The GNS identifies the fraudulent issuance of electronic invoices.

According to the agency, such violations are detected through analytical methods based on risk assessment, as well as using modern digital technologies and information systems.

It is noted that unscrupulous taxpayers create fictitious electronic invoices to artificially inflate expenses and illegally reduce their tax liabilities.

The GNS emphasizes that the issuance of electronic invoices is permitted only if there is a real economic transaction and documented movement of goods, works, or services.

The use of electronic invoices in schemes of fictitious document flow is a serious violation of tax legislation, which entails legal liability as provided by law.

The agency urges taxpayers to refrain from illegal actions and engage in honest business activities, emphasizing that sanctions for such violations are inevitable and can lead to significant financial losses.

The GNS also announced its intention to continue and strengthen efforts to identify and prevent fictitious electronic invoices, and all identified cases will be subject to legal assessment.

Read also:

When the taxpayer must enter purchase data into the EFS system themselves

The State Tax Service reminds that taxpayers using electronic invoices must independently enter...

The GNS clarified who is required to use KKM, ETTN, and ESF

“These tools create a fair and effective tax system” The State Tax Service of the Kyrgyz Republic...

The GNS Warned About Penalties for Fake Invoices

According to the information from the press service of the State Tax Service (GNS), cases of...

Who Should Use KKM, ETTN, and ESF. Clarification from the GNS

The State Tax Service has provided clarifications on the use of the electronic waybill (EWT),...

Ibraev proposed to the Chinese to invest in the construction of the power lines "Kemin-Torugart" and "Barskoon-Bedel"

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

The Tax Service of the Kyrgyz Republic clarified who should apply KKM, ETTN, and ESF

The Tax Service of the Kyrgyz Republic has provided information on the rules for the use of cash...

The exhibition "Kyrgyzstan EXPO 2025" started today in Bishkek.

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

In Kyrgyzstan, there are plans to regulate artificial intelligence. What is behind this?

With the development of artificial intelligence, numerous questions arise regarding its regulation....

Bakyt Torobaev familiarized himself with the activities of the Potato Farming Development Center "Tyup"

On November 24, 2025, the Minister of Water Resources, Agriculture, and Processing Industry, Bakyt...

In Bishkek, the best exporters of the country were awarded

On December 24, 2025, the final of the national competition "Best Exporter of the Kyrgyz...

Products of Batken gardeners enter new markets thanks to a new enterprise

In the Batken region, in the village of Samarkandek, a new enterprise has opened that processes...

Personal QR codes for business are banned. Banks are blocking accounts, cash is requested at the market.

Since 2020, there has been a rise in cashless payments in Kyrgyzstan. According to the National...

Why Are Merchants Afraid of QR Payments? - Interview with the Deputy Head of the State Tax Service

In light of discussions on social platforms and in the media about how many sellers at markets...

The tax authorities explained why businesses cannot accept payments to personal electronic wallets

Banks have the right to block accounts, and violations may lead to penalties. The State Tax...

The National Bank of the Kyrgyz Republic presented new rules for financial marketplaces

The National Bank of Kyrgyzstan (NB KR) has published a draft of new rules aimed at organizing the...

Release of jewelry items without primary documents: clarification from the State Tax Service

Taxpayers have been given the opportunity to be exempt from the obligations of a tax agent...

In the capital, the pilot delivery of solid waste to the new waste processing plant has begun

In the capital, the first stage of the delivery of solid household waste (SHW) to the new waste...

Liquidation of Individual Entrepreneurs: Legal Nuances You Should Know

The State Tax Service of the Kyrgyz Republic has announced the start of the procedure for the...

At the GNS, issues of export and re-export were discussed

Kubanychbek Isabekov, Deputy Chairman of the State Tax Service under the Government of the Kyrgyz...

The tax authority reminded about the deadlines for entering jewelry items into the EFS system

The State Tax Service has informed taxpayers that they have the opportunity to avoid liability and...

Taxpayers will be able to obtain exemption on jewelry without documents

The State Tax Service of the Kyrgyz Republic has clarified the new procedure The State Tax Service...

The Roads of Independent Kyrgyzstan: Major Infrastructure Projects Funded by the State Budget

In recent years, there has been active development of road infrastructure in Kyrgyzstan, funded by...

Mistakes Today - Problems Tomorrow. Expert Explained How to Avoid Tax Issues

Saida Nariman, or Kamila Kasymova, is a tax expert with 20 years of experience who has managed to...

The Cabinet will require businesses to accept payment only by card? Response from the State Tax Service

In late October 2025, a package of amendments to the Tax Code of the Kyrgyz Republic was approved,...

The Russian-Kyrgyz Development Fund invested $1 billion in the economy of Kyrgyzstan

For a successful business start, financial assistance is essential. The Russian-Kyrgyz Development...

Launched updated hydro units of Toktogul and Uch-Kurgan hydropower plants

In the Jalal-Abad region, the Minister of Energy of Kyrgyzstan, Talaybek Ibraev, conducted a...

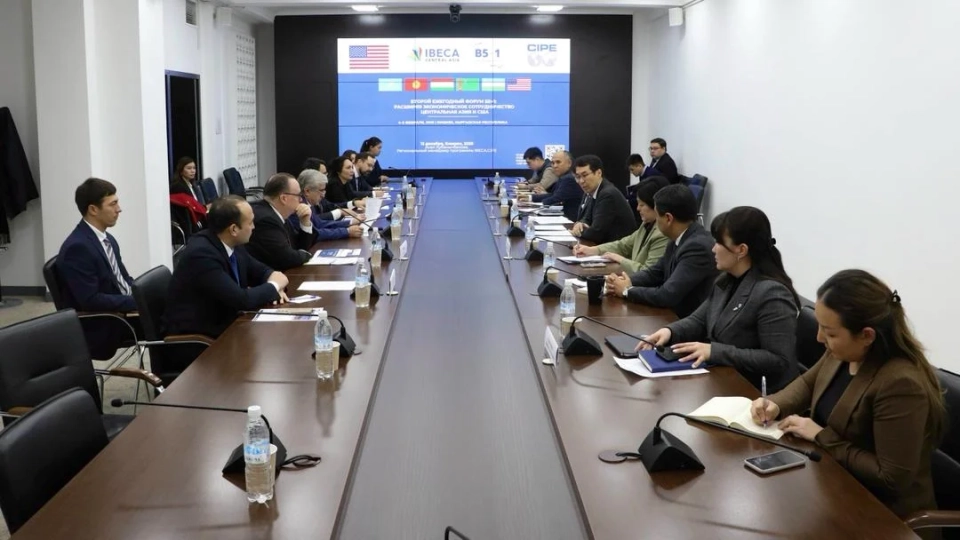

Kyrgyzstan Presented Key Directions of the "B5+1" Forum to the Diplomatic Corps

Today, a joint briefing organized by the Ministry of Foreign Affairs and the Ministry of Economy...

Risks and Development. How is Kyrgyzstan Planning to Regulate Artificial Intelligence?

With the rise of artificial intelligence, numerous questions arise regarding its regulation. How...

Business is ready to invest in people if reforms are conducted transparently

High-level consultations "From Doha to Bishkek" were held in Bishkek, resulting from the...

Beans as a Brand of Kyrgyzstan: A Processing Plant is Proposed to be Built in Talas

Beans are an important agricultural crop grown not only in Kyrgyzstan but also in China, India,...

Kyrgyzstan will increase cargo transportation volume to 110 million tons by 2030 — Sydykov

Currently, the second day of the Central Asian Regional Economic Cooperation (CAREC) business...

Historical Maximum: The State Tax Service Exceeded the Tax Plan by 46.5 Billion Soms

At the hardware meeting led by Almambet Shykmamatov, the chairman of the State Tax Service, the...

Investments Under Legal Protection: Kyrgyzstan is Shaping a New Economic Policy

In Bishkek, a National Investment Dialogue took place, gathering representatives from the...

A large coal open-pit mine opened in Batken

The official opening of the large coal pit "Suluktu," located in section No. 11, took...

Markets and shopping centers are required to monitor entrepreneurs and report to the State Tax Service.

In Kyrgyzstan, a new law has been adopted that significantly changes the rules of tax regulation....

300,000 companies may close in Kazakhstan due to tax reform. Consequences for the KR

A large-scale tax reform in Kazakhstan is already causing significant concern among representatives...

In Kemino, the poultry farm "Agro Kush" was opened

The opening ceremony of the new modern poultry meat production complex "Agro Kush,"...

Artificial Intelligence Used in Tax Audits in Kyrgyzstan

According to information provided by the press service of the State Tax Service, in 2026, the State...

Proposal to Extend the Ban on the Import of Electronic Cigarettes in Kyrgyzstan

The Ministry of Economy and Commerce has published a draft resolution that reintroduces a ban on...

The GNS discussed the latest changes in tax legislation with businesses.

The meeting of representatives of the State Tax Service (GNS) with businesspeople was organized to...

A tourist map of the Naryn region is being created.

The "Naryn Regional Association of Entrepreneurs," with financial support from GIZ in...