To cease the activities of an IE, one must submit an application to the tax authority at the place of registration. The following documents are required to be attached to this application:

- an application for the cancellation of taxpayer registration (form DOC STI-164);

- an identity document;

- liquidation reports on taxes and insurance contributions, as well as a unified tax declaration, if the IE is not exempt from its submission.

Reporting is not required if there are no data on tax reports, except for the tax declaration. IEs that are exempt from submitting the tax declaration according to the legislation are also not required to present it upon termination of activities. Such IEs include:

- entrepreneurs operating in trade zones with special regimes;

- individual entrepreneurs under a unified tax with rates of 0%, 0.1%, 0.5%, and 1%;

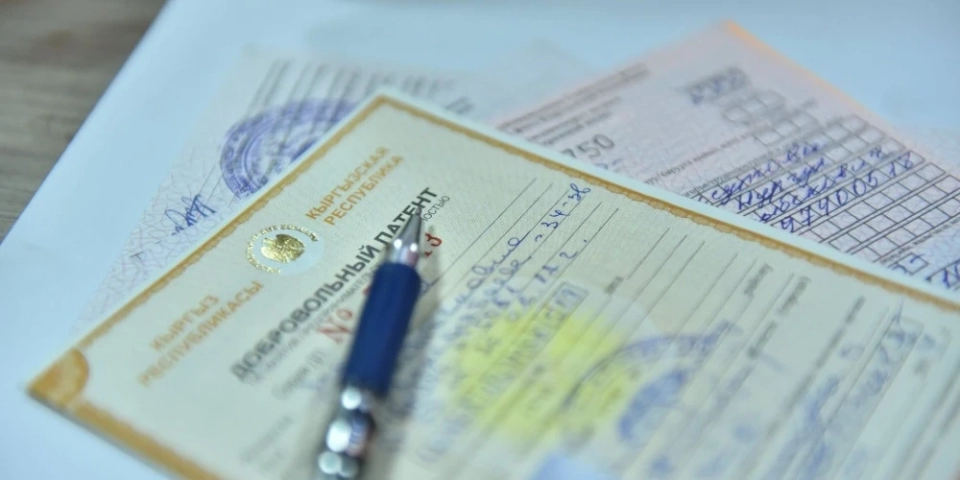

- those working under a patent;

- farmer households registered without forming a legal entity.