifications.

To ensure the correct operation of all services in the "taxpayer's cabinet," it is recommended to check the relevance of registration data in all districts where activities are carried out in advance.

Read also:

Re-registration of Individual Entrepreneurs now takes up to 10 minutes

In Kyrgyzstan, the tax service has launched a new online service for the re-registration of...

Change the legal address or tax regime of an individual entrepreneur online. Instructions from the State Tax Service

In Kyrgyzstan, a new online service for the re-registration of individual entrepreneurs has been...

The taxpayer's cabinet is used by 1 million 521.6 thousand taxpayers – GNS KR

According to the State Tax Service, as of December 16, 2025, 1 million 521.6 thousand taxpayers...

Liquidation of Individual Entrepreneurs: Legal Nuances You Should Know

The State Tax Service of the Kyrgyz Republic has announced the start of the procedure for the...

SFS: "The Taxpayer's Cabinet" is used by 1 million 521.6 thousand people

As of December 16, 2025, the Tax Service of the Kyrgyz Republic reported that 1 million 521.6...

GNS: The Taxpayer Cabinet is used by 1,521,600 taxpayers

As of December 16, 2025, the State Tax Service of Kyrgyzstan reported that 1 million 521.6...

How to Close an Individual Entrepreneur in Kyrgyzstan? Instructions from the State Tax Service

Those who have ever run a business or interacted with tax authorities in Kyrgyzstan know that the...

Digitalization of the State Registration Service: Online Re-registration Service for Individual Entrepreneurs Launched

Individual entrepreneurs no longer need to visit the tax office in person The State Tax Service of...

About 1.5 million citizens of Kyrgyzstan use the "Taxpayer's Cabinet"

The press service of the State Tax Service (STS) reported a significant increase in the number of...

Expanded list of NGOs required to submit consolidated information to the Tax Service

The State Tax Service of the Kyrgyz Republic has announced a significant expansion of the list of...

"Kyrgyz citizens abroad do not need to register with the consulate to participate in the voting, - CEC"

The Central Commission for Elections and Referendums (CEC) informs the citizens of Kyrgyzstan, both...

About 1.5 million Kyrgyz citizens use the online Taxpayer's Cabinet

Mirlán Rakhmanov noted that the tax service is moving towards transforming into a service-oriented...

The Tax Service of Kyrgyzstan has implemented an online re-registration service for individual entrepreneurs.

The State Tax Service of Kyrgyzstan has launched a new online service that allows individual...

The authorities made changes to the decree on support for small businesses and tax control

The President of the Kyrgyz Republic, Sadyr Japarov, has signed a new decree that amends the...

Registration of legal entities and branches in the Kyrgyz Republic is proposed to be conducted under new rules

The government of Kyrgyzstan has presented a draft resolution concerning a new procedure for the...

About 1.5 million citizens use the Taxpayer's Cabinet

The Deputy Chairman of the State Tax Service (GNS), Mirlan Rakhmanov, shared information with...

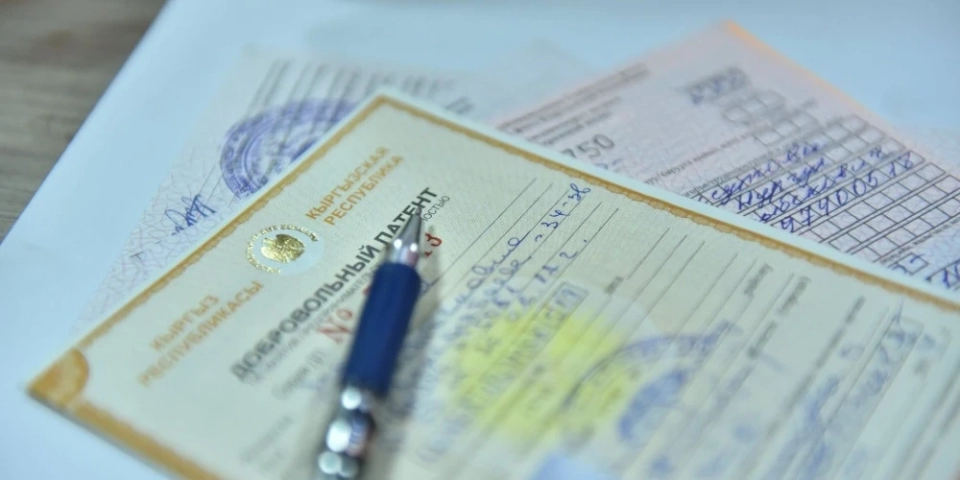

In Kyrgyzstan, tax registration for patent workers has been simplified

In Kyrgyzstan, changes have occurred in the tax registration process for individuals working under...

A Unified System for Accounting Breeding Farms Developed in Kyrgyzstan

According to information from the Ministry of Water Management and Agriculture, a "Unified...

"Salyk Service" implemented AI and simplified tax reports for citizens

The State Enterprise "Salyk Service" announced important results of its work over the...

Artificial Intelligence Used in Tax Audits in Kyrgyzstan

According to information provided by the press service of the State Tax Service, in 2026, the State...

The procedure for re-registering individual entrepreneurs in the KR has been simplified

In Kyrgyzstan, the procedure for re-registering individual entrepreneurs (IE) has been simplified...

Expanded list of NGOs required to submit consolidated information to the tax authorities

Consolidated information must be submitted to the State Tax Service no later than April 1 of each...

Elections for Deputies of the Jogorku Kenesh. Kyrgyz citizens abroad will be able to vote remotely.

The Central Commission for Elections and Referendums of the Kyrgyz Republic announces the upcoming...

How to Re-register a Car Online? Procedure for Registration

The State Center for Vehicle Registration and Driver Licensing, which is part of the Presidential...

What is needed to terminate an individual entrepreneur's activity: a step-by-step guide

The State Tax Service has provided information on how to properly terminate the activities of an...

GNS: Citizens Need to Check Property Data Due to the Implementation of Automatic Tax Assessment

Changes in the Tax Code now allow tax authorities to independently determine the amount of...

In Kyrgyzstan, it is proposed to grant the status of "village" to 10 settlements (list)

In the Kyrgyz Republic, an initiative is being discussed to grant the status of "village"...

Adylbek Kasymaliev presented the results of two key reforms in the field of digitalization of medicine and business simplification.

One of the reforms was the improvement of access to guaranteed medical services for citizens,...

How to Register an Individual Entrepreneur through the Taxpayer's Cabinet?

How to register as an individual entrepreneur through the Taxpayer's Cabinet? This question...

Taxpayers on a Patent Are No Longer Required to Visit Tax Authorities

Changes have occurred in the tax registration process for taxpayers using patents in Kyrgyzstan....

In Kyrgyzstan, taxpayers on a patent are exempt from visiting the GNS.

The State Tax Service of the Kyrgyz Republic has announced the simplification of the tax...

The Tax Service Explained How to Terminate the Activities of an Individual Entrepreneur

The State Tax Service of Kyrgyzstan has provided information on how to terminate the activities of...

The Cabinet of Ministers reduced the registration period for sports educators from 30 to 15 days

The Chairman of the Cabinet of Ministers of Kyrgyzstan, Adylbek Kasymaliev, signed Resolution No....

Taxes, Cars, Transactions, and Benefits: The Cabinet Introduced Major Amendments to the Laws

The government of the country has submitted a draft law to the Jogorku Kenesh concerning amendments...

The State Center for Vehicle Registration Will License Driving Schools

The State Center for Vehicle Registration and Driver Training, which is subordinate to the...

Markets and shopping centers are required to monitor entrepreneurs and report to the State Tax Service.

In Kyrgyzstan, a new law has been adopted that significantly changes the rules of tax regulation....

Tax Service of the Kyrgyz Republic: Online Re-registration Service for Individual Entrepreneurs Launched

Now individual entrepreneurs have the opportunity to submit applications for re-registration at...

The Ministry of Agriculture plans to create 385 processing enterprises by 2030

- The Ministry of Water Resources, Agriculture, and Processing Industry is working on the...

There will be no more green and red books. They have been replaced with a document that will be in Tunduk.

According to the new Land Code, the cadastral plan is now the main document confirming rights to...

The Tax Service of Kyrgyzstan explained who should use KKM, ETTN, and ESF

ETTN National taxpayers selling the specified goods must use ETTN during their turnover. This...

Famous Blogger Featured in KR Tax Service Video

The head of the STS also appeared in the video Kanat Shabdanbek uulu, a popular blogger known for...

The Ministry of Economic Development proposes to adjust the rules for calculating the "risk base" for VAT on imports from the EAEU.

The Ministry of Economy presented a draft amendment to the Cabinet of Ministers' Resolution...

Lagoon of Tales and Valley of Elephants

At ten thirty, our mini-plane landed, and we were flying over the Kalahari once again. From this...