According to Pakhomov, the modernization of the trading system has become an important step for local investors. Previously, the process of purchasing shares of international companies could take up to a day and required significant effort, whereas now a transaction can be completed in just 120 milliseconds. This opens up the opportunity for quick acquisition of shares in giants like Apple, Microsoft, and Coca-Cola.

Investors now have access to over 3000 stocks and exchange-traded funds, significantly expanding their choices. They can apply various strategies—from risky speculative ones to more conservative approaches that provide returns in the range of 3–5% in dollars," he added.

The expert also noted that 2025 has been successful for the global economy and stock markets, with most country indices experiencing growth. The ITS World and ITS Sharia funds demonstrated returns of 25–26%, which, according to Pakhomov, represents a "golden mean" between risk and stability.

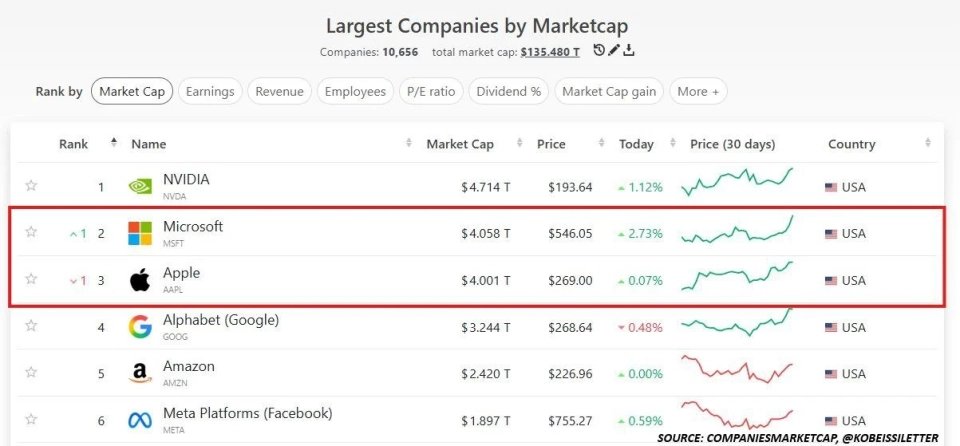

Among the main factors influencing market dynamics, Pakhomov highlighted the tariff policy of the United States, changes in interest rates, and the growing interest in artificial intelligence. The tech giants comprising the "magnificent seven," with a capitalization of over a trillion dollars, have become the main drivers of growth in the American market.

However, recently there has been a shift in trends: investors have started to lock in profits in the tech sector and redirect their funds into more stable areas such as medicine, consumer goods, utilities, and telecommunications, which offer predictable returns.

Interest in artificial intelligence is also beginning to wane, despite significant investments from large companies. Investor profit expectations sometimes do not align with reality, leading to stock overvaluation.

Moreover, the precious metals market is gradually cooling off after a sharp price spike, and investors are increasingly turning to asset diversification and protective instruments.

The American stock market remains close to historical highs: the Dow Jones index has surpassed the 50,000 mark for the first time, while the S&P 500 temporarily rose above 7,000. At the same time, the market is in a process of reevaluation and searching for new equilibria.

The variety of investment instruments allows for portfolio formation depending on the level of risk. Investors seeking high returns may choose volatile assets, while more conservative market participants prefer stable instruments with reliable returns and dividends.

It is also worth noting the growing interest in Islamic financial instruments that comply with Sharia, which are becoming an integral part of the investment infrastructure in the region.

The expansion of access to international capital markets opens new prospects for Kyrgyz investors, contributing to increased financial literacy and the formation of a modern investment approach," Pakhomov concluded.