This scenario is familiar to many who went abroad for work: the money earned through hard labor simply disappears. The main reason for this is not so much low incomes as it is unplanned expenses, lack of control over financial flows, and unnoticed losses.

To find out how to change this situation, we turned to financial literacy coach Jyldyz Bazar Kulova.

We offer you a step-by-step guide on proper saving and transferring funds for those working abroad. To effectively save money, you should follow several key rules:

Rule No. 1. Create a "safety cushion"

Save at least 10–20% of each paycheck. This will help accumulate an amount sufficient to cover living expenses for one to two months (rent, food) and create a reserve for emergencies. If an unforeseen situation arises, you will not have to rely on your family or take out high-interest loans.Rule No. 2. Set financial goals and keep track

Often, a person who has worked for five years returns without any money. It has "dissolved" in everyday expenses, repairs, and celebrations. Therefore, it is important to discuss in advance with your loved ones what the transfers will be spent on. Keep a record of how much and to whom you have sent money, and ask your relatives to document large expenses. This will help avoid misunderstandings when you plan to save for a car, while your relatives think you are simply sending money for daily needs. Your transfers can be divided into two categories:- Expenses for everyday life (e.g., food, transportation, internet, rent).

- Savings for achieving a specific goal (buying an apartment, building a house, children's education).

Rule No. 3. Make informed financial decisions

Migrants usually choose one of three currencies for savings — dollars, euros, or rubles. Each has its advantages and disadvantages that should be considered when making a choice:Dollars — the most reliable currency, stable against fluctuations, and the best option for long-term savings. However, if you work in Russia, buying dollars may be inconvenient.

Euros — a stable currency suitable for travel or study in Europe, but it may be less stable than the dollar and harder to access in CIS countries.

Rubles — optimal for short-term goals if you are working in Russia, but its instability makes long-term savings risky.

Soms — best suited for expenses in Kyrgyzstan.

The recommended savings scheme for migrants:

- Working in Russia: 60–80% in dollars and soms (for long-term savings) and 20–40% in rubles (for current expenses).

- Working in other countries (Korea, Turkey, Europe): the best choice would be dollars or euros, as local currencies are often unstable.

The main principle: keep money in the currency you plan to spend it in. If the goal is to buy real estate or other large expenses in Kyrgyzstan, part of the funds can be kept in dollars, and part in soms. If you plan to study or immigrate to Europe, preference should be given to euros.

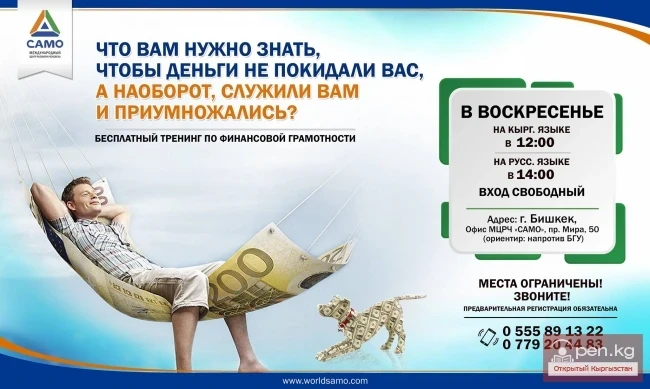

Rule No. 4. Make your money work for you

It is better if active funds are not lying under the mattress, where they can be easily taken for urgent needs. Consider investing your savings:- Bank deposits in reliable institutions in Russia or Kyrgyzstan — the safest option. You can partially keep funds in accounts in Russia (for salary and current expenses) and part in Kyrgyzstan for long-term goals. Advantages: deposit protection and fixed income. Disadvantage: income may be lower than the inflation rate.

- Cash and electronic wallets — a low-risk form of storage. Keep cash in a limited amount (20–30%) and the rest in currency accounts. Advantages: convenience of use and the ability for quick transfers to Kyrgyzstan. Disadvantages: risk of loss and the need to observe security measures.

- Gold (bars or accounts) — a good form of storage, as it can retain its value over many years. However, prices can fluctuate, and it can be difficult to sell quickly.

Rule No. 5. Be cautious with loans

Migrants often face a lack of credit history, which limits access to favorable loans. Banks may set higher rates for foreigners. We recommend following several principles when borrowing:- Carefully assess your financial capabilities and do not take out a loan that exceeds 30–40% of your income.

- Compare the terms of different banks to choose the most favorable.

- Prefer loans in the currency in which you earn income. Avoid currency loans if there is no stable income in that currency.

- Create a reserve for unforeseen expenses — at least for one or two monthly payments, to avoid delays.

- Read the loan agreement carefully and ask questions if something is unclear. Keep all documents.

- Use loans only for necessary expenses, such as housing or education.

- Monitor your credit history and repay debts on time to improve your reputation.

Rule No. 6. Consider hidden costs

Many migrants only pay attention to the size of the commission when choosing a transfer method, but this can be misleading. Banks often profit from exchange rate differences rather than direct commissions.Before sending money, always check how much your relatives will ultimately receive in soms. Compare different transfer services — sometimes a higher commission may be more beneficial if the conversion rate is more favorable. It is also recommended to use digital transfer methods and avoid cash transfers through acquaintances, as this is unsafe and can take a lot of time.