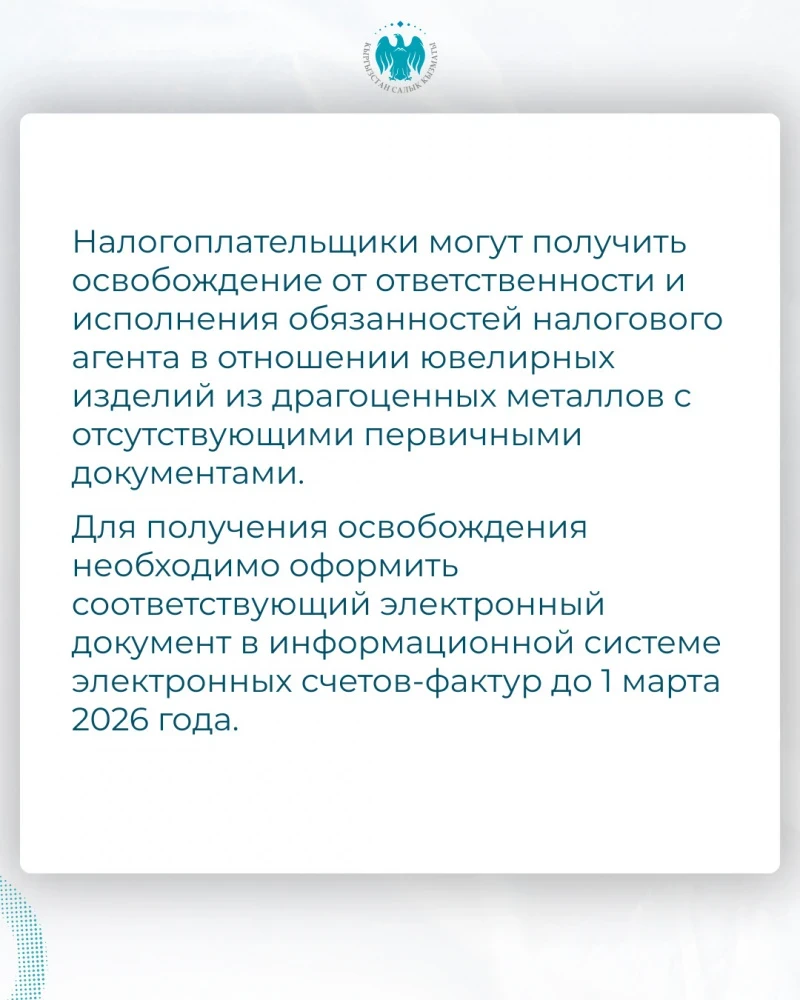

To take advantage of this opportunity, it is necessary to create the corresponding electronic document in the electronic invoice system by March 1, 2026.

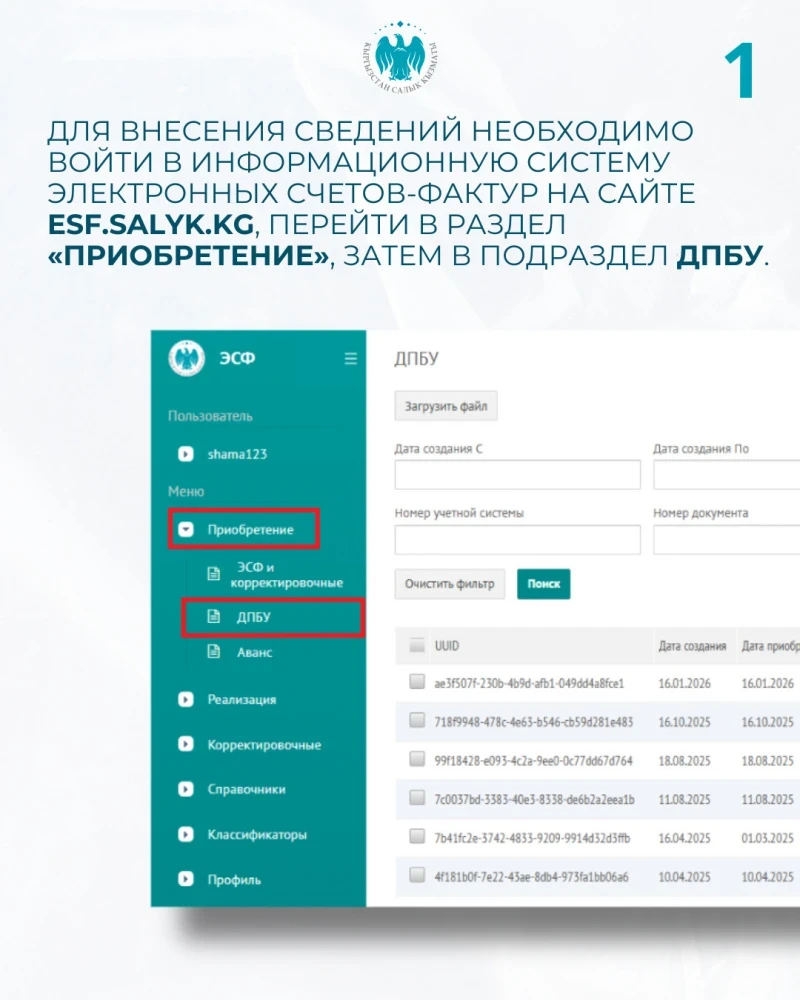

- First, you need to log into the electronic invoice information system at the website esf.salyk.kg and go to the "Acquisition" section, then to the DPBU subsection.

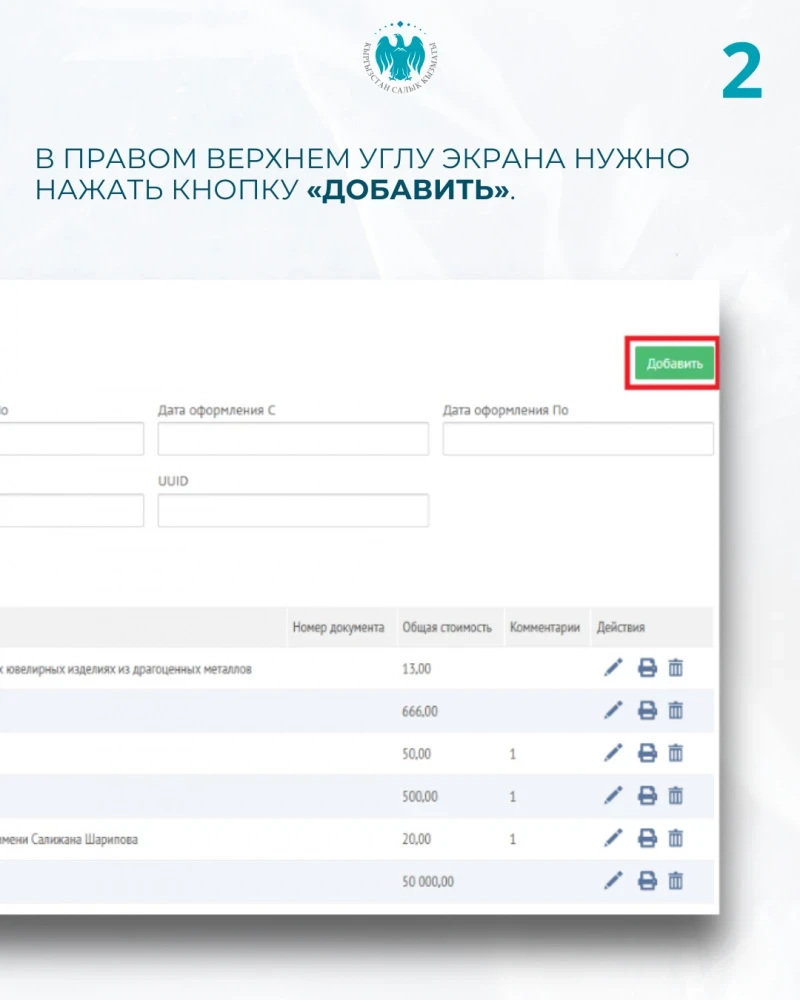

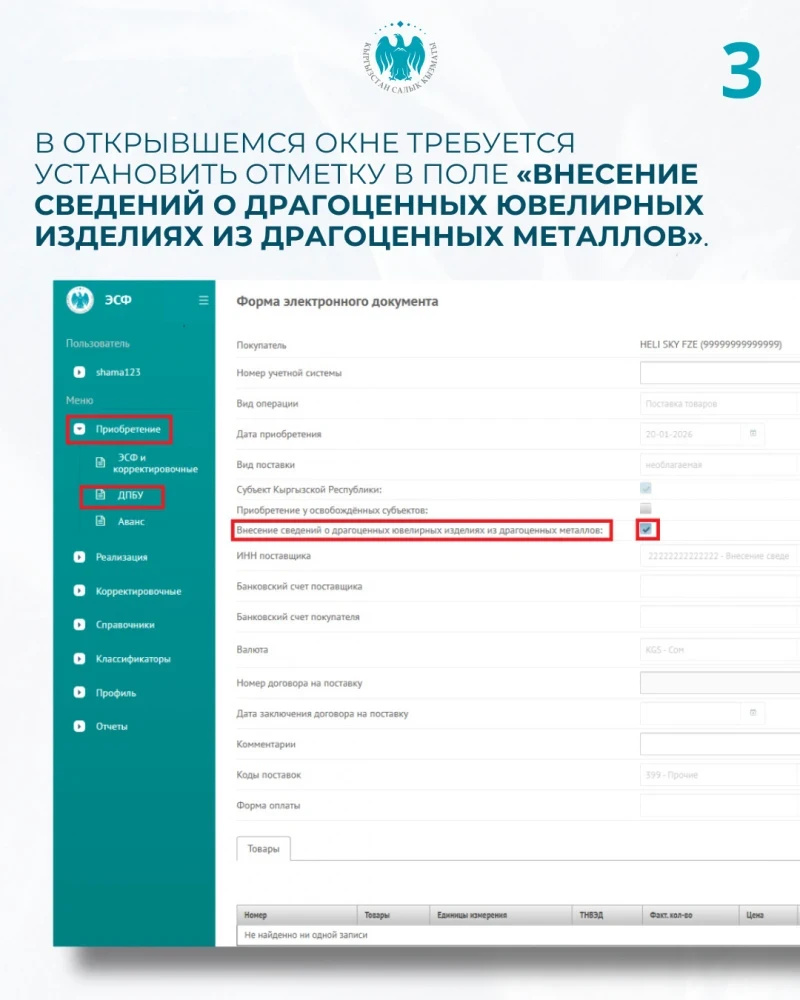

- In the upper right corner of the screen, you should click the "Add" button. In the opened window, you need to check the box in the field "Entering information about precious jewelry made from precious metals".

- After selecting this option, the main details of the electronic document will be generated automatically. The taxpayer will only need to fill in the goods section of the document in accordance with paragraph 19 of the Procedure for the registration and application of invoices, approved by the GNS order dated April 28, 2023, No. 101 (with amendments from January 14, 2026, No. 4).

It is important to note that the created electronic document cannot be changed or declared invalid.

For this reason, the taxpayer is obliged to fully and accurately fill in all the data, as the provided information will be subject to mandatory accounting and cannot be changed or canceled in the future.