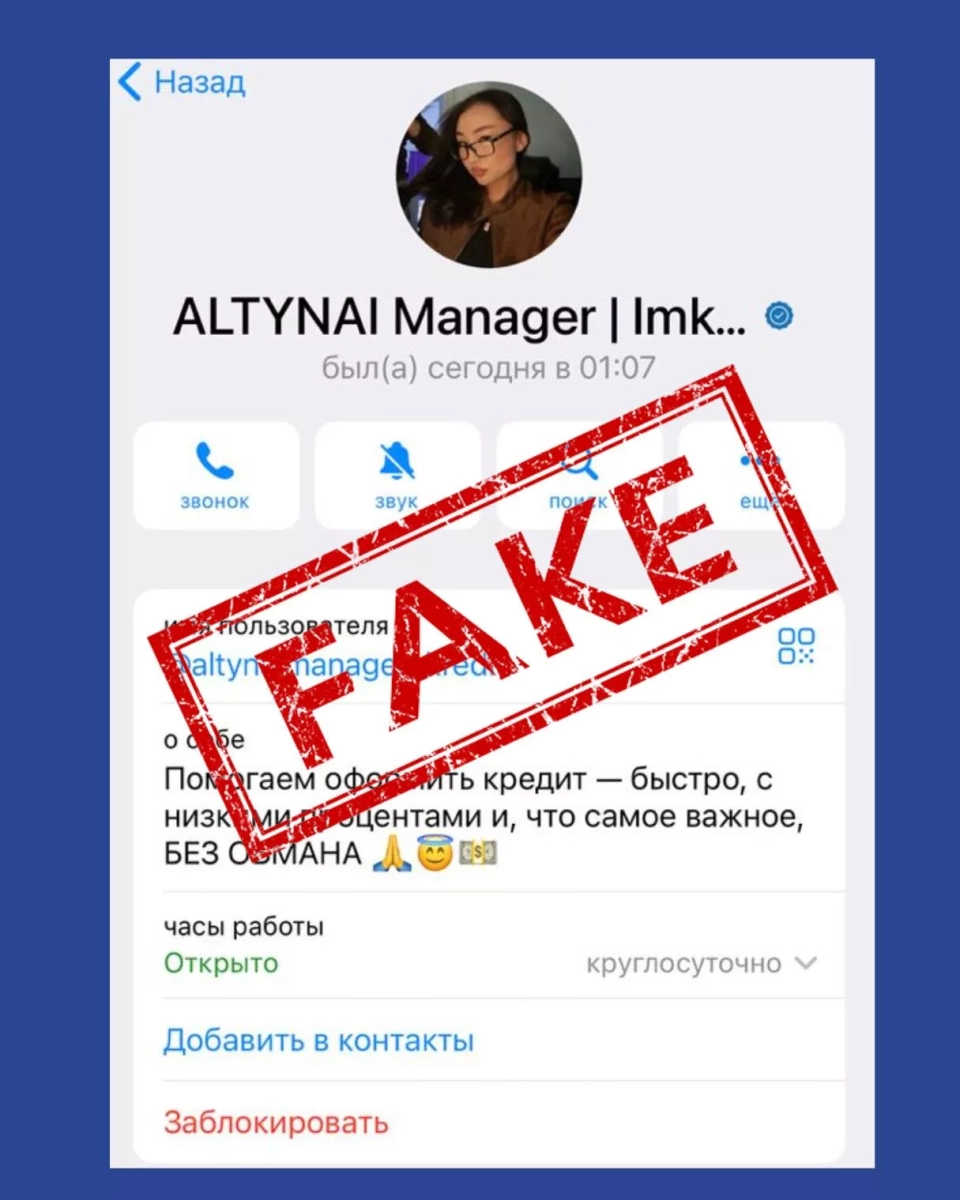

The answer is simple: it protects against internet fraudsters who may use your personal data to obtain a loan. Unfortunately, such cases are not uncommon, and government agencies have developed a method to avoid financial problems and protect personal data.

A self-ban on loans is a mechanism that allows citizens to independently limit their ability to obtain loans through online services. This tool helps avoid unnecessary debts and protects against fraud (for example, if someone tries to take out a loan in your name).

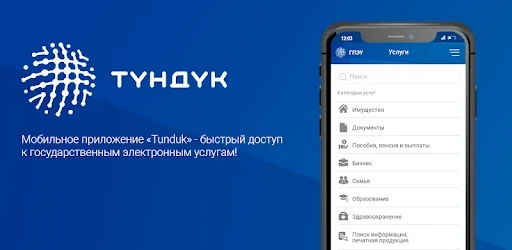

The National Bank of Kyrgyzstan, together with the Ministry of Digital Development and the "Tunduk" system, developed this mechanism. Next, we will explain how to properly set up a self-ban.

Citizens can set or remove the self-ban remotely and free of charge through the State Portal of Electronic Services and the "Tunduk" mobile application at any time.

What to start with?

If you do not yet have the "Tunduk" app, you can download it through:- Google Play;

- App Store.

Ready? Then let's proceed to setting up the self-ban!

What to do next?

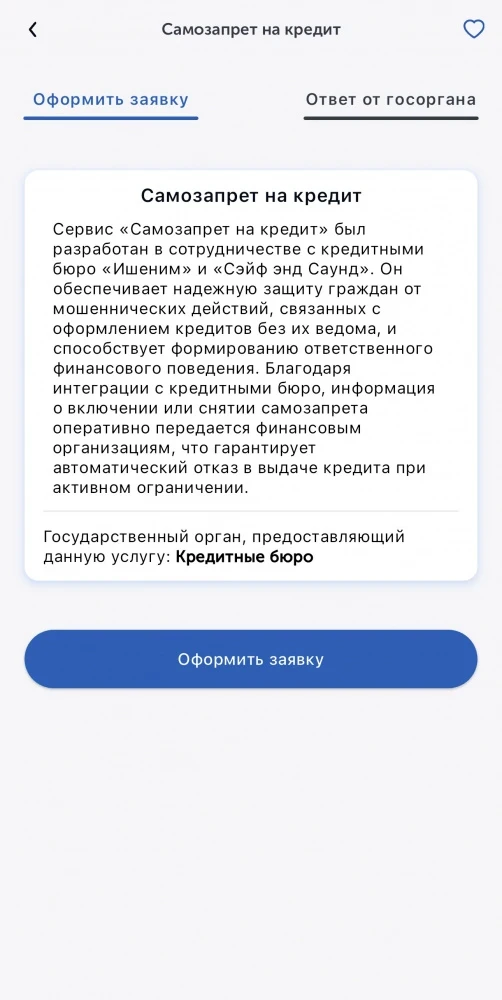

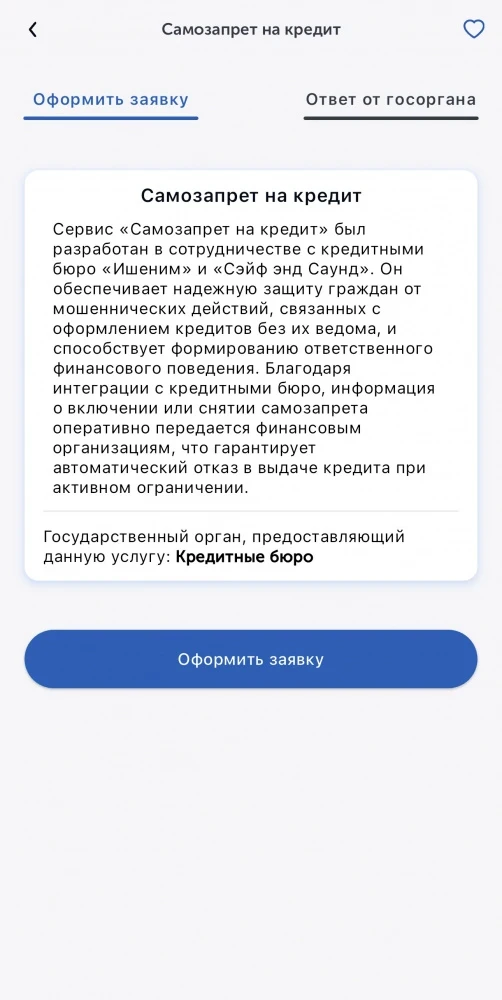

On the main page of the "Tunduk" app, in the "Recommended Services" section (in the bottom right corner), find the item "Self-Ban on Credit." Go to this section.

Setting the Ban

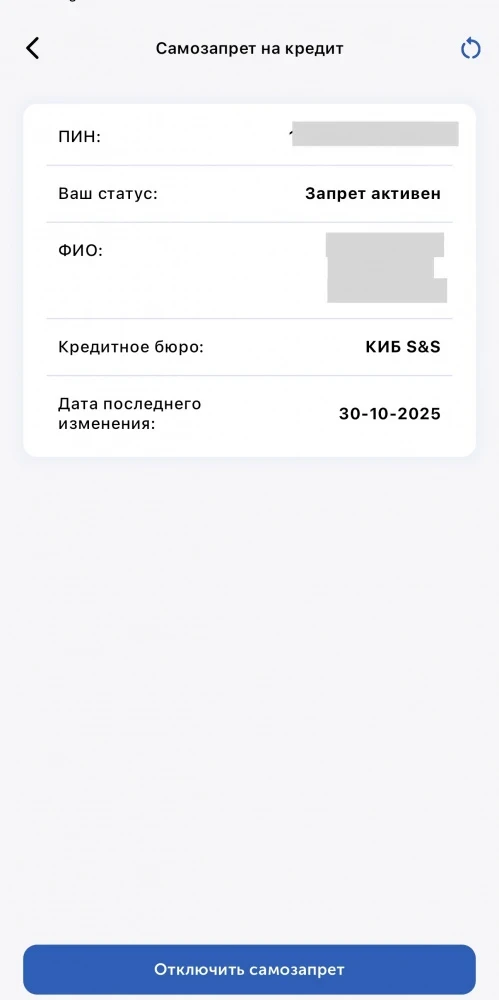

Select the "Self-Ban on Credit" option and click "Submit Application."

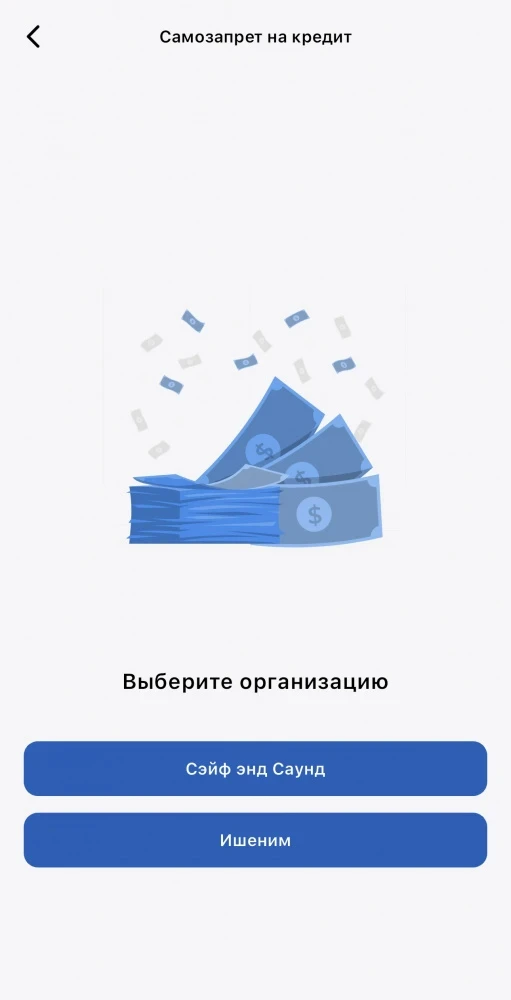

Next, choose one of the credit bureaus (KIB "Isheni" or KIB "SES") that will process your information.

It doesn't matter which one you choose; both bureaus keep records of the credit histories of clients of financial organizations. After making your choice, you will be directed to a section where your data will already be filled out.

That's it! Now just click "Activate Self-Ban."

The protection is activated instantly.

What are the benefits?

This mechanism gives citizens time to make informed decisions.All financial institutions, including online services, are required to check for the presence of a self-ban before issuing loans. If a loan is issued with an active self-ban, such a contract is considered invalid, and the citizen is not obliged to fulfill it, and the lender has no right to demand repayment.

Thus, if you have a self-ban in place and someone takes out a loan in your name, you will not be held responsible for it — that falls on the financial organizations.

Can the self-ban be canceled?

Yes, of course. To do this, you need to go back into the "Tunduk" app, select the "Self-Ban on Credit" service, choose a credit bureau, and click "Remove Self-Ban." The removal will be automatically processed within 12 hours.However, if you want to cancel the removal, you can reopen the service within 12 hours after submitting the application and click "Cancel Application."

This will give you the opportunity to take your time with the decision.

Thanks to the integration with the "Tunduk" state services portal, the norms of legislation on the protection of personal data are observed, and the information is recorded in a separate registry, without affecting the credit history, ensuring the relevance of data for banks.