On November 24, 2025, the Board of the National Bank of Kyrgyzstan decided to raise the key (policy) rate by 100 basis points, bringing it to 11%. This change will take effect on November 25, 2025.

Since the beginning of 2025, the inflation rate in the Kyrgyz Republic has reached 7.3%, and on an annual basis — 8.9%. The current price situation in the country is determined by external economic conditions, which continue to have a significant impact on domestic prices. The rise in global food prices and high inflation in neighboring countries also contribute to this. In particular, the highest price increases are observed in the non-food goods segment, which is associated with the rising costs of imported fuels and lubricants, increased electricity tariffs, and heightened domestic consumption. At the same time, food prices are rising more moderately.

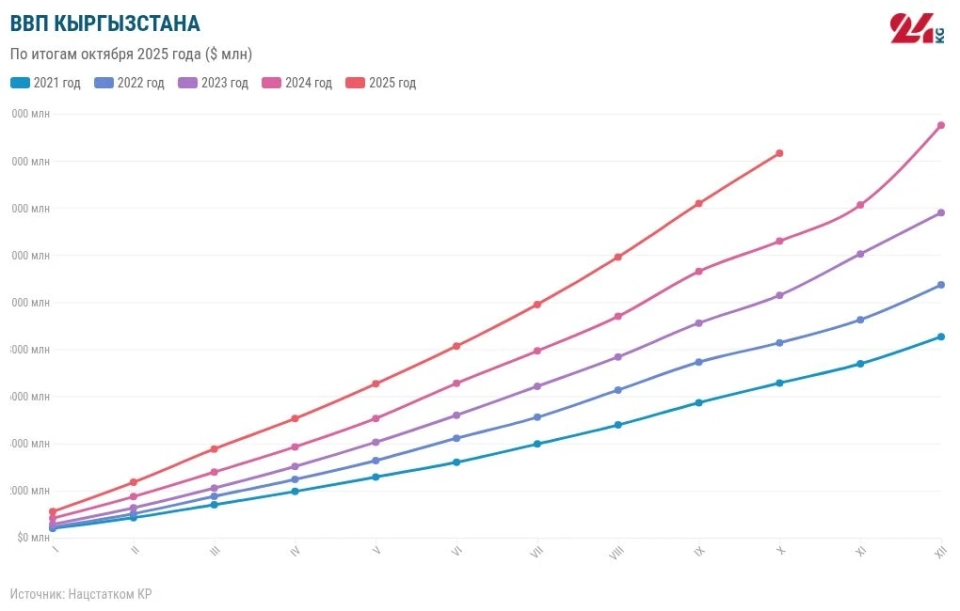

The economy of the country remains highly active. From January to October 2025, the real gross domestic product increased by 10% due to stable consumer demand and growing investment activity. The main drivers of GDP growth are the services sector (+4.5 percentage points), construction (+2.0 percentage points), and industry (+1.6 percentage points). High domestic demand is supported by rising real wages, an influx of remittances, and growth in consumer lending. Investments in fixed capital continue to increase, mainly due to domestic sources of financing, which contributes to the development of the construction sector.

Monetary conditions are aimed at achieving the target inflation level in the range of 5-7%. The interbank benchmark interest rate BIR is at the lower bound of the National Bank's interest corridor, indicating a high level of liquidity in the banking system.

The domestic foreign exchange market demonstrates stability: the balance between supply and demand for foreign currency is maintained. The increase in the National Bank's international reserves strengthens resilience to potential external shocks amid uncertainty.

The stability of the banking sector is also maintained, and its high level of liquidity provides sufficient opportunities for lending. As of the end of the first nine months of 2025, the volume of the banks' loan portfolio grew by 35.2%, and the deposit base increased by 35.7%. The increase in deposits in the national currency is associated with rising real incomes of the population and its saving activity against the backdrop of tightening monetary policy. Overall, there is a gradual decrease in the level of dollarization of both deposits (to 35.0%, -7.9 percentage points since the beginning of the year) and loans (to 17.8%, -2.3 percentage points since the beginning of the year).

Price volatility for energy resources and rising global food prices, combined with inflationary trends in partner countries, continue to exert pressure on the prices of imported goods. This creates a risk of an inflationary background in the near future and underscores the need for current tightening of monetary policy. However, domestic inflationary factors remain under control and relatively moderate. In this context, the National Bank's policy rate was raised to 11.00%. This decision is intended to help shape price dynamics in the medium term within the target range of 5-7%.

The National Bank applies a balanced approach in its monetary policy and continues to analyze external and internal factors affecting inflation. In the event of risks to price stability, the bank reserves the right to adjust its policy.

The next meeting of the National Bank's Board, where the issue of the policy rate will be considered, is scheduled for January 26, 2026, according to information from the National Bank.