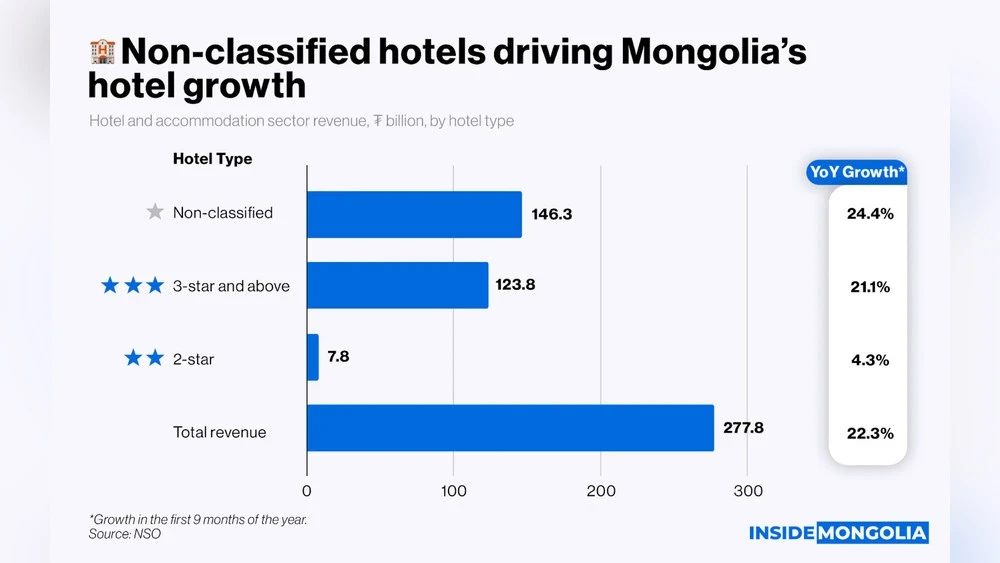

«The hotel and tourism service sector in Mongolia continues to show positive dynamics: according to the National Statistical Committee, the sector's revenue for the first three quarters of 2025 increased by 22.3% compared to the same period in 2024, reaching ₮277.8 billion,» reports InsideMongolia.

📈 Record growth over 3 years

The total income of the hotel sector rose from ₮208.3 billion in 2022 to ₮320.9 billion in 2024, which is a 54% increase over three years. Additionally, the average annual growth rate from 2022 to 2024 was about 24%, indicating stable sector dynamics rather than a short-term recovery from the pandemic.

🛏️ Unclassified hotels drive growth

The main contribution to the sector's expansion comes from unclassified hotels, which currently provide a significant share of accommodation revenue. For example, revenue from unclassified hotel services increased by 58.5%, reaching ₮167.2 billion in 2024 compared to the previous year. Moreover, in the first nine months of 2025, they generated ₮146.3 billion, nearly matching the total income for 2022. This growth is driven by domestic tourism, increased length of stay in cities, and flexible accommodation options, rather than the opening of new high-end facilities.

⭐ Slow growth in the premium hotel segment: at the same time, the segment of 3-star hotels and above increased from ₮95.3 billion to ₮143.7 billion between 2022 and 2024, reaching ₮123.8 billion at the beginning of 2025. Despite ongoing expansion, it faces constraints in production capacity and high operating costs.

⚠️ Challenges for two-star hotels: The annual turnover of two-star hotels is about ₮10 billion, and they find themselves in a difficult position between budget and premium options, raising concerns about their long-term competitiveness.

🏚️ Capacity constraints

Despite the positive revenue dynamics, the hotel sector in Mongolia faces capacity issues, especially outside of peak tourist seasons in the summer. The country has 492 hotels, 486 guesthouses, and 922 tourist camps, offering about 35,560 overnight accommodations. However, seasonality reduces supply: out of 145 winter camps, only 55 are operational, providing just 3,500 places when demand is concentrated in cities.

Overall… Ulaanbaatar is home to international 4- and 5-star hotels such as Shangri-La, Kempinski, Best Western, Novotel, and Pullman, but during peak months from June to September, there is a shortage of room inventory, highlighting the gap between supply and demand for high-end rooms.