Home insurance is an important tool for financial protection for homeowners, allowing them to minimize the consequences of unexpected events. In the event of a natural disaster or fire, the owner can receive compensation from the insurance company without relying on assistance from the government or other organizations. This is beneficial for both citizens and the state.

The insurance culture in several countries is significantly developed, as can be observed in countries such as the USA, Germany, Japan, Switzerland, France, and the Netherlands.

Germany

In Germany, over 90% of homes are insured, indicating a high level of insurance prevalence. Policies cover risks associated with fires, floods, storms, and other natural disasters. When obtaining a mortgage, insurance becomes almost mandatory. Locals view it not as an additional expense but as a necessary safety measure.

Japan

In Japan, where the risk of earthquakes is high, home insurance has become part of cultural traditions. There is a combined system that includes both public and private insurance, as well as special earthquake protection programs, which is an important aspect of government policy to prevent the consequences of disasters.

Switzerland

In Switzerland, home insurance is mandatory, and there are state insurance funds that promptly make payments. The population trusts the insurance system, as evidenced by a high level of satisfaction.

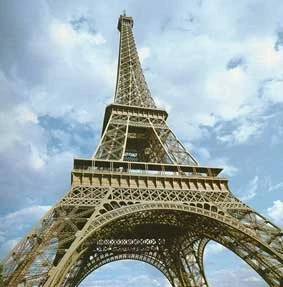

France

In France, home insurance is popular among both owners and renters, especially programs related to fire and flood protection. Insurance contracts are simple and accessible, allowing for clear definitions of responsibility for both renters and owners.

USA

In the United States, home insurance is closely linked to mortgage lending, and there are many programs tailored to different regions, which explains the high insurance rates among Americans.

Netherlands

In the Netherlands, given the high risk of flooding, home insurance is the norm. Prevention and compensation systems work effectively, providing protection for citizens.

According to the State Insurance Organization, Kyrgyzstan ranks among the leaders in the CIS in terms of home insurance levels. The state also covers significant expenses to assist victims. Despite this, the insurance culture has not yet reached high levels, but active efforts to raise awareness are leading to positive changes.

The head of the Loss Adjustment and Payments Department of the State Insurance Company, Azatbek Osmonaliev, reported that a charter capital of 1.15 billion soms has been approved to expand the home insurance program.

Conclusion

Home insurance is not a burdensome obligation but an important guarantee of peace and safety. People who insure their homes protect themselves and contribute to the resilience of society. The development of insurance culture is a sign of a responsible attitude of society towards its future.