The NBKR has made changes to the legislation on the special regulatory regime for banks

As part of the testing, operations with virtual assets backed by both national and foreign currencies are now permitted. However, only commercial banks, payment system operators, and payment organizations are allowed to participate in these operations.

The new version of the document clarifies the requirements for innovative products, risk management, and compliance, including necessary measures to prevent money laundering and identify clients. The National Bank Committee now has expanded powers, including the ability to suspend or revoke licenses in case of violations.

The updated rules also outline the conditions for extending the testing (no more than once and for a maximum of 6 months), as well as the procedure for withdrawing from participation before the testing begins and for early termination with a mandatory client protection plan.

Additionally, the National Bank can now initiate a special regulatory regime on its own without a prior request from participants, publishing the conditions, timelines, and list of permitted operations on its official website.

Changes

Amendments to the Resolution of the Board of the National Bank of the Kyrgyz Republic

“On the Approval of the Regulation ‘On the Special Regulatory Regime’ dated August 12, 2020, No. 2020-P-12/45-3-(NPA)

Amendments have been made to the resolution concerning the special regulatory regime previously approved:

1) Paragraph 1 now reads as follows:

“1. This Regulation defines the procedure for creating a special regulatory regime for testing and implementing innovative technologies and solutions in the field of banking and payment operations, including operations with virtual assets, all of which must occur in a controlled environment. Furthermore, the Regulation describes the participation procedure and requirements for participants, including initiatives for the implementation of digital technologies and improving financial accessibility.

Participants in the special regulatory regime are subject to the requirements of legislation, taking into account the conditions and specifics defined by this Regulation and the decisions of the Committee. The Committee may engage independent experts to evaluate applications for participation.

Banking operations within the special regime must be ready for testing in real conditions and at the stage of a minimum viable product.

The technologies being implemented must meet a number of criteria, including their novelty and focus on expanding financial accessibility, as well as the absence of legal restrictions on conducting operations.

The special regulatory regime cannot be used as a means to circumvent the legislation of the Kyrgyz Republic.

2) The main tasks of the special regime now include:

- reducing legal uncertainty for participants;

- defining available rules for testing innovative operations;

- accelerating the market entry of new banking services;

- developing regulatory requirements for new relationships arising from the implementation of innovations;

- enhancing the accessibility and customer orientation of banking services.

3) Changes in paragraphs 3, 4-1, and 5 relate to the description of operations with virtual assets and requirements for participants.

4) Paragraph 6 now describes the testing process and includes definitions of those participating in the special regime.

5) Important changes also affect the rules for submitting applications to create a special regulatory regime — now this can only be done by commercial banks and payment organizations.

6) Amendments have been made to the application submission and processing procedures, including the documents that need to be provided.

7) The conditions and timelines for extending the testing, as well as the rules for early withdrawal from participation, have been clarified.

8) New reporting requirements on the results of the testing and rules for initiating the special regime by the National Bank have been established.

9) The section on conducting the special regulatory regime at the initiative of the National Bank now also includes new conditions and requirements for participants.

Read also:

The National Bank of the Kyrgyz Republic has allowed the opening of special escrow accounts for virtual assets.

Financial and credit organizations in Kyrgyzstan are now allowed to open special escrow accounts...

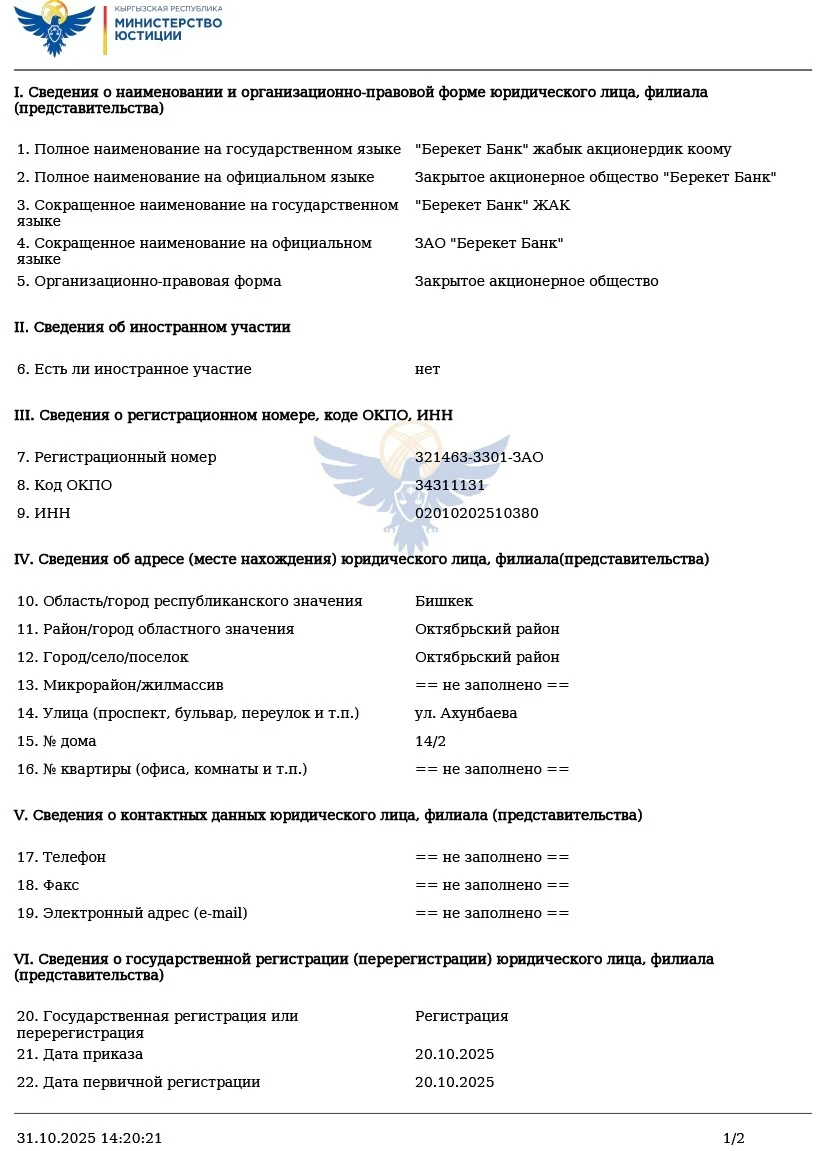

NBKR issued a license to "Berekett Bank"

- As reported by the National Bank, on December 3, 2025, the board made the decision to license JSC...

The National Bank has put forward amendments for public discussion on combating money laundering

- The National Bank of the Kyrgyz Republic has announced a draft resolution of the Board titled...

In the city of Osh, 24 citizens were fined for illegal currency exchange.

- The punishment affected 24 (twenty-four) citizens of the Kyrgyz Republic, as reported by the...

The National Bank of Kyrgyzstan Proposes to Increase Requirements for Minimum Charter and Own Capital for Banks

The National Bank of Kyrgyzstan proposes to the public to discuss the increase in requirements for...

The NBKR suspended the license of a currency exchange office in Bishkek and fined a citizen for illegal operations

- From November 22 to December 6, 2025, inclusive, the action of license No. 6524, issued on May 4,...

The National Bank of Kyrgyzstan Tightens Rules on Payments and Combating Money Laundering

The National Bank of Kyrgyzstan has initiated a public discussion on a draft of amendments to...

The NBKR Tightens Accounting for QR Payments: System Participants Will Report Monthly According to Established Codes

- On October 29, 2025, the Board of the National Bank of Kyrgyzstan issued resolution No....

NBKR Introduced Minimum Anti-Fraud Requirements for Payment Organizations — Text of the Regulation

The National Bank of Kyrgyzstan, at its meeting on October 31, decided to approve the Regulation...

Reserves of the National Bank of Kyrgyzstan in gold and currency increased by almost 2.7 times

The reserves of the National Bank of the Kyrgyz Republic from the revaluation of foreign currency...

The National Bank fined an exchange office in the Talas region 55,000 soms

- In the Talas region, one of the exchange offices was fined 55,000 soms by the National Bank of...

The National Bank fined a commercial bank more than 21 million soms

On December 5, the National Bank of the Kyrgyz Republic decided to impose a fine of 21 million 600...

Increase the Minimum Capital of Commercial Banks Proposed in Kyrgyzstan

In the Kyrgyz Republic, an initiative to increase the minimum capital for commercial banks,...

"Bereket Bank," established by the president's son, received a license to conduct banking operations.

There are now 22 banks in Kyrgyzstan...

In Kyrgyzstan, it is planned to allow banks to work with virtual assets in a pilot mode.

At the moment, there is no legal framework in Kyrgyzstan that allows banks to effectively work with...

The banks' deposit base grew to 804.1 billion soms over 9 months, - National Bank

According to the National Bank of the Kyrgyz Republic, as of the end of September 2025, the total...

In Kyrgyzstan, escrow accounts for virtual assets are being introduced

The National Bank of Kyrgyzstan has announced the introduction of the concept of "escrow...

The National Bank extended the ban on charging fees for money transfers between banks in the Kyrgyz Republic.

On December 3 of this year, the board of the National Bank of the Kyrgyz Republic (NB KR) announced...

Sadyr Japarov signed the updated edition of the constitutional law "On the National Bank"

- President Sadyr Japarov approved a new edition of the constitutional law "On the National...

A New Commercial Bank Has Emerged in Kyrgyzstan

A new commercial bank named "Berekett Bank" has launched in the country, becoming the...

The National Bank has established the maximum share of credit claims in the collateral for refinancing.

- In accordance with this document, the National Bank of the Kyrgyz Republic has established...

The National Bank approved new requirements for anti-fraud systems in payment organizations to protect against fraud

- In an effort to strengthen the fight against fraudulent activities in the payment system, the...

The NBKR has made changes to the regulation of credit risk and operations with virtual assets

- The Resolution of the Board of the National Bank of the Kyrgyz Republic No. 2025-П-12/60-4-(NPA),...

The National Bank commented on the EU sanctions imposed on 2 banks of Kyrgyzstan

The National Bank of Kyrgyzstan reacted to the sanctions imposed by the European Union concerning...

The amount of transactions with virtual assets in Kyrgyzstan has been announced

According to information from the Financial Market Regulation and Supervision Service, the total...

Banks in Kyrgyzstan will be required to justify the pricing of their services

The National Bank of Kyrgyzstan has proposed amendments to a number of legislative acts related to...

The National Bank fined a commercial bank 21.6 million soms for money laundering.

- On December 5, 2025, the National Bank decided to impose a fine of 21 million 600 thousand soms...

The Cabinet approved a new procedure for working with international agreements

The Cabinet of Ministers issued decree No. 747, dated November 20, 2025, regarding the application,...

The rules for admission to colleges and technical schools in Kyrgyzstan will be changed.

In the Kyrgyz Republic, the rules for admission to institutions of secondary vocational education...

National Bank: The banks' loan portfolio has grown to 460 billion soms, the share of deposits in national currency continues to increase

As of October 1, 2025, the banks' loan portfolio reached 460 billion soms, which is a 35%...

Financial Intelligence has fined two banks 293,000 soms for violations of legislation.

- According to a statement from the press service, the State Service for Financial Intelligence of...

"There is no shortage of dollars in Kyrgyzstan - National Bank"

The National Bank of the Kyrgyz Republic is taking all necessary measures to support the national...

In Kyrgyzstan, the operation of technology parks will be organized.

The government of the country has approved a new decree regarding the regulation of technology...

A competition has been announced in Kyrgyzstan for the 2026-2028 World University Games

The Ministry of Science, Higher Education and Innovations of the Kyrgyz Republic has initiated a...

The NBKR raised the discount rate to 11%

On November 24, the Board of the National Bank of the Kyrgyz Republic decided to raise the...

Starting from 2026, banks in the Kyrgyz Republic will not be able to charge fees for international money transfers.

On December 3, 2025, the Board of the National Bank of the Kyrgyz Republic approved a new...

A new bank "Berekett Bank" will appear in Kyrgyzstan. Who are the founders?

A new closed joint-stock company called "Berekett Bank" will be launched in the...

In Kyrgyzstan, control over banks and loans has been intensified: fines up to 65,000 soms

Sadyr Japarov, the President of Kyrgyzstan, recently signed a law that amends the Civil Code and...

NBKR updated lending rules: self-restriction on loans through the government portal will take effect on November 1

- The National Bank of Kyrgyzstan, according to resolution No. 2025-P-12/55-3-(NPA) dated October...

The National Bank has submitted new requirements for banks' financial recovery plans for public discussion.

- The National Bank of the Kyrgyz Republic has initiated a discussion on the draft resolution of...

The new National Bank building has a seismic resistance level of up to 12 points, - Deputy Head Attokurov

On October 28, a ceremonial opening of the new building of the National Bank of the Kyrgyz Republic...

The Financial Supervision Authority has designated the state system "Ranex" as the sole provider of AML/KYT services for virtual asset providers in Kyrgyzstan.

- The Financial Regulation and Supervision Service informs virtual asset providers about a new...

Appointment of the Deputy Chairman and a Member of the Board of the National Bank of the Kyrgyz Republic

On September 16, 2014, the President of the Kyrgyz Republic, Almazbek Atambayev, signed decrees...