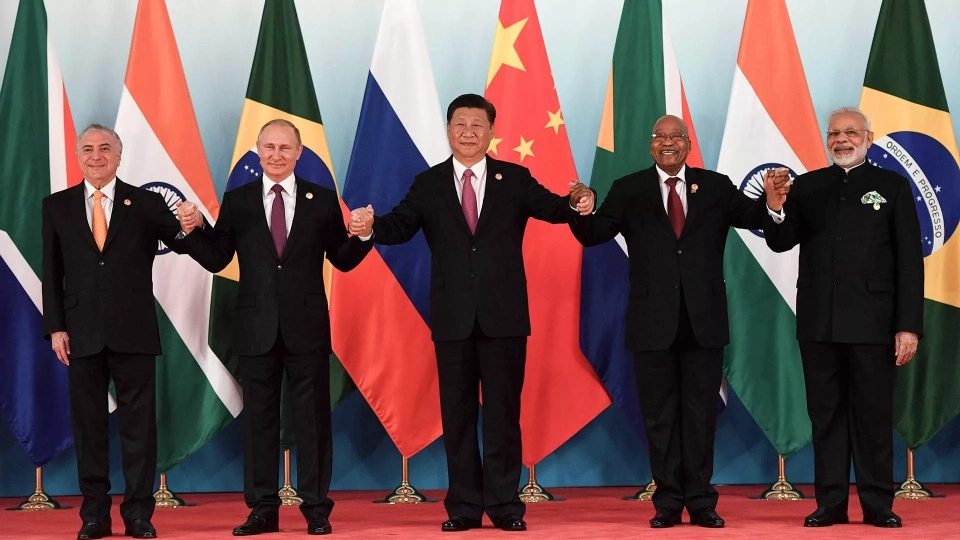

Kazakhstan, despite criticism from its representatives in the EAEU for a lack of persistence in defending economic interests, is taking decisive steps to protect domestic car manufacturers and agricultural machinery producers at the beginning of 2026, when it will assume the presidency of the union, notes Maksat Nurpeisov.

On February 3, the public discussion period for the draft order from the Ministry of Ecology of the Republic of Kazakhstan ended on the "Open NPA" portal. The agency proposed to increase the recycling fee for cars and agricultural machinery imported from Russia and Belarus. This step was a response to actions by the Russian side, which significantly raised recycling fees for equipment from Kazakhstan and other countries. Last autumn, the Telegram channel Baza reported that more than 30,000 cars assembled in Kazakhstan were imported into Russia since spring 2024, but starting in October, the Federal Customs Service began demanding additional payments, which caused dissatisfaction among the owners of these vehicles. The Kazakh side did not respond to the actions of the Federal Customs Service, citing a lack of competence in this matter.

Now, the Ministry of Industry and Infrastructure Development of Kazakhstan asserts that these events will lead to a "restoration of balance," but this only concerns equipment imported from Russia and Belarus.

There has been no official response from Moscow and Minsk yet, but representatives of industry associations in these countries are already expressing concern. The current recycling fee rates in Kazakhstan are set at 757,000 tenge (about 114,000 rubles), which is significantly lower than in Russia. The draft order from the Ministry of Ecology proposes to increase the coefficient 40-fold, resulting in tariffs of 29 million tenge or 4.4 million rubles.

This increase in fees could make the import of cars, especially from AvtoVAZ, unprofitable. It will also open new opportunities for Kazakhstani car manufacturers, the need for the development of which has long been discussed in the government. However, AvtoVAZ, which is experiencing a crisis, holds not only economic but also political significance for the Russian authorities. Anton Shaparin, Vice President of the National Automobile Union of Russia, believes that this step by Kazakhstan could be a "blow to the Eurasian Economic Union" and predicts possible retaliatory actions from Moscow.

Shaparin emphasizes that Kazakhstan is trying to limit access to its market for AvtoVAZ products, while Russia has already closed its market to other manufacturers. This could lead to the expansion of similar measures to other goods and the blocking of Russian certificates. According to him, the recycling fee is becoming a tool of political pressure, and it is important to hope for serious negotiations about the future of the EAEU.

Under Kazakhstan's presidency, the exchange of blows within the framework of Eurasian integration is likely to continue. The question of the beginning of a "trade war" between Astana and Moscow, which seemed strange just yesterday, is becoming relevant due to changes in global trade and Kazakhstan's attempts to revise its contracts with transnational companies. The situation regarding the response to Russia's actions against Kazakhstani car manufacturers shows that Kazakhstan is beginning to restore order in its integration relations, which were conceived by Nursultan Nazarbayev.

Although the EAEU is called an economic union, in practice it has become a platform for Russia to exert pressure on its partners. An example is the "sugar crisis" of 2022, when Russia cut off supplies to Kazakhstani factories, leading to a sharp rise in prices. Over the past decade, Russia has employed numerous non-tariff measures against Kazakhstan and other partners, making it difficult for Kazakhstan to respond, given its historical dependence on Russian imports.

Nevertheless, the question remains: why does Kazakhstan continue to engage in unprofitable trade not only with Russia but also with other EAEU countries? In 2023, the negative trade balance with Russia and Belarus amounted to billions of dollars. Experts point to the "difference in economic potentials" as a reason, but this is not the only factor at play.

According to Olzhas Zhoraev from the Association for Analysis and Management of State Policy, the structure of the Eurasian Economic Commission limits the promotion of the interests of member countries. Kazakhstani economists, such as Arman Beisembaev, also emphasize that the country does not gain economic benefits from participating in the EAEU, having a trade imbalance with Russia. Experts point to the lack of competencies among Kazakh representatives in the EAEU as a primary reason for the problems, as well as the absence of reliable statistics.

Ultimately, Kazakhstan's current actions to protect its automotive market may signal the beginning of more decisive steps, although it is still too early to talk about exiting the EAEU. However, it is important that Kazakhstan has begun to take the initiative, even if it is merely a reaction to the actions of other countries. As they say, the first step has been taken…