The Head of the State Tax Service spoke about the transformation of tax administration

According to him, significant changes are planned for 2025 aimed at reducing the tax burden and increasing tax benefits for key sectors of the economy. Priority areas will include agriculture, the IT sector, renewable energy, as well as the textile and jewelry industries, alongside important social initiatives, including support for sports.

“Small and medium-sized enterprises will have the opportunity to choose the optimal tax regime — general, single tax, or patent. This innovation will allow businesses to align their tax obligations with the actual scale of their activities, while the state will be able to form a stable and growing tax base. Tax rates in Kyrgyzstan remain among the lowest in the post-Soviet space, which becomes a strategic competitive advantage in attracting investments and human capital,” emphasized Shykmamatov.

The head of the Tax Service also noted that a crucial part of the reforms in 2025 will be a deep restructuring of tax administration.

“We have consciously abandoned the practice of excessive checks and pressure on businesses, realizing that fear cannot be a sustainable source of budget revenue. We have completely eliminated on-site inspections by employees of the central office of the Tax Service, which has helped minimize corruption risks,” he added.

Approaches to appointing and conducting inspections on the ground have also been revised, and a control and coordination system has been created, focused not on the number of inspections but on their justification and quality, the head of the Tax Service believes.

Simplifying tax administration has become an important step for businesses and citizens.

Since the beginning of this year, the mandatory use of electronic waybills for most goods has been canceled, a moratorium on control purchases and raid tax inspections in markets has been introduced, and general tax declarations for individuals who are not individual entrepreneurs and mandatory “zero” reports have been abolished.

“These measures have freed up time and resources for businesses, which should contribute to economic development. The policy of legalizing economic activities, which allows for the legalization of goods without penalties until April 1, 2025, and the write-off of tax debts from previous periods, sends a signal: the state prefers to create conditions for honest work rather than punish for past mistakes. This has allowed thousands of entrepreneurs to start from scratch and restore trust in the tax system,” added Shykmamatov.

The transformation of taxation for markets and shopping centers has also taken an important place in the reform.

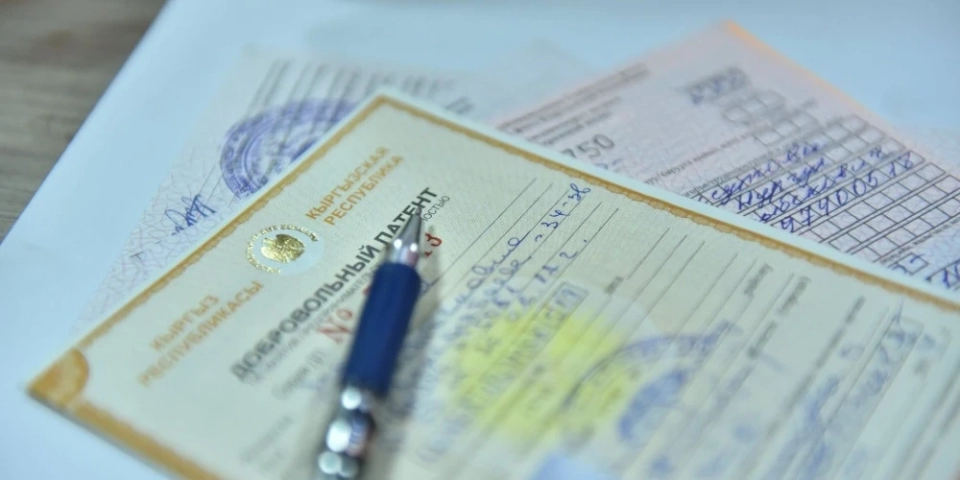

The return of the patent system, exemption from the mandatory use of cash registers, an increase in the annual revenue threshold to 50 million soms, and the introduction of reduced rates for the jewelry industry have resulted from dialogue with entrepreneurs rather than cabinet decisions.

“The pilot project in the markets ‘Dordoy’, ‘Kara-Suu’, and ‘Madina’, where the administrations act as tax agents, has demonstrated that eliminating the human factor and direct contacts significantly reduces the risks of abuse and increases discipline,” noted the chairman of the Tax Service.

Digitalization has become the cornerstone of all reforms.

“In 2025, tax administration will significantly transition to remote formats. We have expanded the functionality of the ‘Taxpayer Cabinet’, implemented automated tax risk management systems, and launched a pilot project for fiscal software with data transmission. The integration of accounting systems for public catering enterprises with the Tax Service's information system has already led to an increase in average daily revenue and a reduction in shadow turnover,” noted Alambet Shykmamatov.

The modernization of the electronic invoice system and the implementation of the ‘Salyk Kyzut’ module, which will allow tracking the movement of goods throughout the chain — from import or production to the final consumer — is also ongoing.

“These are not just technological innovations. This is a transition to a system where the rules are the same for everyone and operate automatically, which significantly simplifies control. The results of tax reforms organically fit into the overall macroeconomic dynamics. According to the National Statistical Committee, last year the GDP volume reached almost 2 billion soms, which is 11 percent more than in the previous period. For the first time in a long time, the growth of the economy and tax revenues has shown such clear consistency, confirming that tax reform has become a driver of development rather than an obstacle,” concluded the head of the Tax Service.

Read also:

Business is ready to invest in people if reforms are conducted transparently

High-level consultations "From Doha to Bishkek" were held in Bishkek, resulting from the...

From Flour to Billions: What Small and Medium Businesses in the Country Live By

Over the past five years, small and medium-sized enterprises (SMEs) in Kyrgyzstan have...

Ibraev proposed to the Chinese to invest in the construction of the power lines "Kemin-Torugart" and "Barskoon-Bedel"

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

In 2025, taxes and insurance contributions amounted to 391.8 billion soms

In 2025, the total amount of collected taxes and insurance contributions amounted to 391.8 billion...

The exhibition "Kyrgyzstan EXPO 2025" started today in Bishkek.

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Kyrgyzstanis Mainly Work Informally. What Reforms Could Change the Situation?

In 2025, an analytical report by the International Monetary Fund was presented, dedicated to the...

The Second Stage of Tax Service Reforms: How the KEZET System Will Replace Inspectors

Photo from the internet. Almambet Shykmamatov, Chairman of the Tax Service A year ago, the...

Historical Maximum: The State Tax Service Exceeded the Tax Plan by 46.5 Billion Soms

At the hardware meeting led by Almambet Shykmamatov, the chairman of the State Tax Service, the...

Almambet Shykmamatov: The Tax Service Will Begin the Second Stage of Reforms from the New Year

In Kyrgyzstan, at the direction of President Sadyr Japarov, a year ago, the process of significant...

Kazakhstan – a Leader in Mutual Investments in Eurasia: How the Republic is Breaking the Raw Material Model

The country has confirmed its role as a key investment center in Central Asia Kazakhstan has...

In Kyrgyzstan, there are plans to regulate artificial intelligence. What is behind this?

With the development of artificial intelligence, numerous questions arise regarding its regulation....

Tax and Insurance Benefits are Being Prepared for the Sewing Industry: Clarification from the State Tax Service

In Kyrgyzstan, the development of a draft law is planned, which will create uniform conditions for...

300,000 companies may close in Kazakhstan due to tax reform. Consequences for the KR

A large-scale tax reform in Kazakhstan is already causing significant concern among representatives...

Natural Resources - to the People of Kyrgyzstan

Recently, a discussion took place in Bishkek on the topic "Global Trends in Central Asia:...

In Kyrgyzstan, taxpayers on a patent are exempt from visiting the GNS.

The State Tax Service of the Kyrgyz Republic has announced the simplification of the tax...

Foreign Capital in Kyrgyzstan: What Foreign Business Lives by in the Country

According to the latest annual report from the National Statistical Committee, published on October...

Bakyt Torobaev familiarized himself with the activities of the Potato Farming Development Center "Tyup"

On November 24, 2025, the Minister of Water Resources, Agriculture, and Processing Industry, Bakyt...

The Russian-Kyrgyz Development Fund invested $1 billion in the economy of Kyrgyzstan

For a successful business start, financial assistance is essential. The Russian-Kyrgyz Development...

In Bishkek, the best exporters of the country were awarded

On December 24, 2025, the final of the national competition "Best Exporter of the Kyrgyz...

Mistakes Today - Problems Tomorrow. Expert Explained How to Avoid Tax Issues

Saida Nariman, or Kamila Kasymova, is a tax expert with 20 years of experience who has managed to...

Products of Batken gardeners enter new markets thanks to a new enterprise

In the Batken region, in the village of Samarkandek, a new enterprise has opened that processes...

Taalaybek Ibraev: All mining farms in Kyrgyzstan have been shut down

In an interview with 24.kg, Talaybek Ibraev reported a critically low water level in the Toktogul...

How and When to Submit the Unified Tax Declaration for 2025

The State Tax Service has announced the start of its campaign for the acceptance of the unified...

Investments Under Legal Protection: Kyrgyzstan is Shaping a New Economic Policy

In Bishkek, a National Investment Dialogue took place, gathering representatives from the...

Uncovering the Mining Industry: Why Everyone Should Know Who Owns the Deposits in Kyrgyzstan

Kyrgyzstan has significant reserves of natural resources, including not only gold but also many...

"Kygryzindustriya": What Happened to the Holding Companies Over Four Years

The holding "Kyrgyzindustry" was founded in 2022 with a charter capital of 1 billion...

Kyrgyz Light Industry in Crisis. Why Are Goods Stuck at the Border with Russia?

In Kyrgyzstan, the sewing industry is facing a new crisis, caused not by a lack of orders or a...

Finland taught artificial intelligence data centers to heat cities

In 2026, Google and Microsoft are launching unique projects in Finland, where the waste heat from...

In the capital, the pilot delivery of solid waste to the new waste processing plant has begun

In the capital, the first stage of the delivery of solid household waste (SHW) to the new waste...

The National Bank of the Kyrgyz Republic has raised the discount rate to 11 percent

On November 24, the Board of the National Bank of the Kyrgyz Republic made a decision to raise the...

The State Tax Service Exceeded the Revenue Collection Plan This Year

At the staff meeting, Almambet Shykmamatov summarized the work of his department over the year....

The Roads of Independent Kyrgyzstan: Major Infrastructure Projects Funded by the State Budget

In recent years, there has been active development of road infrastructure in Kyrgyzstan, funded by...

Personal QR codes for business are banned. Banks are blocking accounts, cash is requested at the market.

Since 2020, there has been a rise in cashless payments in Kyrgyzstan. According to the National...

Special Zone and Unified Wallet of the EAS. What Will Change in the Tax Sphere in 2026

Starting from 2026, significant changes are expected in the tax sphere, affecting various...

In Kyrgyzstan, the single tax rate for working abroad has been reduced

The rate has been reduced to 0.1 percent According to information from the State Tax Service, the...

The Economy of Kyrgyzstan - 2025: Growth Records and Price Shocks

The year 2025 became a time of significant changes for Kyrgyzstan. The country recorded...

At the GNS, issues of export and re-export were discussed

Kubanychbek Isabekov, Deputy Chairman of the State Tax Service under the Government of the Kyrgyz...

Implementation of the "Bazar" System: 727 Million Soms in Taxes Collected in 10 Months

The State Tax Service of the Kyrgyz Republic has summarized the results of the implementation of...

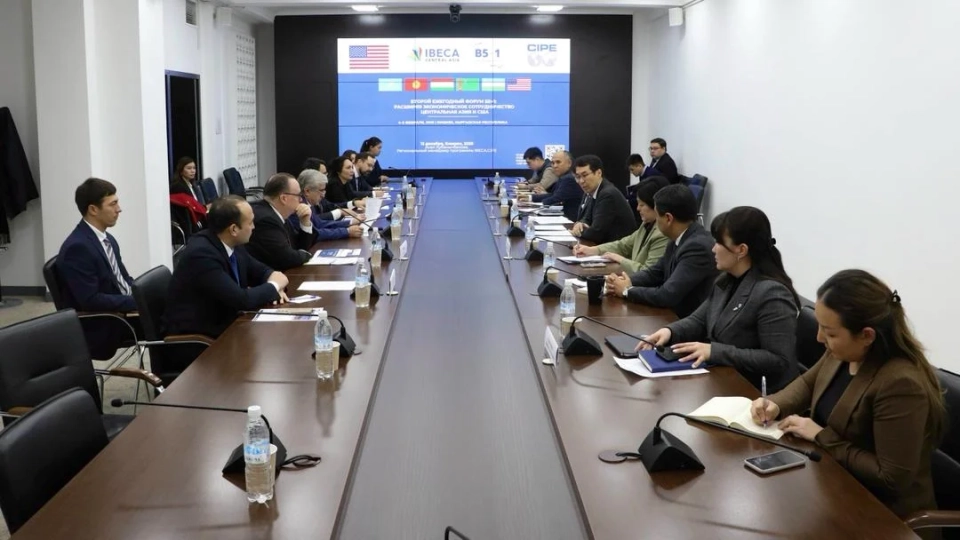

Kyrgyzstan Presented Key Directions of the "B5+1" Forum to the Diplomatic Corps

Today, a joint briefing organized by the Ministry of Foreign Affairs and the Ministry of Economy...

Liquidation of Individual Entrepreneurs: Legal Nuances You Should Know

The State Tax Service of the Kyrgyz Republic has announced the start of the procedure for the...

The GNS discussed the latest changes in tax legislation with businesses.

The meeting of representatives of the State Tax Service (GNS) with businesspeople was organized to...

Journey to the Kyrgyz Living Abroad

The Kyrgyz are one of the oldest peoples who lived in Central Asia and roamed the vast expanses of...