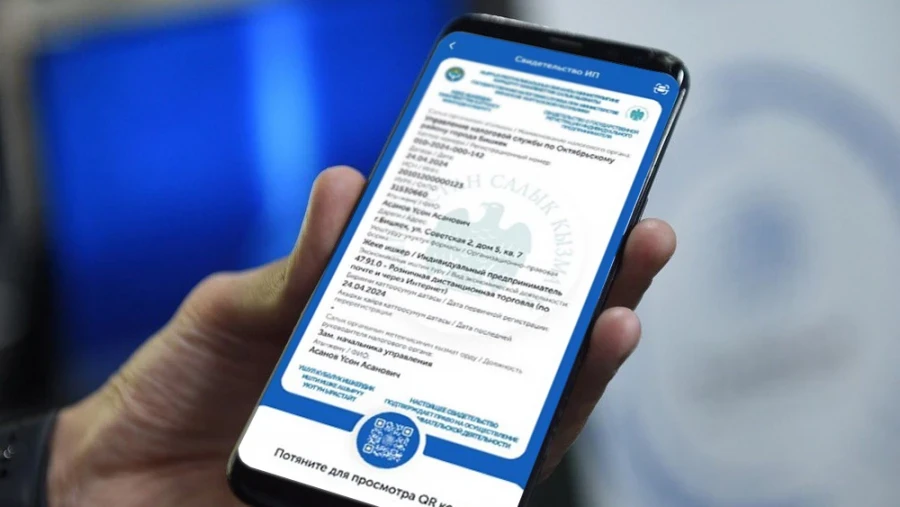

The State Enterprise "Salyk Service" announced important results of its work over the past four years. The leading outcomes include the complete digitalization of tax reports and the implementation of remote tax payments through the platform cabinet.salyk.kg and the Salyk mobile application. Additionally, the service has begun to use artificial intelligence for data analysis, which has significantly increased operational efficiency. Plans for 2026 include the integration of AI into tax audit processes, which should enhance transparency and automate procedures.

The director of the State Enterprise "Salyk Service," Shamshybek Kachkynbai uulu, noted that digital technologies have significantly reduced the time citizens spend on preparing reports, submitting declarations, and communicating with tax authorities. The main task of the service is to eliminate all possible inconveniences for taxpayers, making the process as simple and convenient as possible.

According to the World Bank, in 2025, tax payment in Kyrgyzstan was recognized as the fastest among all countries, which became possible due to the implementation of digital solutions. Previously, according to the bank's information, tax calculation took seven times longer than the payment itself, but the new system has significantly improved this indicator.