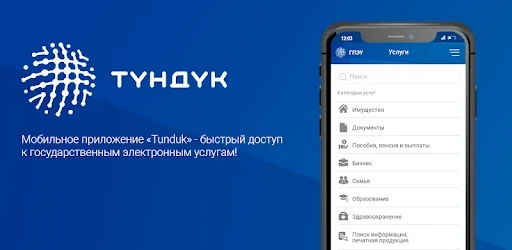

More than 30,000 Kyrgyz citizens have imposed a self-ban on loans through the "Tunduk" app

This service is available through the "Tündük" application. When the restriction is activated, if a user attempts to apply for a loan at a bank or online service, the system checks their data with credit bureaus and automatically blocks the issuance of the loan.

To date, more than 30,000 citizens have already used this service by setting up a self-restriction through the "Tündük" application. This mechanism is available to all citizens, regardless of whether they have had loans in the past. Those who do not have the application are advised to contact credit bureaus with their passport and a corresponding application, as reported in a live broadcast by Erkin Mamatibraim uulu, head of the consumer rights protection department of the National Bank, and Azamat Tilenbaev, chief information security administrator.

As they explained, the presented system helps citizens protect themselves from fraudsters who previously used calls or suspicious links to access financial data. Additionally, it provides time for reconsidering decisions: to cancel the self-restriction, it will take approximately 12 hours. The restriction applies to all citizens, regardless of their credit history, and for those without the "Tündük" application, there is an option to contact credit bureaus with their passport and application.

Experts from the National Bank emphasize that this service is particularly relevant for elderly people and those who seek to protect themselves from financial fraud and unwanted loans obtained through online services.

Read also:

In Kyrgyzstan, over 19,000 people have imposed a self-ban on obtaining loans

From November 1 to 7, over 19,000 people in Kyrgyzstan used the new self-restriction mechanism for...

Self-Ban on Lending. How Many Kyrgyzstanis Have Already Taken Advantage of This Opportunity?

Starting from November 1, residents of Kyrgyzstan have been given the opportunity to impose a...

Starting November 1, citizens will be able to impose a self-ban on credit.

Starting from November 1, 2025, citizens will be able to use the self-restriction function on...

Self-Ban on Loans in the Kyrgyz Republic Has Started. How to Protect Yourself from Fraudsters and Free Loans

Starting from November 1, residents of Kyrgyzstan have the opportunity to establish a self-ban on...

Zhamangulov presented the "Self-Ban on Lending" feature in Tunduk - video

At the press conference, the Minister of Digital Development and Innovative Technologies of the...

Self-ban on loans comes into effect on November 1: how it works

Photo 24.kg Starting from November 1, 2025, citizens of the Kyrgyz Republic will have the...

In Kyrgyzstan, the self-ban on loans will come into effect on November 1.

According to Aliyev, the self-ban mechanism will be activated through the Tunduk application, and...

Already 19 thousand Kyrgyz citizens have imposed a self-ban on loans

In early November, more than 19 thousand citizens of Kyrgyzstan used the mobile application...

The Central Bank named the main reasons for introducing the self-ban mechanism on loan issuance.

The Deputy Chairman of the National Bank, Bektur Aliyev, announced at a press conference in Bishkek...

Kyrgyzstanis can now impose a self-ban on loans - how to do it

To activate the self-ban mechanism on lending, you can use the Tunduk application. Starting from...

Commercial banks have responded positively to the introduction of a self-imposed credit ban for citizens, - Deputy Chairman of the NBKR Aliyev

On October 30, in Bishkek, during a press conference, Deputy Chairman of the Board of the NBKR...

Self-ban on loans will protect Kyrgyz citizens from financial fraud – NBKR

In order to protect citizens from fraudulent activities on the internet, the National Bank of the...

Self-Ban on Lending. Why It Is Necessary and How to Establish It (Complete Guide)

According to information from the Ministry of Digital Development, a self-ban on lending is a free...

The National Bank Warned About Widespread Financial Fraud Schemes

- In a live broadcast, Anara Sabyrbek kyzy, the chief specialist of the financial literacy group at...

The self-ban on credit can only be lifted after 12 hours, - Minister Zhamangulov

- The self-ban on credit can only be lifted after 12 hours. This statement was made by the Minister...

Fraudsters Target "Tündük". The Ministry of Internal Affairs Urges Citizens to Stay Vigilant

Recent reports indicate that scammers are using WhatsApp to call citizens of Kyrgyzstan, posing as...

Most cases of fraud in Kyrgyzstan occur due to the gullibility of citizens, - Union of Banks

- On the air, Rustam Sarybaev, head of the Academy of Sustainable Development at the Union of...

At the request for a driver's license, it can be shown in the "Tündük" app.

In the "Tündük" application, driver's licenses have the same legitimacy as their...

Driver's licenses can be replaced online

In Kyrgyzstan, a transition to the digitization of the process of obtaining driver's licenses...

About 1.5 million citizens of Kyrgyzstan use the "Taxpayer's Cabinet"

The press service of the State Tax Service (STS) reported a significant increase in the number of...

NBKR updated lending rules: self-restriction on loans through the government portal will take effect on November 1

- The National Bank of Kyrgyzstan, according to resolution No. 2025-P-12/55-3-(NPA) dated October...

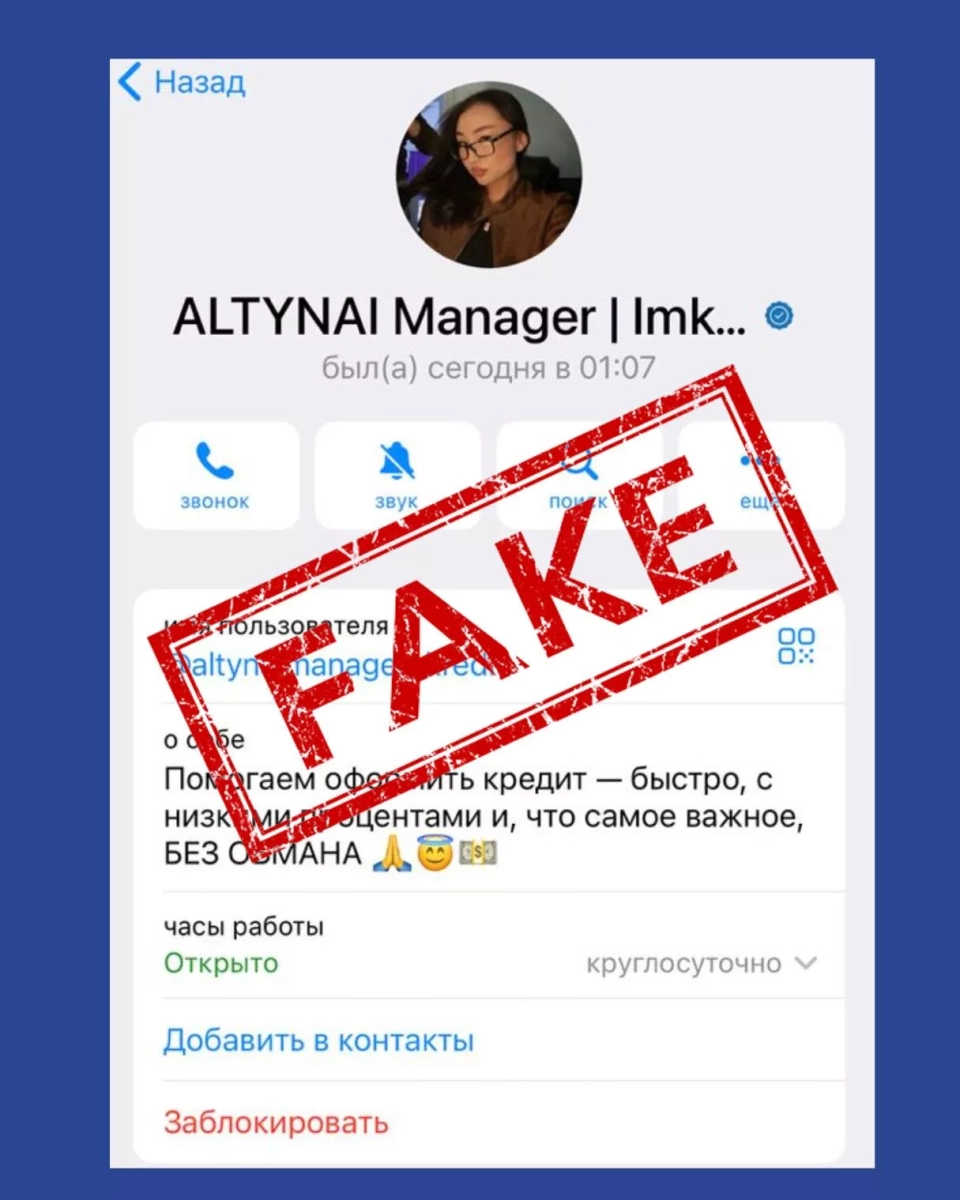

Fraudsters impersonating the National Bank promise citizens preferential loans

Citizens of Kyrgyzstan are receiving messages from unknown individuals via the Telegram messenger,...

Near the "Ak Zhol" checkpoint, exchange points were dismantled. The NBKR named the reason.

- In a live broadcast on the platform of the National Bank, Ravshanbek Murzaliev, head of the group...

In Kyrgyzstan, new convenient features for citizens have been added to the electronic queue system

New features have been implemented in the electronic queue system in Kyrgyzstan, which works in...

The Kyrgyz language is now available in Google Translate!

The translation feature for the Kyrgyz language has officially appeared in the most popular online...

The tourist service Go Bus has updated its app

The Go Bus tourist service provides its clients with safe and convenient travel conditions. The...

Two new medical online services have become available in the Tunduk app

The Ministry of Digital Development and Innovative Technologies of Kyrgyzstan has announced the...

Through the "Gifts-Darmek" app, you can report inflated prices on medications, - DLO

The head of the information and technical support department of the Department of Medicines and...

"Kyrgyz citizens abroad do not need to register with the consulate to participate in the voting, - CEC"

The Central Commission for Elections and Referendums (CEC) informs the citizens of Kyrgyzstan, both...

"Every Kyrgyzstani can search for medications through the mobile application 'Dary-Darmek,' - DLO"

The head of the information and technical support department of the Department of Pharmaceuticals...

Elections to the ЖК: Today is the last day for Kyrgyzstanis to check their names on the voter list

As of today, the deadline for residents of Kyrgyzstan to check their registration on the voter...

The Ministry of Internal Affairs once again reminded citizens about cases of telephone fraud

The Ministry of Internal Affairs of the Kyrgyz Republic once again reminds about the spread of...

In November, migrants need to register digitally in Moscow and the Moscow Region

According to information published on the official website of the State Duma, the deadline for...

NBKR updated 19 regulatory acts on credit risks and Islamic financing

- The National Bank of Kyrgyzstan, according to the resolution dated October 23, 2025, has updated...

About 1.5 million Kyrgyz citizens use the online Taxpayer's Cabinet

Mirlán Rakhmanov noted that the tax service is moving towards transforming into a service-oriented...

A mobile application has been developed for women who have faced violence

A new mobile application called SOS Universal has been launched, developed for women who have...

In September, more than half of the volume of bank loans in Kyrgyzstan were issued for a term of over 3 years

- In September 2025, more than half of the volume of bank loans in Kyrgyzstan was issued for a term...

The mortgage company increased its capital to 87.5 billion soms – president

During the opening ceremony of the residential complex "Asman Residence-4," held in the...

Digitization of Diplomas: A New Online Service is Being Implemented in Kyrgyzstan

The Ministry of Science, Higher Education, and Innovations, in collaboration with JSC...

Caution! Fraudsters impersonating the National Bank of Kyrgyzstan promise citizens preferential loans

Unknown individuals are offering services for obtaining preferential loans with enticing...

The Bank of Russia will consider large transfers to oneself as a sign of fraud.

The Central Bank of Russia plans to amend its list of fraud indicators by adding large transfers to...

In the "Gifts-Darmek" app, you can report inflated prices on medications

The mobile application "Dary-Darmek" provides users with the ability to report inflated...