Plans for a Crisis: The National Bank of Kyrgyzstan Approved New Requirements for Banks

This document introduces mandatory and uniform requirements for the content, procedure for development, and submission of financial recovery plans by credit organizations. Such plans must be prepared in advance and include specific measures to restore financial stability in the event of a deterioration in their economic condition.

Unlike the old practice, where measures were developed at the request of the regulator only after problems were identified, the new regulation assumes a preventive approach. Banks are now required to assess potential stress scenarios in advance, such as deposit outflows, declining asset quality, and liquidity shortages, as well as to develop mechanisms for responding to such risks.

The document also emphasizes the realism of the submitted plans. Credit organizations must specify concrete sources for recapitalization and financing, confirming their availability, as well as set clear deadlines for the implementation of proposed measures. A formal approach to planning is prohibited.

The regulation establishes the responsibility of the bank's governing bodies for creating and executing the financial recovery plan.

The National Bank also gains the right to assess the adequacy of the proposed measures and require their revision.

In the country's main financial institution, it is emphasized that the adoption of this regulation is aimed at strengthening the resilience of the banking sector and protecting the interests of depositors and creditors.

The official decree has been published on the website of the National Bank of the Kyrgyz Republic.

Read also:

The National Bank has submitted new requirements for banks' financial recovery plans for public discussion.

- The National Bank of the Kyrgyz Republic has initiated a discussion on the draft resolution of...

The National Bank approved the requirements for the banks' financial recovery plan

- On December 26, 2025, the Board of the National Bank of the Kyrgyz Republic adopted Resolution...

The NBKR refused to provide a list of systemically important banks

- The National Bank of the Kyrgyz Republic did not provide a list of systemically important banks,...

New Capital Requirements Introduced for Securities Market Participants

The Cabinet of Ministers of the Kyrgyz Republic has approved a new regulation concerning the...

The National Bank has established the maximum share of credit claims in the collateral for refinancing.

- In accordance with this document, the National Bank of the Kyrgyz Republic has established...

The National Bank has put forward amendments for public discussion on combating money laundering

- The National Bank of the Kyrgyz Republic has announced a draft resolution of the Board titled...

Financial Marketplaces in the Kyrgyz Republic: The National Bank Aims to Simplify Rules for Non-Banking Organizations

- The leadership of the National Bank of Kyrgyzstan has adopted new rules for the creation and...

In Kyrgyzstan, it was proposed to raise the requirements for the charter capital of banks

The National Bank of Kyrgyzstan has presented a draft resolution for public discussion, proposing...

The National Bank has presented new Rules for the Creation and Regulation of Marketplaces in Kyrgyzstan for discussion.

- The Board of the National Bank has decided to introduce new Rules for the creation and regulation...

NBKR will gradually increase the minimum capital of commercial banks to 3 billion soms.

- The National Bank of the Kyrgyz Republic has approved a new regulation on the minimum amount of...

The NBKR has made changes to the legislation on the special regulatory regime for banks

- On December 17, 2025, the Board of the National Bank of the Kyrgyz Republic made a decision to...

In Kyrgyzstan, the requirements for banks' charter capital have been increased.

On December 29, 2025, the board of the National Bank approved resolution No. 2025-П-12/71-3-(NPA),...

In Kyrgyzstan, the profits of financial sector organizations have nearly doubled

The total income of financial sector organizations for the first nine months of 2025 amounted to...

The National Bank intends to strengthen control over credit unions in Kyrgyzstan.

The National Bank of Kyrgyzstan has announced its intention to increase control over the...

The National Bank of Kyrgyzstan Proposes to Increase Requirements for Minimum Charter and Own Capital for Banks

The National Bank of Kyrgyzstan proposes to the public to discuss the increase in requirements for...

The National Bank updated the rules for licensing and regulating credit unions

- On December 24, 2025, the Board of the National Bank made a decision to amend several regulatory...

Strategy for Regional Growth. A Unified Standard for Master Plan Development is Being Prepared in Kyrgyzstan

The Ministry of Economy and Commerce has presented a draft order that introduces a unified...

The National Bank intends to raise the charter capital of commercial banks to at least 5 billion soms by 2030.

- The National Bank has presented for public discussion a draft resolution that introduces new,...

The Cabinet approved the Regulation on Social Support for Children by Social Workers

The Cabinet of Ministers approved a new Regulation on Social Support for Children, according to...

NBKR Introduced Minimum Anti-Fraud Requirements for Payment Organizations — Text of the Regulation

The National Bank of Kyrgyzstan, at its meeting on October 31, decided to approve the Regulation...

The National Bank of the Kyrgyz Republic presented new rules for financial marketplaces

The National Bank of Kyrgyzstan (NB KR) has published a draft of new rules aimed at organizing the...

Increase the Minimum Capital of Commercial Banks Proposed in Kyrgyzstan

In the Kyrgyz Republic, an initiative to increase the minimum capital for commercial banks,...

Exchange offices are required to identify clients for transactions over 100,000 soms (new rules from the NBKR)

- On December 19, 2025, the Board of the National Bank of Kyrgyzstan made a decision to implement a...

The National Bank Warned About Widespread Financial Fraud Schemes

- In a live broadcast, Anara Sabyrbek kyzy, the chief specialist of the financial literacy group at...

In Moscow, the formation of a common financial market within the EAEU was discussed

A meeting dedicated to the creation of a common financial market within the framework of the...

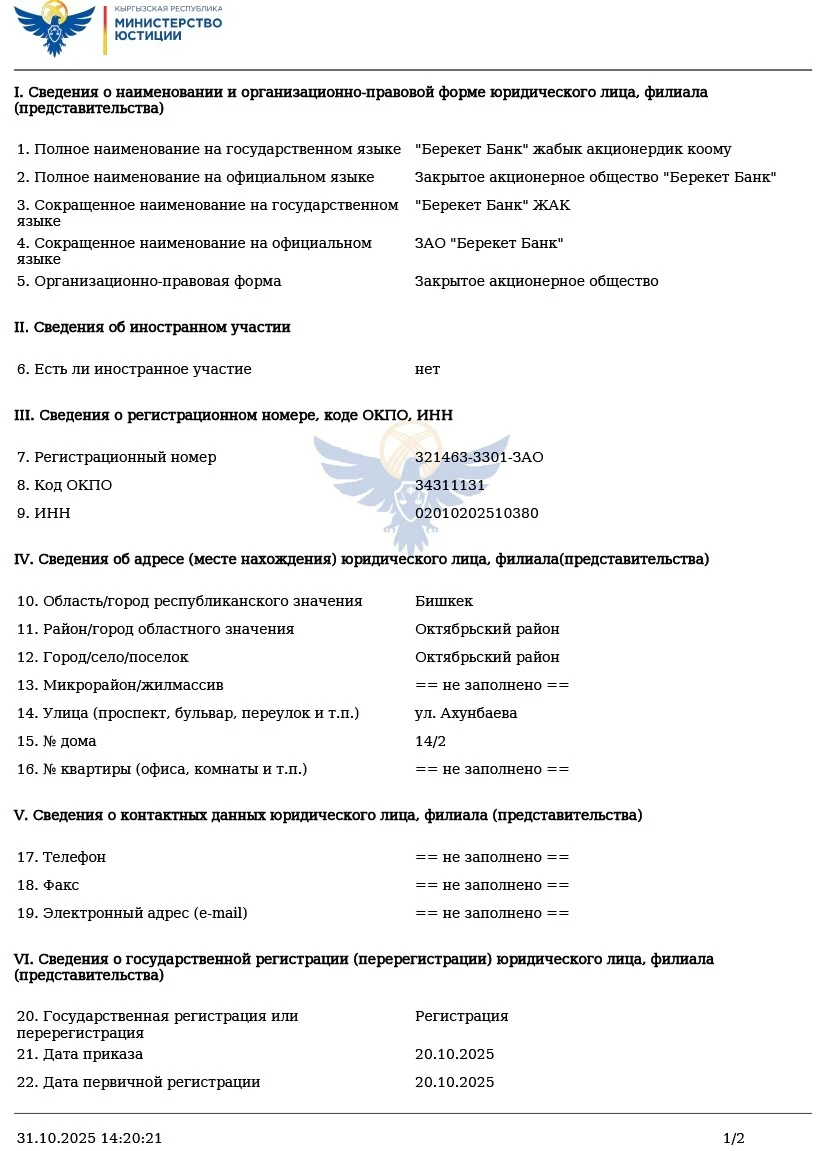

A new bank "Berekett Bank" will appear in Kyrgyzstan. Who are the founders?

A new closed joint-stock company called "Berekett Bank" will be launched in the...

The National Bank approved new requirements for anti-fraud systems in payment organizations to protect against fraud

- In an effort to strengthen the fight against fraudulent activities in the payment system, the...

The authorities propose to approve unified rules for the courts of elders.

The draft order for the establishment of regulations for the Council of Elders' Courts has...

The Cabinet approved new capital regulations for professional participants in the securities market

- The Cabinet of Ministers has adopted a new Regulation governing the normative indicators of...

The National Bank commented on the EU sanctions imposed on 2 banks of Kyrgyzstan

The National Bank of Kyrgyzstan reacted to the sanctions imposed by the European Union concerning...

The National Bank proposes that the FCKS issue loans to individuals and legal entities

The National Bank of Kyrgyzstan has proposed for discussion a project that changes the operating...

The National Bank has strengthened capital and reporting requirements for microfinance organizations

- On December 29, 2025, the Board of the National Bank of the Kyrgyz Republic approved resolution...

Self-imposed credit restrictions established by 114,000 people, - National Bank

In 2025, one of the key achievements of the National Bank was the significant improvement in...

The Supreme Council of the EAEU Supported Approaches to Creating a Common Financial Market

At a recent meeting of the Supreme Eurasian Economic Council, important approaches aimed at...

The Cabinet approved the standard provision on psychological, medical, and pedagogical consultation

The Cabinet of Ministers has adopted a new regulation on psychological, medical, and pedagogical...

The new JSC "Berekett Bank" has joined the deposit protection system

As of December 30, JSC "Berekett Bank" officially became part of the registry of...

The NBKR Tightens Accounting for QR Payments: System Participants Will Report Monthly According to Established Codes

- On October 29, 2025, the Board of the National Bank of Kyrgyzstan issued resolution No....

Exchangers will be able to verify the origin of clients' money, including foreigners

The National Bank of the Kyrgyz Republic has adopted a new regulation aimed at establishing minimum...

In Kyrgyzstan, "Post Bank" Will Appear: The National Bank is Considering the Application

The National Bank of Kyrgyzstan has begun reviewing documents related to the establishment of a...

In Kyrgyzstan, requirements for participants in the virtual asset market will be tightened

The Cabinet of Ministers of the Kyrgyz Republic has approved a resolution aimed at improving the...

The National Bank of the Kyrgyz Republic commented on the sanctions against "Eurasian Savings Bank" and "Tolubaya"

On October 23, the countries of the European Union officially approved a new package of sanctions,...

More than 30,000 Kyrgyz citizens have imposed a self-ban on loans through the "Tunduk" app

- Starting from November 1, a self-restriction mechanism for obtaining loans has been implemented...

Water Tourism Routes by Difficulty Categories

Water routes are in a somewhat more limited position. The fact is that many mountain rivers allow...