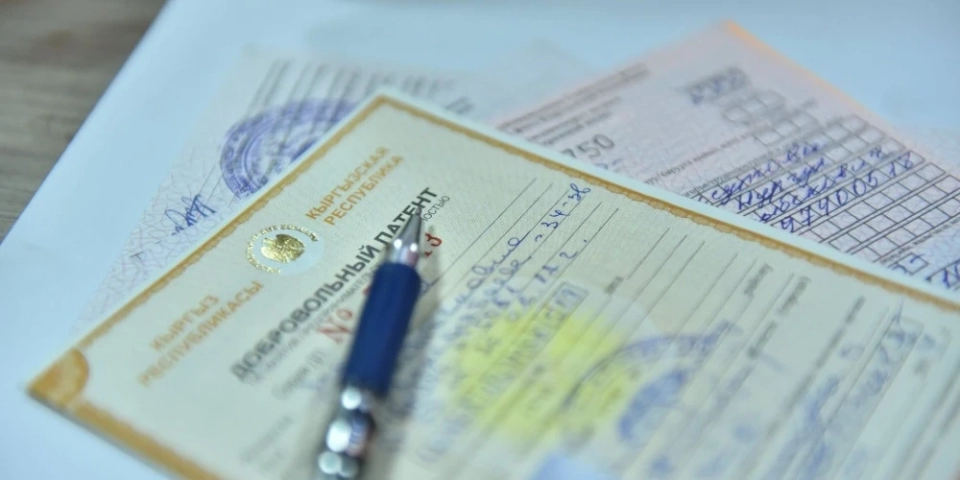

In the agency's statement, it is specified that "such violations are identified based on analysis using a risk-oriented approach and modern digital tools." Dishonest taxpayers distort tax accounting data by creating fictitious electronic invoices to unlawfully reduce tax liabilities.

These actions violate the tax legislation of the Kyrgyz Republic and entail the legal consequences provided by law.The GNS emphasizes that the issuance of electronic invoices is only possible in the presence of real business transactions and confirmed movement of goods, works, and services.

“We assure you that all attempts to use electronic invoices in schemes of fictitious documentation will be detected and stopped,” the GNS stated, urging taxpayers to cease such actions and conduct honest business activities. “Sanctions and liabilities established by law are inevitable and quite strict,” they added.

Ultimately, such schemes will be uncovered, leading to significant financial losses.The GNS will continue its work to identify and suppress such violations, promising to intensify efforts in this direction.