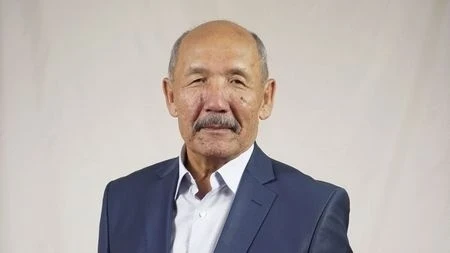

Deputy Chairman of the Board of the State Insurance Organization OJSC Baktygul Abdyjaliev shared his vision of the role of insurance in the sustainable development of Kyrgyzstan's economy on Birinchi Radio, as well as discussed current efforts to create a national reinsurance operator.

In his opinion, the last five years have been crucial for the country. Kyrgyzstan has managed not only to restore its economy but also to achieve stable growth, strengthen statehood, and begin systematic improvements in the living standards of its citizens. In this regard, insurance occupies an important place, performing a stabilizing function.

Abdyjaliev noted that "this is not something new; the entire civilized world is following this path. Without financial instruments such as insurance, it is impossible to ensure sustainable economic development."

He pointed out that mandatory housing insurance was introduced ten years ago, but due to the lack of penalties, its coverage was only 10%. The main policyholders remained representatives of the budget sector, while the population, in general, was skeptical about insurance due to insufficient informational work and a lack of political will.

The situation began to change in the context of economic growth, Abdyjaliev noted.

“We see the development of the state in all economic sectors. Kyrgyzstan ranks third in the world in GDP growth rates and leads the CIS in economic growth for several years. This is a source of pride and confirms our potential for further development,” he emphasized.

Currently, the State Insurance Organization OJSC is actively working on creating a national reinsurance operator in accordance with Presidential Decree No. 79 of March 20, 2024, "On Measures for the Development of the Insurance Market." These functions will be assigned to the state organization.

According to Abdyjaliev, the creation of a national operator is aimed at protecting and stabilizing the insurance market, as well as supporting private companies in this field.

“Insurance companies offer policies at relatively low prices but bear significant responsibility, sometimes in the billions of soms. In the case of large payouts, they may face the inability to meet their financial obligations. Therefore, it is necessary for the state to support them through the national reinsurance operator,” he explained.

More than 90% of insurance market participants responded positively to this initiative, and some private companies have already begun transferring part of their risks to the State Insurance Organization.

Abdyjaliev also pointed out that previously a significant share of risks was transferred to foreign reinsurers, which sometimes led to serious problems for Kyrgyz insurers, even to the threat of bankruptcy due to refusals to pay.

“To avoid dependence on foreign companies with their strict rules and sanctions, the state is creating a national operator here in Kyrgyzstan. This provides more transparency, reliability, and benefits for local businesses,” he added.

Since the beginning of 2024, the insurance market has begun to develop actively: the coverage of mandatory housing insurance has increased to almost 30%, and OSAGO has been successfully implemented. These mass products have helped the population better understand the benefits of insurance.

Abdyjaliev assured that the creation of a national reinsurance operator will not lead to market monopolization, but rather will contribute to its development.

“Risks should be shared. The state supports the market by providing its protection. This is beneficial for both businesses and citizens, as well as for the economy of the country as a whole,” he concluded.