QCP Capital Links Bitcoin's Rise to Maduro's Arrest

In their new report, experts from QCP Capital point out that the rise in prices for Bitcoin and Ethereum, which have emerged from a long sideways trend, coincided with recent events in Venezuela, including the arrest of President Nicolás Maduro.

Breakthrough After a Long Period of Stability

At the beginning of trading in Asia, Bitcoin surpassed the $92,000 mark, while Ethereum rose above $3,100. This movement occurred against the backdrop of rising stock indices and falling oil prices, which analysts believe may be linked to actions by the United States.

According to QCP Capital, the correlation between the movement of cryptocurrencies and traditional assets may indicate a change in trading dynamics. Bullish sentiment is observed at the beginning of the new year, especially after the tax season has concluded and in anticipation of new legislative initiatives in the cryptocurrency sector.

The Impact of Venezuela and "Shadow" Reserves

Although many optimistic assumptions are already priced in, Maduro's arrest could serve as a short-term catalyst for Bitcoin's growth. Concurrently, rumors have resurfaced in the market regarding possible large reserves of Bitcoin held by Venezuela.

According to rumors, the Venezuelan government may control a significant "shadow" reserve of Bitcoin comparable to the assets of MicroStrategy; however, QCP Capital emphasizes that this data has not yet been confirmed.

If the information proves true, it could make Venezuela the largest sovereign holder of Bitcoin, aligning with the country's increasing dependence on cryptocurrencies, including the use of USDT in oil transactions starting in 2024.

Options Activity and Strategic Reserves

The potential addition of confiscated Bitcoin to the strategic reserves of the United States could reduce the likelihood of forced sales, highlighting the growing importance of Bitcoin amid international competition for accumulating this asset.

There is an optimistic trend in the options market. QCP Capital notes a decrease in put skew and the purchase of over 3,000 call options with a strike price of $100,000 expiring on January 30, 2026.

This strategy allows traders to acquire the right to buy Bitcoin at a price of $100,000 until the end of January 2026, providing the opportunity for profit if the price rises above this level. It also helps minimize risks by limiting maximum losses to the cost of the option premium.

Demand for growth-related strategies is also increasing, including straddles, which involve the simultaneous purchase of call and put options with the same strike price, indicating the closing of short positions and increasing gamma movement risk amid the ongoing rally.

Warning from QCP Capital

Despite positive trends, QCP Capital warns against excessive complacency. American trading sessions continue to restrain recent gains, and this pattern requires close attention.

Geopolitical events in Venezuela are creating a new dynamic for the cryptocurrency market, merging traditional politics with digital assets and opening up new opportunities.

Analysis from an AI Perspective

From a machine analysis standpoint, the connection between geopolitical events and cryptocurrency prices often proves erroneous. History shows that many Bitcoin movements have been attributed to external factors post-factum, from Federal Reserve decisions to military conflicts. Statistical analysis of over 100 such cases in the last five years indicates that in 70% of instances, the correlation disappears within a few trading sessions.

While the macroeconomic logic regarding the disinflationary effect of oil seems reasonable, it overlooks an important fact: Bitcoin traditionally responds weakly to fluctuations in the Consumer Price Index. More significant factors remain dollar liquidity and institutional flows. The hypothesis of Venezuela's "shadow reserves" resembles myths about treasures—it is appealing but requires more substantial evidence than mere market speculation.

Source: hashtelegraph.com

Read also:

Upcoming Events for Lawyers from the British Company "Capital Business Events"

Dear Ladies and Gentlemen!...

The Beginning of a New Era? When Culture Shapes the Financial World

The Interaction of Cryptocurrency and Culture Cryptocurrencies are a vivid example of the...

Kyrgyzstan has dropped to 41st place in the global gasoline price ranking

According to the report from the analytical portal Global Petrol Prices, Kyrgyzstan ranks 41st in...

Kyrgyzstan has worsened its position in the global ranking of gasoline price accessibility

According to a recent report by the analytical portal Global Petrol Prices, Kyrgyzstan ranks 41st...

Kazakhstan and the USA will jointly mine tungsten in the Karaganda region

The American company Cove Capital and the Kazakhstani "Tau-Ken Samruk" have signed an...

One of the veterans of intellectual sports in Mongolia won the Asian poker tournament

Khatanbaatar Khandsuren The Asian Poker Tour (APT) is one of the most significant series of poker...

Kyrgyz Stock Exchange Records First ESG Report from Private Business

The first non-financial company to publish an ESG report on the Kyrgyz Stock Exchange is a...

In Kyrgyzstan, a Higher School of Governors Will Be Launched

A Higher School of Business for Central Asia has been opened in Bishkek, created in partnership...

Kyrgyzstan took 10th place at the World Cup in India

At the World Boxing Cup stage held in India, the Kyrgyzstan team took 10th place in the overall...

Partner of "AvtoVAZ" launched a hub for localization of Russian production in Kyrgyzstan

According to the press service of Central Asia Capital, a memorandum for the establishment of the...

Global Finance included the head of the National Bank of the Kyrgyz Republic in the Central Banker Report Cards ranking.

Every year, Global Finance magazine publishes a ranking called Central Banker Report Cards. This...

Tapered Net-cap

Tapered Net-cap (Dictyocephalus attenuatus (Peck) Long et Plunkett). Status: VU. A very rare...

Obtusilobous Windflower / Uchsuz Anemone / Anemone obtusiloba

Obtusilobous Windflower Status: VU. The westernmost boundary of its range in Kyrgyzstan is located...

White-bellied Long-eared / Akboor Jebekulak Bat / Desert Long-eared, or Hemprich’s Arrow-eared, Bat

Desert Long-eared Bat Status: Category VII, Lower Risk - Least Concern, LR/lc....

Lesser Horseshoe Bat / Kidik Taka Tumshuktyu Jarganat / Малый подковонос

Lesser Horseshoe Bat Status: Category VI, Near Threatened, NT: R. A species with a declining...

Huge stress for tourists. Official on toilets in Kyrgyzstan

Currently, there are only ten facilities known as Rest Points operating in Kyrgyzstan. This was...

Venezuela. Bolivarian Republic of Venezuela

Venezuela. Bolivarian Republic of Venezuela A country in the northern part of South America. Area...

"Two Boards with a Roof": The Lack of Proper Toilets in Kyrgyzstan Deters Tourists

In Kyrgyzstan, as part of the Rest Point project, it was initially planned to build 58 modern...

Establishment of the Honorary Certificate. Document No. 207 (May 1958)

RESOLUTION OF THE FRUNZE CITY COUNCIL OF WORKERS' DEPUTIES "ON THE ESTABLISHMENT OF THE...

The strategy of "using Taiwan to contain China" is doomed to fail

In an interview with "Vecherniy Bishkek", Liu Jiangping, the Extraordinary and...

Resources and Investments. India Strengthens Ties with Key Partners in Africa

President of India Droupadi Murmu. Photo by Capital FM. From November 8 to 13, 2025, President of...

Trump stated that the US seized an oil tanker off the coast of Venezuela

President Donald Trump stated that a "very large" oil tanker was seized by American...

Construction and Opening of the Automobile and Road Technical School in Frunze. Document No. 204 (June 1957)

DECREE OF THE COUNCIL OF MINISTERS OF THE KYRGYZ SSR "ON THE OPENING OF THE AUTOMOBILE ROAD...

Catmint-like Scullcup / Nepeta dalmatica / Scullcap-like Catmint

Catmint-like Scullcup Status: VU. A very rare narrowly endemic species. Ornamental plant....

Kashgarian Bean Caper

Kashgarian Bean Caper Status: VU. Rare, little-studied endemic species....

The USA has seized a second oil tanker off the coast of Venezuela

According to CBS and Bloomberg, on Sunday the U.S. Coast Guard began an operation against the...

Solo Concert of Ozoda

Uzbek pop star Ozoda is coming to Kyrgyzstan for her first solo concert! The singer @ozodaofficial...

The Prosecutor General's Office of Kazakhstan will once again check the assets of Nazarbayev's nephew.

Nurbul Nazarbayev The Prosecutor General's Office of Kazakhstan has initiated a check of the...

Issyk-Kul Scaleless Osman / Kök Chaar, Ala Buga

Issyk-Kul Scaleless Osman Status: 2 [CR: D]. Lake form, very rare, critically endangered....

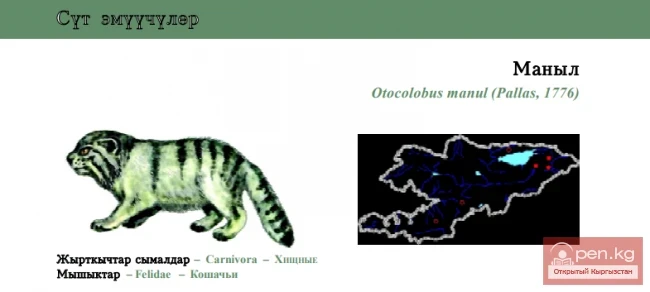

Pallas's cat

Manul Status: VI category, Near Threatened, NT. Rare species throughout its range....

Knorring's Hawthorn / Knorring's Dolenos / Knorring’s Haw-tree

Knorring’s Haw-tree Status: VU. A narrowly endemic species....

The USA Captured a Tanker Off the Coast of Venezuela

Trump also added that this day has been "interesting in terms of news." "We just...

Information on Social Competitions Among Artels of Frunze. Document No. 125 (March 1939)

INFORMATION FROM THE INTERDISTRICT INDUSTRIAL UNION ON SOCIALIST COMPETITION AND STAKHANOV...

Approval of the Planning and Development Project for the City of Frunze. Document No. 209 (June 1958)

City of Frunze June 27, 1958. The Council of Ministers of the Kyrgyz SSR resolves:...

Organization in Frunze of the Kyrgyz State Drama Theater. Document No. 129 (June 1941)

RESOLUTION OF THE COUNCIL OF PEOPLE'S COMMISSARS OF THE KYRGYZ SSR "ON THE ORGANIZATION...

Hackers Claim to Have Hacked Pornhub and Threaten to Expose Premium User Data

A hacker group called ShinyHunters has announced that they have hacked Pornhub and stolen data from...

Resolution of the Kirov Regional Committee of the All-Union Communist Party (Bolsheviks). Document No. 106 (October 1936)

RESOLUTION OF THE KIRGHIZ REGIONAL COMMITTEE OF THE VKP(b) "ON THE ORGANIZATION AND...

Organization of a Puppet Theater in the City of Frunze. Document No. 123 (September 1939)

RESOLUTION OF THE COUNCIL OF PEOPLE'S COMMISSARS OF THE KYRGYZ SSR "ON THE ORGANIZATION...

Kazakhstan topped the ranking of the happiest country in Central Asia

According to the latest World Happiness Report 2025, Kazakhstan ranked first as the happiest...

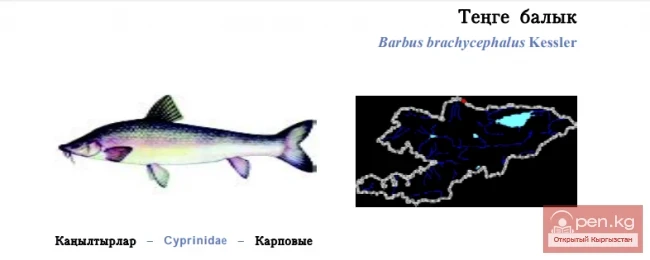

Aral Catfish / Tenge Fish / Aral Barbel

Aral Barbel Status: 2 [CR: C]. Species extinct in Kyrgyzstan....

Kyrgyzstan Premier League: Maxim Shatskikh Became the Coach of "Asia"

The football club "Asia," a newcomer to the Kyrgyzstan Premier League from Talas, has...

The International Business Council has developed a vision for the development of Kyrgyzstan's economy.

The International Business Council has developed a vision for the development of the Kyrgyz...