As a result of the quarterly earnings report, shares of Amazon, one of the leading American technology giants, plummeted sharply. On February 5, during evening trading hours on the NASDAQ exchange, the company's stock fell by 10%, but by the end of the main session, the decline was 4.4%, according to Bloomberg.

Despite this, the financial results were generally in line with analysts' expectations: revenue increased by 14%, reaching $213.4 billion, and net income amounted to $21.2 billion.

The main reason for the pressure on the stock was Amazon's plans for significant investments in artificial intelligence technologies. The company intends to invest in chip acquisitions, new equipment, and the construction of data centers. Investors express concerns that such large expenses may not pay off and may not provide the expected returns even in the long term.

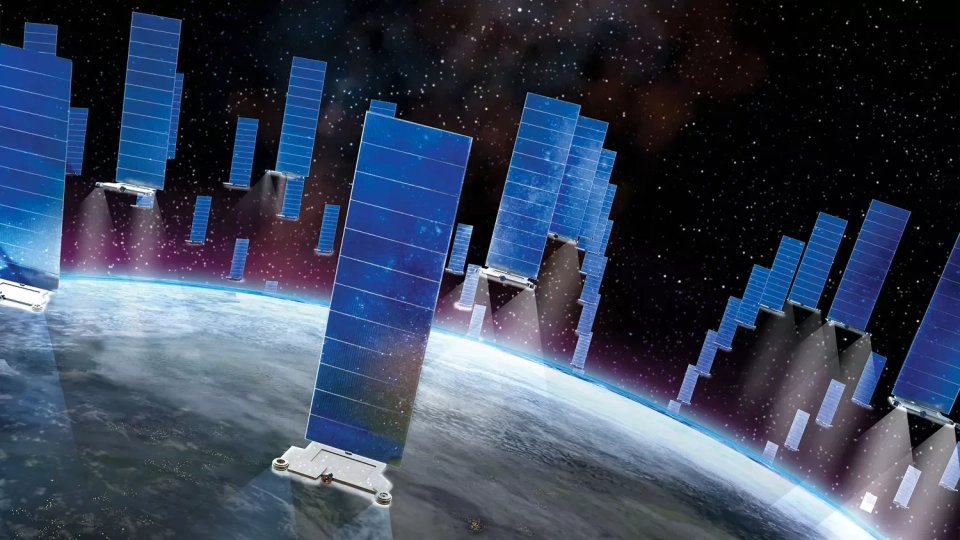

Forecasts suggest that Amazon's total investment could reach $200 billion by 2026. Part of this funding will be directed towards launching satellites to compete with SpaceX's Starlink system, but a larger portion will be invested specifically in artificial intelligence projects.

Amazon CEO Andy Jassy, speaking with analysts, emphasized that the company will continue to actively invest in artificial intelligence, aiming to take a leading position in the market. However, the reaction from investors was the opposite: doubts arose about whether large-scale investments in AI could yield the necessary returns.

A similar situation was observed earlier with other major technology companies. For example, Microsoft and Alphabet also faced sharp declines in their stocks after releasing reports related to rising expenses on artificial intelligence, with Microsoft's drop being one of the most significant in the company's history.