Although the stock market in Kyrgyzstan shows some signs of development, it remains limited and is primarily concentrated in the primary segment, leading to low liquidity and a lack of opportunities for stable income. In contrast, the real estate market in Bishkek demonstrates significant growth: the average annual price increase is between 10% and 15%, while rental yields reach 7–9% per annum, significantly surpassing traditional financial instruments.

EFSD Forecast Indicates Acceleration of Kyrgyzstan's Economy — Support for the Real Estate Market

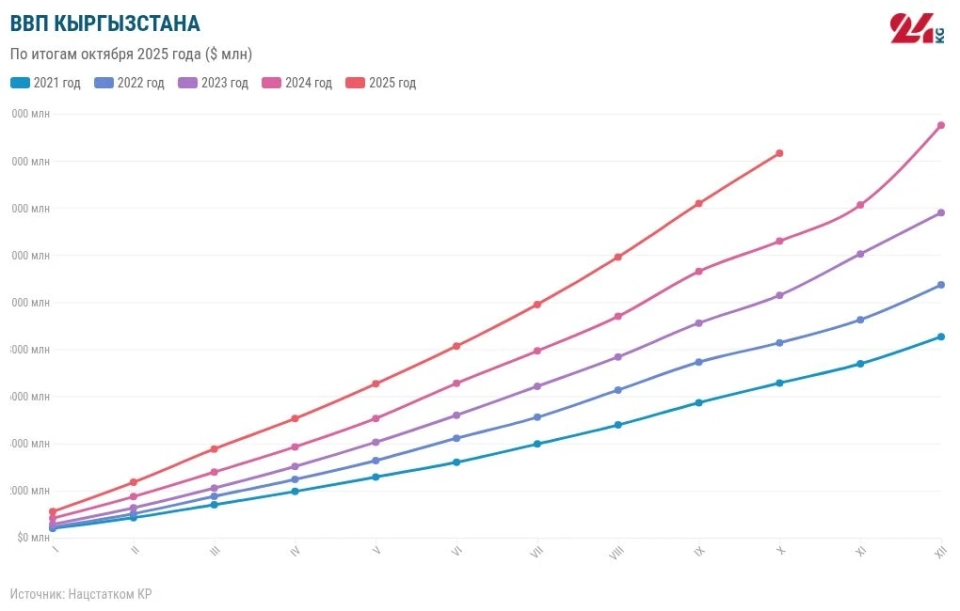

On November 12, 2025, the Eurasian Stabilization and Development Fund (EFSD) updated its GDP growth forecast for Kyrgyzstan, noting that the economy is showing active growth due to investments in the construction sector. GDP is expected to grow by 9% in 2025, then slow to 6.4% in 2026, 6% in 2027, and 5.5% in 2028. The medium-term forecast was also raised by 0.8 percentage points, mainly due to the development of the "My Home" construction program. Inflation is expected to be at 8.1% in 2025, decreasing to 6.4% in 2026, which brings it back into the National Bank's target range. A budget surplus of 1.6% of GDP is expected during the 2025–2027 period, opening opportunities for the restructuring of state enterprises in sectors such as energy and construction. Starting in 2028, a slight deficit (~0.2% of GDP) may arise due to declining tax revenues. These positive trends highlight the high growth rate and macroeconomic stability of Kyrgyzstan, which, in turn, increases investor interest in long-term assets such as real estate, especially in Bishkek. (Source: EFSD Regional Economic Report 2025)

View of Bishkek — the capital of Kyrgyzstan.

Bishkek as a Capital-Attracting Center in Central Asia

Considering the instability in global financial markets and investor caution, the question arises about the attractiveness of the banking sector. Low interest rates and high borrowing costs reduce interest in traditional financial instruments. According to the latest KPMG report, there is a shift in foreign direct investment (FDI) from traditional markets to emerging economies, including Central Asia. According to the National Statistical Committee of Kyrgyzstan, in the first quarter of 2025, the country attracted $288.3 million in foreign direct investment, which is 44% more compared to the same period in 2024. The total volume of FDI at the end of 2024 exceeded $1 billion, with Bishkek becoming the most attractive destination, receiving over $525 million.

The sharp increase in foreign investment inflows, especially in Bishkek, indicates that international investors are directing their efforts towards markets with real growth indicators and significant potential. Amid declining yields from traditional financial instruments, Bishkek stands out as a new investment destination in Central Asia, opening a new phase of growth for assets with real value, primarily in real estate.

Bishkek Real Estate Market: Unique Growth Opportunities

The increase in foreign investment inflows makes the real estate market a central element of investment activity in Central Asia, especially in Bishkek, where the market is in its early stages of development but shows impressive growth rates. In the first eight months of 2025, Bishkek registered 7,576 real estate transactions, which is 74.6% more than the previous year. The average price of apartments increased by 35.1%, reaching 95,900 KGS per square meter, while the price of private houses rose by 25.3%, to 142,100 KGS per square meter. These figures indicate a growing demand for both residential and commercial real estate. Rental yields stand at 7–9% per annum, significantly exceeding the performance of traditional financial instruments. This confirms the high interest from both domestic and foreign investors, creating a solid foundation for stable returns and long-term asset value growth (according to Akchabar and 24.kg).

Moreover, Kyrgyzstan is creating a favorable legal environment: foreigners can easily acquire apartments and commercial real estate, and registration procedures are characterized by transparency and simplicity. Taxation on the purchase and sale of properties remains clear and predictable, while owners' rights, including the right to use, lease, and generate income from properties, are reliably protected. This makes the market more attractive and secure compared to other countries in the region, opening long-term opportunities for investors focused on high and stable returns.

The geographical location of Bishkek and the potential for economic and tourist development of surrounding areas — Issyk-Kul, Ala-Archa, and the suburbs of the capital — create long-term investment opportunities. Property prices in these areas remain affordable, while the demand for recreation, eco-tourism, and modern urban infrastructure is rapidly growing, allowing investors to take advantage of future price increases and the development of multifunctional projects. The combination of these factors makes the Bishkek real estate market not only a short-term opportunity but also a strategic choice for those looking to invest in sustainable assets with high and stable returns, as well as participate in the creation of modern urban spaces that provide comfort for living, working, and leisure.

The growth in the number of transactions, the rapid increase in property prices, and rental yields exceeding average market indicators, along with a transparent legal framework and growing demand for urban and tourist infrastructure, indicate that Bishkek is on the brink of a new growth phase as an emerging real estate market. It is not only the most attractive destination for investment flows in the region but also a strategic opportunity for investors looking to get ahead of the long-term growth cycle, as asset values still have significant potential for further increases, and a modern urban ecosystem is gradually taking shape.

New Horizons for Investment Amid a Shortage of Reliable Investment Products in Bishkek

In the context of a severe shortage of quality and safe investment instruments, Royal Central Park — the first large-scale All-in-One project in Bishkek — stands out as the optimal choice for investors seeking long-term and guaranteed assets. The project is implemented by RCA Living, part of TNG Global Foundation (UK), and is focused on the concept of "a city within a city", where residents can live, work, study, and relax without leaving the complex. Royal Central Park includes 24,000 modern apartments, 766,000 m² of commercial space, a 55-story office complex, and numerous parks, lakes, schools, hospitals, hotels, sports facilities, and recreation areas. The project is located in the new western center of Bishkek, which is being formed as the future administrative, business, and financial hub of the capital. This creates significant potential for property value growth as infrastructure is completed.

The multifunctional complex Royal Central Park — a new symbol of happiness in Central Asia.

Royal Central Park stands out due to its philosophy of sustainable development: the project is implemented according to international standards using eco-friendly materials, optimizing green spaces and energy consumption. More than 70% of the area is allocated for parks and public spaces, including a central park of over 10 hectares, referred to as "the main lungs of Bishkek." Royal Central Park is not just a residential complex but the creation of a modern lifestyle where material and spiritual values intertwine, creating a unified community.

Construction progress of the multifunctional complex Royal Central Park

According to Akchabar.kg, in the first eight months of 2025, the average cost of housing in Bishkek increased by 35.1%, significantly exceeding bank interest rates and the inflation level. Combined with a transparent legal framework that protects the interests of foreign investors and allows them to freely manage their income and transfer ownership rights, real estate becomes an effective long-term "safe haven" for capital. With high price growth and a favorable investment climate, the Bishkek real estate market is becoming a reliable channel for long-term investments, surpassing traditional financial instruments. Royal Central Park, as the first All-in-One project in the capital, offers sustainable returns and an integrated concept of "live-work-play," making it a strategic choice for investors focused on long-term assets. In a context where global capital flows seek safety and efficiency, the banking sector is no longer the only option. Royal Central Park is becoming a symbol of "a new generation investment haven" in the heart of Kyrgyzstan, providing investors with the opportunity to preserve capital and benefit from stable price growth in the real estate market, which is still in the formative stage but has enormous potential.

Discover Royal Central Park with the "city within a city" concept — the first all-in-one urban complex in Bishkek:

Royal Central Park — a new symbol of happy urban space in Bishkek.