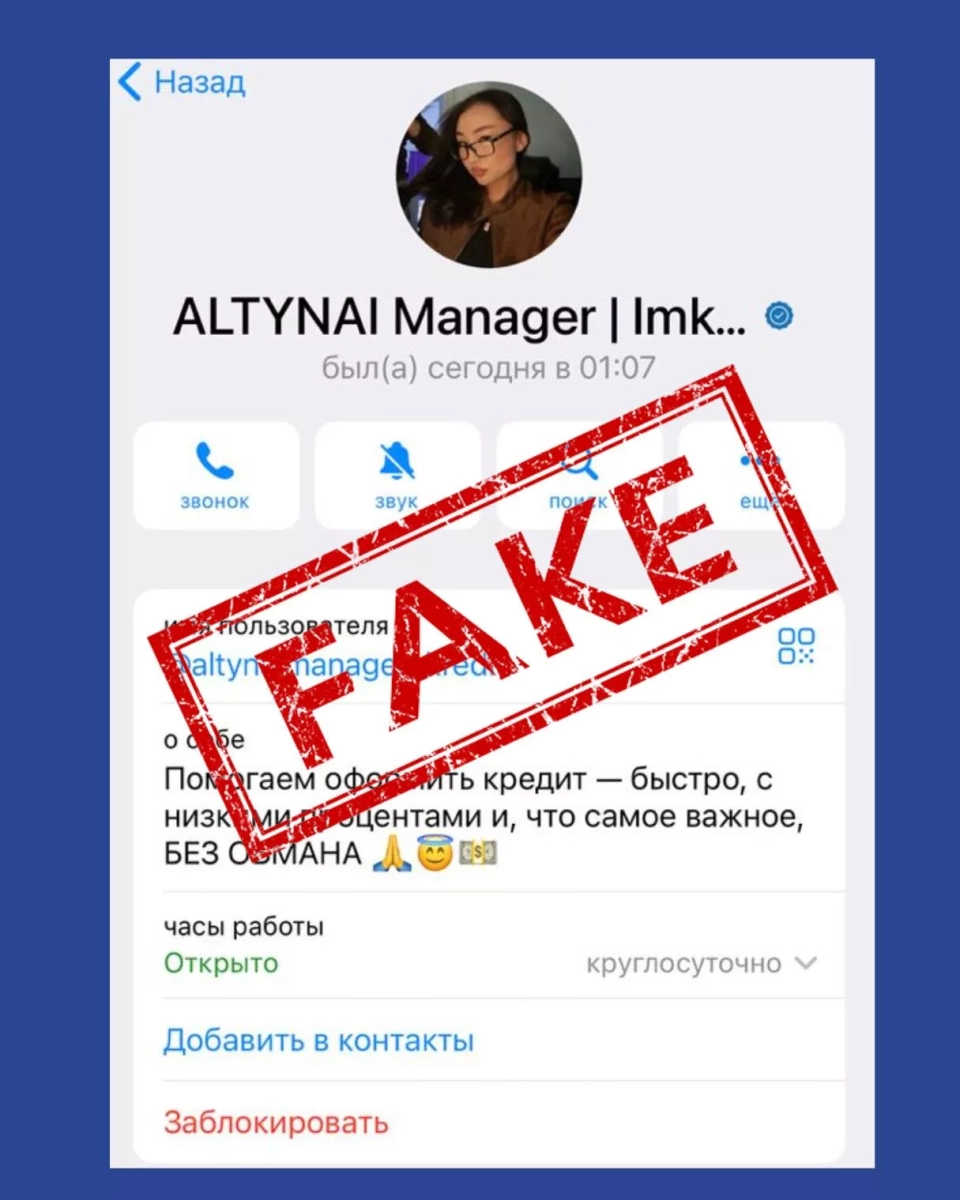

According to the expert, the main schemes of fraud today include phishing (both SMS and internet scams), social engineering, and manipulation through phone calls. The increase in cashless payments and online transactions in the country contributes to the rise of such crimes.

“According to law enforcement agencies and banks, most citizens lose money due to their trustfulness. Fraudsters apply psychological pressure, creating a sense of urgency or forging official requests,” Sarybaev noted.

He also added that banks are taking measures to enhance security: strengthening authentication requirements, implementing additional checks, and monitoring systems for suspicious transactions. However, the most important factor remains the vigilance of the citizens themselves.

Sarybaev recommended the following:

- never share your passwords and confirmation codes with outsiders;

- always check the addresses of websites and links before entering data;

- use two-factor authentication;

- do not trust calls that supposedly come from banks and government agencies — employees do not request information over the phone.

He also reminded that in 2024, the National Bank registered over 1,000 appeals from people who became victims of fraudsters. This was one of the reasons for tightening the responsibility for cybercrimes and implementing a mechanism that allows citizens to voluntarily prohibit the issuance of loans in their name.

Note: From November 1, 2025, a law will come into effect in Kyrgyzstan allowing citizens to independently impose a ban on obtaining loans in their name. In addition, the President of the Kyrgyz Republic signed a law tightening penalties for fraud using digital and information-communication technologies.