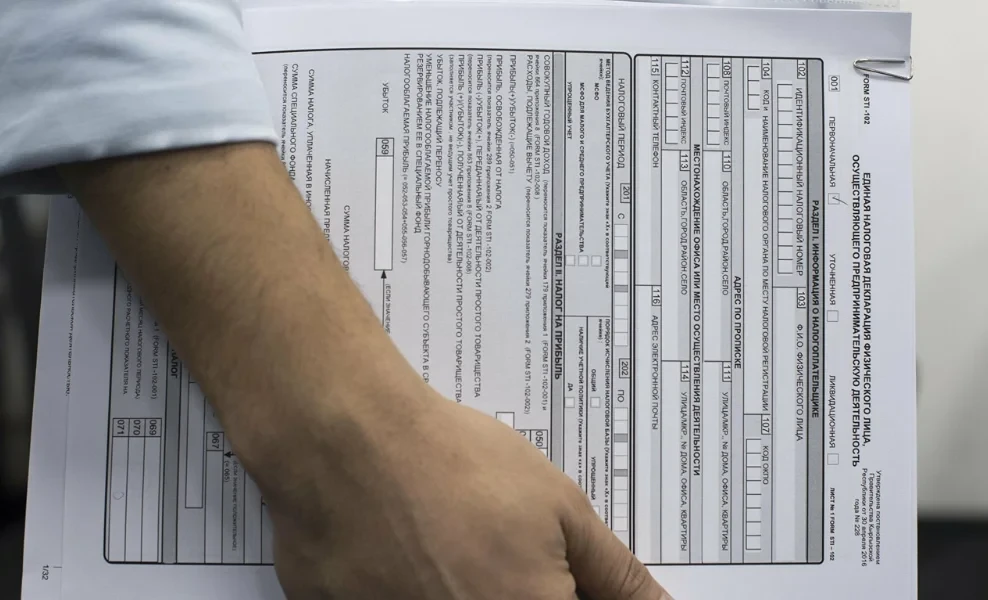

The State Tax Service of the Kyrgyz Republic once again draws taxpayers' attention to the necessity of checking information about real estate. In particular, owners of both individuals and legal entities possessing taxable properties must compare the data presented in ownership documents with the records in state registers.

Key information that needs to be verified with the information system of the State Agency for Land Resources, Cadastre, Geodesy, and Cartography under the Cabinet of Ministers of the Kyrgyz Republic (State Enterprise "Cadastre") includes:

– TIN;

– name or surname of the owner;

– area of real estate and land plots;

– purpose of the property;

– share participation;

– dates of acquisition or sale;

– other data.

It is important to note that such verification is necessary for the accurate and correct automated assessment of tax on residential and non-residential properties for the year 2026.

The State Tax Service strongly recommends that taxpayers pay attention to the timeliness of information verification to avoid errors in tax calculation.

According to tax legislation, the responsibility for calculating and assessing the tax on real estate lies with the tax authorities, while taxpayers are obliged to pay the established amount on time.

In addition, the Tax Service is actively working on the implementation of an automated tax assessment system for residential and non-residential properties. The first phase of these changes was successfully completed in 2025 concerning residential properties.

The second phase, concerning non-residential properties, will start in 2026. These measures are aimed at simplifying the process of calculating local taxes and creating more comfortable conditions for taxpayers.