She noted that fraudsters typically do not resort to physical violence but act through psychological manipulation and technical tricks. Among the most frequently encountered schemes, she highlighted:

- Fraudulent sales of goods through online stores or advertisements;

- Unauthorized access to accounts and email to steal passwords;

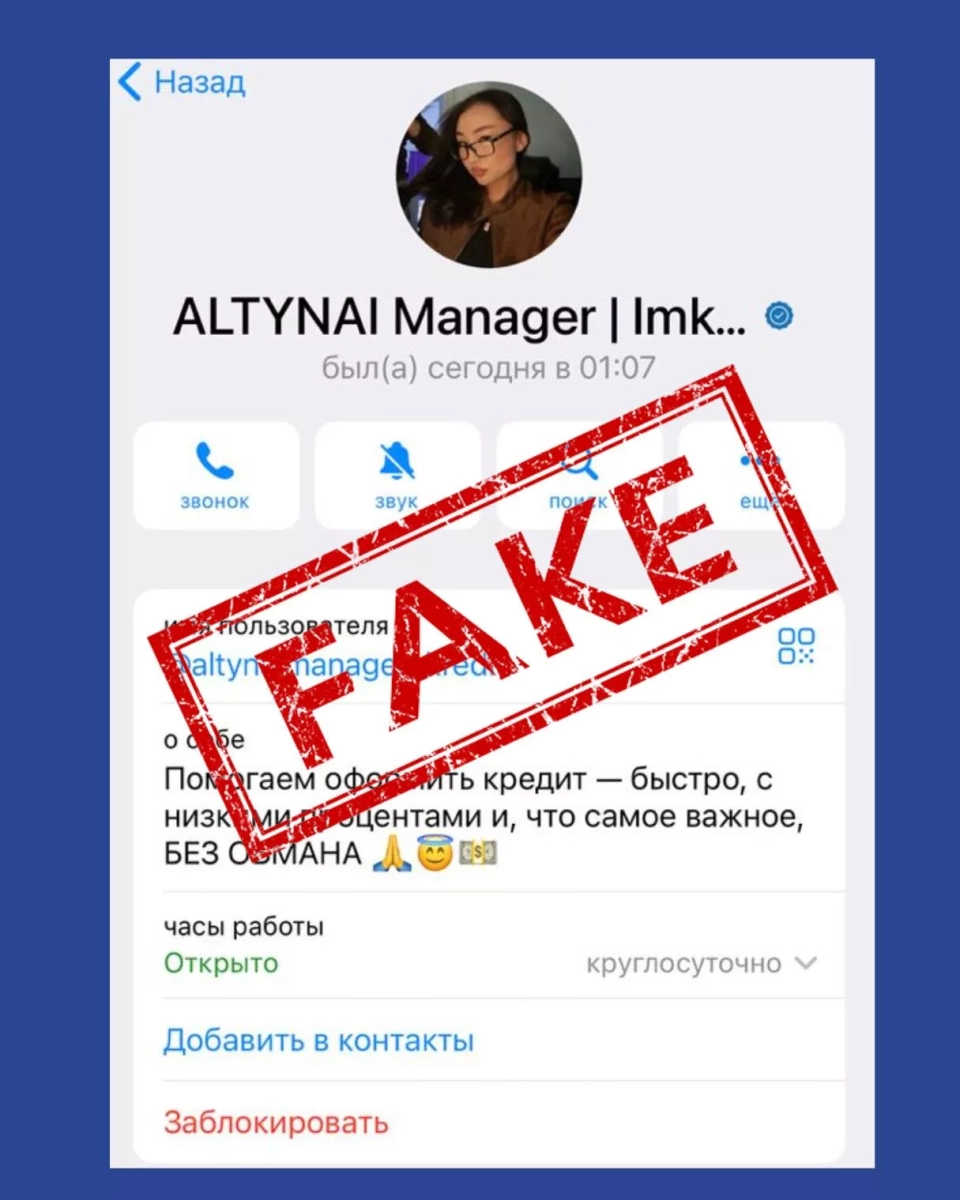

- Impersonating bank or government employees to obtain secret codes and card information;

- Data theft through ATMs or attempts to spy on PIN codes;

- Psychological pressure, where perpetrators scare or rush the victim.

According to the representative of the National Bank, commercial financial institutions are taking measures to protect clients, including analyzing and monitoring transactions, verifying identities, and notifying clients of suspicious activities.

Anara Sabyrbek kyzy emphasized that bank employees never ask for PIN codes, CVV codes, confirmation codes, or secret words over the phone.

“If someone calls and demands you to provide a code from an SMS or card details, they are fraudsters,” she noted.

The National Bank recommends that citizens:

- not share personal data and codes over the phone or through messengers;

- use two-factor authentication;

- if necessary, set up self-restriction on obtaining loans, which can help prevent fraudulent loans.

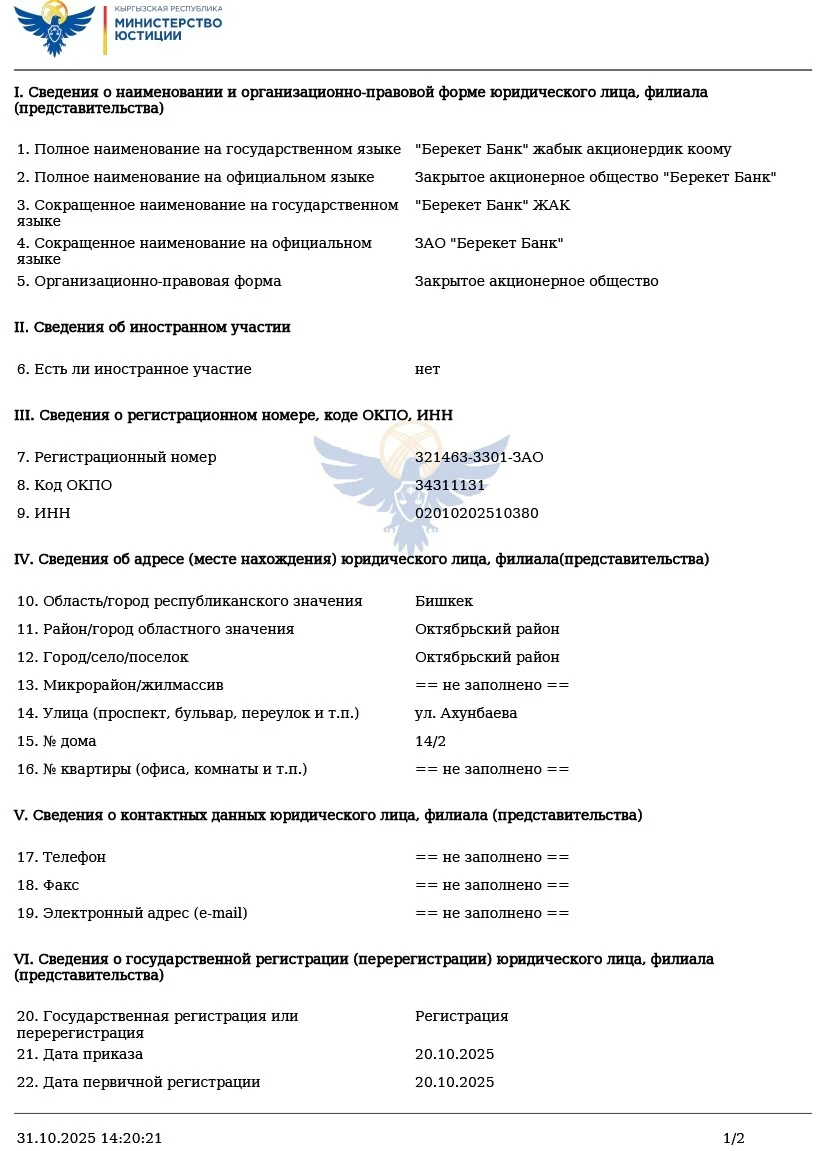

Note: Starting from November 1, 2025, citizens will have the option to voluntarily prohibit loans and credits in their name.