What is actually happening? Wigi emphasizes that the current situation represents not just a series of crises but an astonishing consolidation of the debt economy. In his view, this system operates solely due to managed instability. Crises are no longer failures of policy; they have become its main driver.

Thus, crises become an integral part of the mechanism that allows for the maintenance of a distorted semblance of socio-economic order. Consider monetary policy: it is no longer limited to dull technical measures aimed at controlling inflation and ensuring financial stability. Instead, it transforms into a key organizing principle of power, influencing domestic and international relations, social ties, and even everyday narratives. It is important to note that the market, the state, and society no longer strive for ideal equilibrium; their governance is conducted through constant disruptions of stability. Why does this happen? Because equilibrium has begun to threaten a crisis of insolvency.

History provides examples where currency devaluation was used to solve financial problems: the Weimar Republic employed it to pay off debts after World War I, and the Bretton Woods system emerged from fears that uncontrolled currency competition could undermine the political order. The 1985 Plaza Accord legitimized the devaluation of the dollar to restore economic balance in the U.S. All these cases indicate that currency mechanisms have always taken into account political and fiscal contradictions. However, the current situation is distinguished by the absence of new solutions on the horizon—only chaos and improvisation have become the primary methods for managing deteriorating socio-economic conditions.

The so-called West, which positions itself as a bastion of free-market capitalism, now boils down to two main categories: debt burden and dependence on asset prices. Essentially, these are unpaid debts and a hyperinflationary financial system that can only exist through manipulation. The situation has reached a point where it cannot be sustained under conditions that could guarantee stability. Production growth and efficiency improvements are relics of the past, and political systems are fragmented, as any attempts at stability require the artificial creation of defaults and restructurings that can only be executed through political imagination. Constant crises allow technocrats to postpone problem-solving indefinitely.

Political leadership has turned into a purely administrative apparatus. Decision-makers no longer act as independent leaders but become puppets of the financial mechanism. Politicians rarely exhibit true prudence; more often, they follow protocols. They become executors, carrying out the dictates of markets and finance rather than making independent decisions. This is a modern version of the banality of evil, automated for the financial age: a world where people no longer think, as the system has already defined what it means to "think."

Against this backdrop, authoritarian figures like Trump come to the forefront, becoming not exceptions but catalysts of disorder. They act not as independent leaders but as agents of chaos, justifying extraordinary measures and financial interventions. Their role is systemic and tied to the financial order, which now relies on destabilization.

At this moment, it is essential to recognize that "crises" become opportunities for liquidity infusions, regulatory suspensions, and the creation of mechanisms to alter narratives that align with the rapidly changing reality. An example is the response to recent fluctuations in the market capitalization of major companies like Microsoft and Nvidia, which now serve as indicators not only of technological trends but also of broader financial processes. The situation of market stress was quickly overshadowed by other events, such as the appointment of a new Fed chair. This illustrates how volatility becomes part of the structure: it hides in plain sight under narratives of instability. While we are distracted, central banks quietly expand their balance sheets and absorb government debt, reinforcing a regime in which fiat money, having lost its function as a store of value, drifts into economic void without formally collapsing.

Currently, the United States is at the center of this system of deliberate information concealment. The dollar, while remaining the world's reserve currency, is losing its former role. It is undergoing a slow devaluation—an undeclared process that is commonly ignored or regarded as a success. When Trump claims that the dollar "feels great," he is correct: a weaker dollar reduces the burden of American debt and exports inflation abroad while maintaining geopolitical influence without the political costs associated with openly acknowledging devaluation. Goods inflation is presented as a temporary phenomenon explained by supply chain issues or actions of foreign states. Thus, an 11 percent decline in the dollar per year is perceived as a normal market movement. Sharp fluctuations in gold and silver prices are viewed as technical anomalies rather than signals of systemic stress.

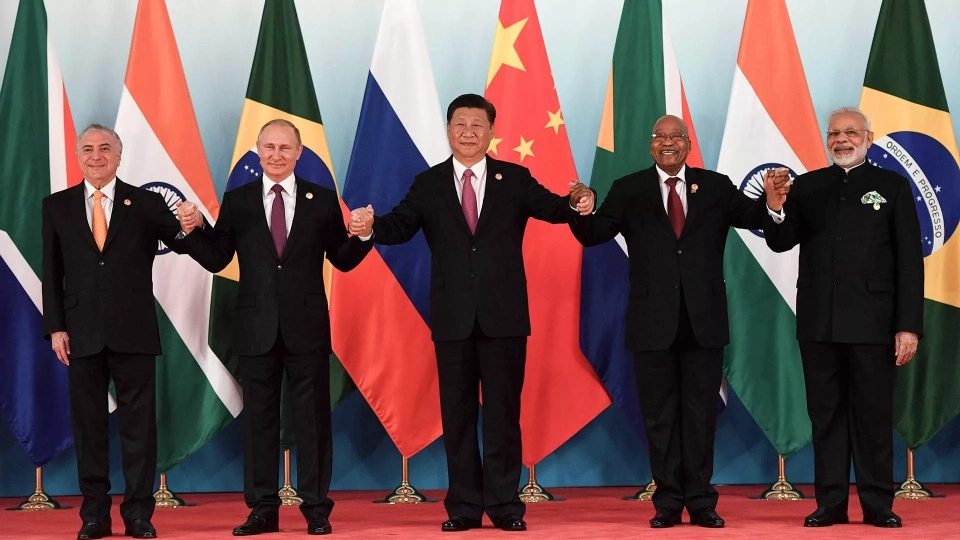

In this context, the dollar's decline is not an accident but a necessary "political error." Acknowledging this fact could undermine trust in the currency with catastrophic consequences. Therefore, inflation becomes a scapegoat for wars, viruses, and other problems. The devaluation of the dollar also has serious financial implications: it redirects capital into competing currencies and assets, intensifies inflationary pressure, and creates the risk of coordinated responses from other countries. This poses a geopolitical threat, considering that trust in the dollar underpins global trade and debt obligations.

This logic extends beyond finance. Geopolitical conflicts and domestic violence serve as justifications for implementing emergency measures and distract from structural problems. The state of emergency has become a permanent backdrop, and acknowledging its permanence would require accountability. Central banks now await disorder sufficient to legitimize the next stage: political collapse or geopolitical escalation, which will serve as a pretext for introducing new measures and expanding balance sheets.

In the United States, fiscal dysfunction has become structural. The threat of a government shutdown is no longer rare—it is part of the system's functioning, manifesting in temporary measures. Since the early 1990s, Congress has shifted to temporary resolutions, and most government shutdowns over the past three decades have occurred during this period. For example, the 35-day shutdown in 2018-2019 and the record 43-day suspension from October 1 to November 12, 2025, during which nearly a million federal employees went without pay.

This cycle continues to gain momentum. In early 2026, lawmakers faced a new funding deadline amid unpassed bills. The situation was exacerbated by public discontent over law enforcement actions, signaling a breakdown of the social contract. As a result, there was a four-day government shutdown, exemplifying the new norm—instability and dependence on short-term conflicts.

Internal tensions only exacerbate an already fragile economic environment. Conflicts and political reactions to the actions of ICE (Immigration and Customs Enforcement) indicate a loss of state control and an increasing reliance on force to maintain power. Political legitimacy and financial authority are simultaneously eroding, albeit unevenly.

The final outcome of this dynamic is not hyperinflation but a slow devaluation of fiat money, obscured by statistical manipulations. While purchasing power declines, nominal stability is maintained. Society adapts to a deteriorating quality of life, and expectations are lowered. Emergency capitalism does not collapse suddenly; it gradually loses legitimacy, replacing active management with passive crisis management. By the time devaluation becomes evident, it will be irreversible, leaving no chance for redistribution.

Amid all this, a narrative about AI as the last great growth story unfolds, supporting high stock valuations. However, even insiders acknowledge that this is merely another financial bubble disguised as innovation. When high-profile figures warn of an inevitable correction, markets ignore these warnings. In reality, AI has become a liquidity sink that could sharply contract when funding falls, triggering a massive wave of devaluation.

Ultimately, all these events create an extremely fragile architecture: central banks replace solvency with liquidity, governments exchange rhetoric for legitimacy, and markets trade leverage for growth. All these elements signal an impending crash. Dollars, euros, yen, and other currencies are involved in a slow process of re-evaluating trust. The real event is not a single crisis but a collapse of the coherence that supports this system. When trust collapses, do not expect a smooth rollback: it will crash onto the markets and society that have mistaken managed appearances for resilience. At that moment, familiar players will abandon the sinking ship. We stand at a crossroads, and if only we could see the forest for the trees.