Prices and Inflation in the Country

The National Bank reports that as of the beginning of 2025, the inflation rate in Kyrgyzstan reached 7.3%, and on an annual basis, it is 8.9%.

The dynamics of prices in the country are influenced by external economic factors, which have a noticeable impact on domestic prices. Global food prices continue to rise, and the inflation rate in neighboring countries remains high.

According to the NB KR, imported goods are becoming more expensive, which in turn affects inflation. The most pronounced increase is observed in the prices of non-food goods, which is associated with the rising cost of imported fuel, increased electricity tariffs, and growing domestic consumption. At the same time, prices for food products are rising moderately.

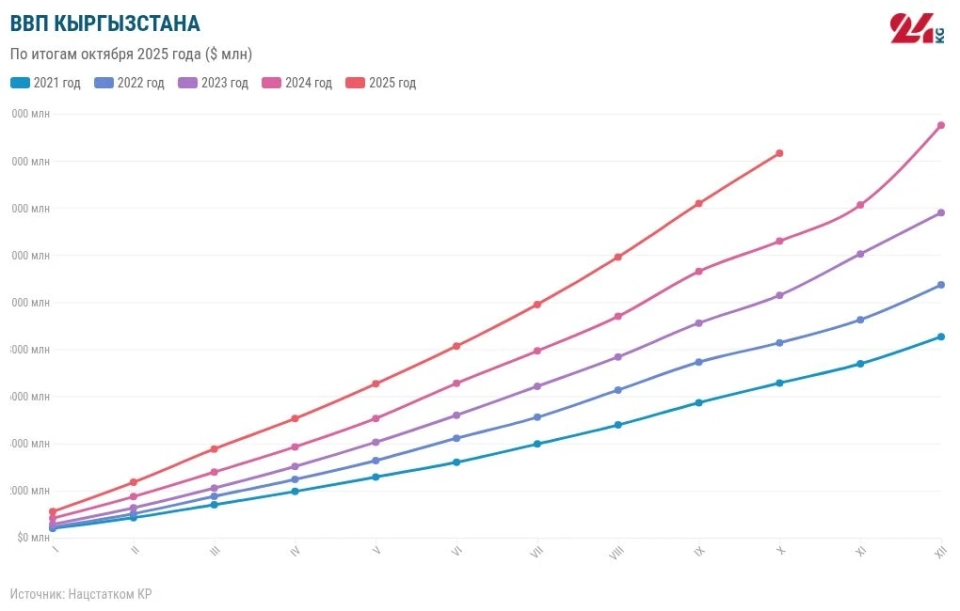

Economic activity in the country remains high: as of the end of January-October 2025, real GDP increased by 10% due to stable consumer demand and active investments. The services, construction, and industrial sectors continue to make the largest contributions to GDP growth.

Support for high domestic demand is ensured by the growth of real wages, an increase in remittances, and the expansion of consumer lending. Investments in fixed capital continue to grow, contributing to the development of the construction sector.

Monetary policy is aimed at returning inflation to the medium-term target range of 5-7%.

The interbank BIR rate is set near the lower boundary of the National Bank's interest corridor, indicating a significant liquidity surplus in the banking system.

State of Finances and the Banking System

The National Bank emphasizes that the domestic currency market remains stable, and the balance between supply and demand for currency is maintained.

According to the NB KR, the banking sector demonstrates stability and a high level of liquidity, allowing for effective lending to the economy. Over the nine months of 2025, the volume of the banks' loan portfolio increased by 35.2%, and the deposit base grew by 35.7%. The growth of deposits in the national currency is due to the increase in real incomes of citizens and active savings by the population amid tightening monetary policy.

Overall, the level of dollarization in the banking sector continues to decline: the share of dollar deposits was 35%, and loans were 17.8%.

Energy Resource Prices

Price fluctuations in energy resources in the region and rising global food prices, along with inflationary pressure from Kyrgyzstan's main trading partners, create price pressure on imports. These circumstances indicate a high likelihood of an inflationary background in the near future, justifying the need for a tightening of monetary policy.

The National Bank does not rule out the possibility of adjustments in monetary policy in case of risks to price stability.

The next scheduled meeting of the National Bank's board regarding the policy rate will take place on January 26, 2026.