How can you avoid such troubles? In Kyrgyzstan, starting from November 1, 2025, a self-restriction on lending has been introduced — a convenient mechanism that allows you to set a "lock" on your loans. This means that no one will be able to take out a loan in your name without your consent.

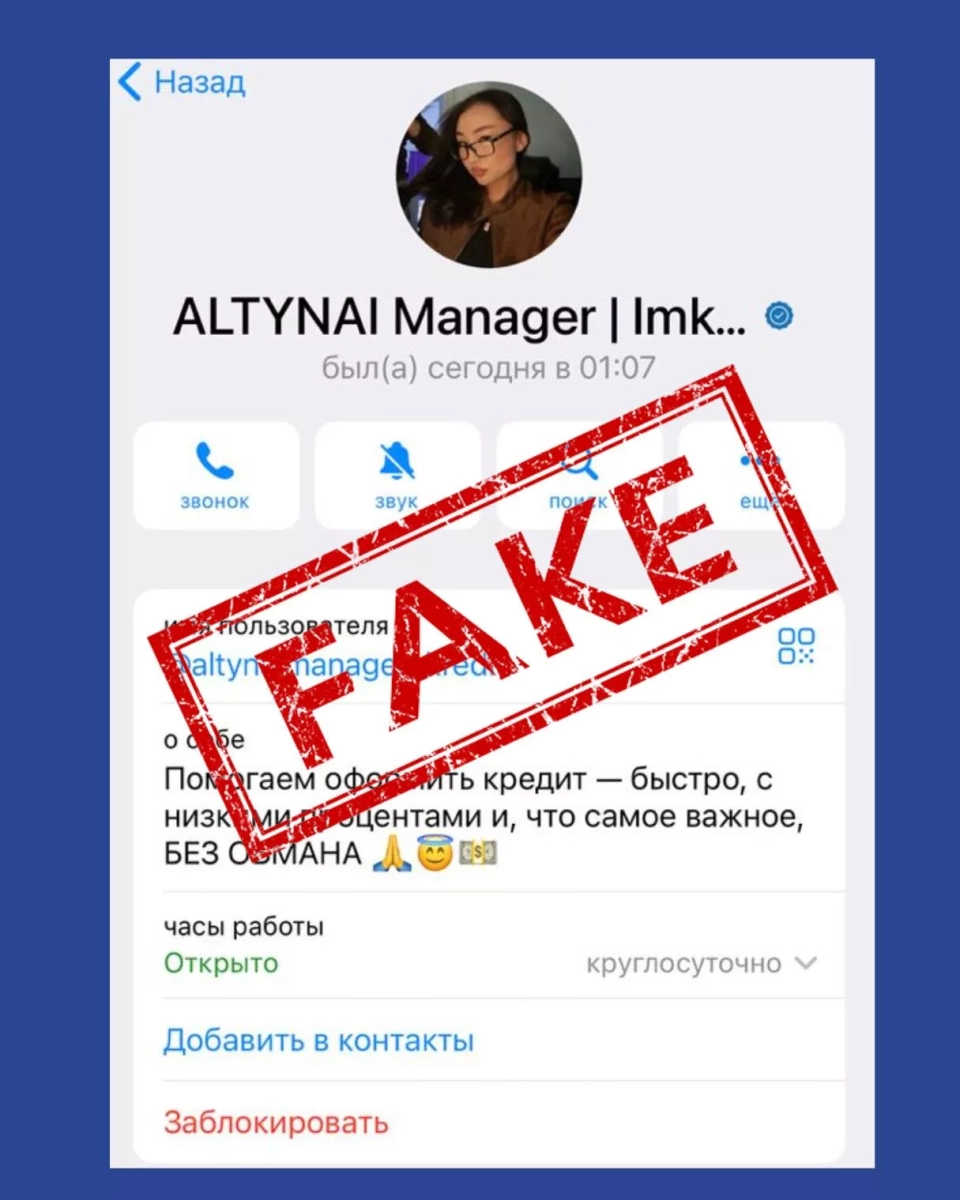

In 2024 alone, 15,000 Kyrgyzstani citizens became victims of scammers, losing 2 billion soms. This issue was discussed at meetings of the Jogorku Kenesh, resulting in an initiative to introduce a self-restriction on loans, which was approved by President Sadyr Japarov.

Setting a self-restriction helps protect against internet scammers, data theft, and unintentional spending. As of December 5, 65,356 people have already taken advantage of this opportunity, and the number is growing.

What is a self-restriction and how can it help you?

A self-restriction is a digital protection: you voluntarily block the ability to obtain loans (both online and offline) through banks and other financial institutions. If scammers attempt to take out a loan in your name, it will be deemed invalid.Banks are required to check for the presence of a self-restriction in the credit bureau (KIB "Ishenim" or "SES") before approving a loan. This is especially important for online loans.

If a loan is still taken out without your knowledge, you will not be held responsible, as the lending organization will have to explain how this occurred.

According to a survey by the National Bank, 70% of users who have set a self-restriction are young people aged 25-35 who are afraid of hackers. However, the older generation often does not know about such a feature as a self-restriction. Experts from the financial regulator emphasize the need to inform parents and elderly people about this tool.

Therefore, it is worth spending just one minute to set a self-restriction in the "Tunduk" app, which can protect you and your loved ones from fraudulent calls.

How to set a self-restriction?

To set a self-restriction, follow these steps: log into the "Tunduk" app → select the "Self-restriction on lending" option → click "Submit application" → choose the credit bureau → confirm the action. The protection will be activated instantly.Removing the self-restriction is also simple: log into the "Tunduk" app → select "Self-restriction on lending" → choose KIB → click "Remove self-restriction." The removal will occur automatically within 12 hours.

If you change your mind, you can cancel the application within 12 hours after submission, and the protection will remain active.

Banks will receive information about your self-restriction immediately. The mechanism is integrated with credit bureaus: when applying for a loan, the bank requests current data. If the self-restriction is active, the application will be rejected.

Do not postpone setting a self-restriction in case scammers attempt to seize your funds or the money of your loved ones. Set a self-restriction today!