According to data presented by MiddleAsianNews, the United States, along with its allies, intends to change the global market for critical minerals and rare earth elements.

The U.S. held a meeting with representatives from 54 countries and the European Commission, taking an important step towards reforming the global market for critical minerals, including rare earth elements.

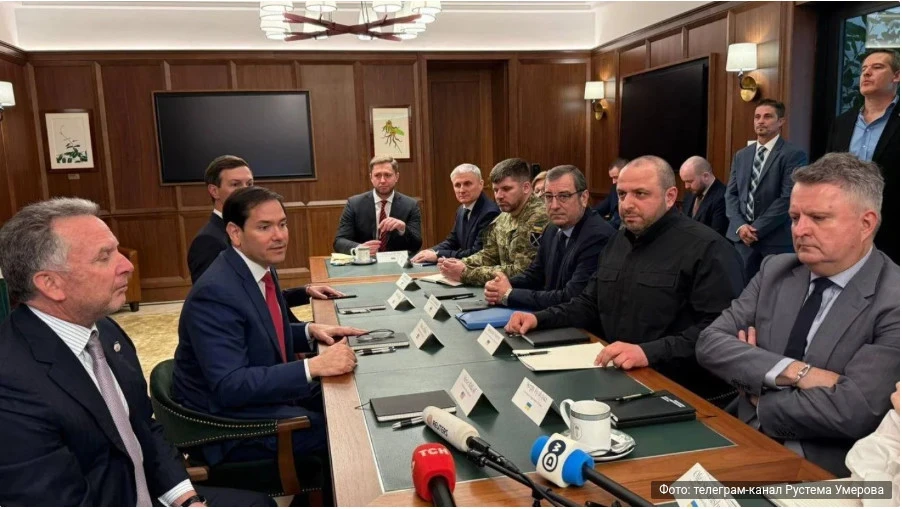

At the 2026 Ministerial Meeting on Critical Minerals, Secretary of State Marco Rubio, along with Vice President J.D. Vance and other senior officials, hosted delegations from 54 countries, including 43 foreign ministers and representatives from various agencies.

The conference featured delegations from numerous countries, including: Angola, Argentina, Armenia, Australia, Bahrain, Belgium, Bolivia, Brazil, Canada, Cook Islands, Czech Republic, Democratic Republic of the Congo, Dominican Republic, Ecuador, Estonia, European Commission, Finland, France, Germany, Greece, Guinea, India, Israel, Italy, Japan, Jordan, Kazakhstan, Kenya, Lithuania, Malaysia, Mexico, Mongolia, Morocco, New Zealand, Norway, Oman, Pakistan, Paraguay, Peru, Philippines, Poland, Qatar, South Korea, Romania, Saudi Arabia, Sierra Leone, Singapore, Sweden, Thailand, Netherlands, Ukraine, United Arab Emirates, United Kingdom, Uzbekistan, and Zambia.

The U.S. State Department emphasized that "critical minerals and rare earth elements are essential for our most advanced technologies, and their importance will grow as artificial intelligence, robotics, batteries, and autonomous devices transform our economies. Currently, the market for these resources is highly concentrated, making it vulnerable to political pressure and supply chain disruptions, which jeopardizes our interests. We intend to create new supply sources and develop reliable transportation and logistics networks to ensure the security and resilience of the global market."

"At the conference, the United States, together with partners, began to form resilient supply chains for critical minerals. New bilateral framework agreements and memoranda of understanding were signed in one day, and opportunities for public funding to support strategic mineral resource projects were announced, laying the groundwork for the launch of FORGE," stated the U.S. State Department.

The United States signed 11 new bilateral agreements on critical mineral resources with countries such as Argentina, Cook Islands, Ecuador, Guinea, Morocco, Paraguay, Peru, Philippines, UAE, UK, and Uzbekistan. Over the past five months, the U.S. has signed ten more agreements and completed negotiations on bilateral agreements with seventeen other countries, reaffirming its leadership in critical mineral diplomacy. These framework agreements create conditions for jointly addressing pricing issues, development incentives, creating fair markets, and improving access to financing.

Rubio announced the establishment of FORGE as a successor to the Mineral Security Partnership (MSP). The Republic of Korea will chair FORGE until June, facilitating the resolution of pressing issues in the global market for critical minerals. FORGE partners intend to work together at both political and project levels to promote initiatives aimed at creating resilient and reliable supply chains.

"Recognizing that governments alone cannot solve this problem, we seek close cooperation with the private sector, including the Pax Silica project, which will promote investments in the extraction and processing of minerals. The day before the ministerial meeting, we gathered leaders from the private sector and government representatives to discuss supply chain aspects and investment opportunities. Deputy Secretary of State Landau was also present at the signing of a memorandum of understanding between Glencore and the Orion Critical Mineral Consortium regarding the potential acquisition of assets in the Democratic Republic of the Congo, aligning with the goals of the strategic partnership between the U.S. and DRC," the statement noted.

Export-Import Bank of the United States (EXIM)

On February 2, President Trump announced the "Vault" project, which is an important initiative led by the chair of the Export-Import Bank of the United States (EXIM). This project represents a key step in U.S. industrial policy, creating a strategic reserve for critical minerals. The EXIM Board of Directors approved a loan of up to $10 billion for the Vault project, which is record funding to protect domestic producers from supply shocks and support the expansion of critical materials processing in the U.S.

In its activities over the past year, EXIM has issued letters of interest totaling $14.8 billion for critical mineral extraction projects, including recent amounts: $455 million for the development and processing of rare earth elements in the U.S., $400 million for lithium extraction in Arkansas, $350 million for cobalt and nickel production in Australia, and $215 million for tin extraction in the UK and Australia.

EXIM's approved critical mineral deal portfolio includes:

$10 billion – Vault Project: Establishing a strategic reserve of critical minerals in the U.S. to support domestic producers and strengthen supply chain security

$1.3 billion – Reko Diq (Pakistan): Copper and gold production

$27.4 million – 6K Additive (Pennsylvania): Titanium, nickel, and modern metal powders

$23.5 million – Amaero Advanced Materials (Tennessee): Processing of modern materials and critical metals

$15.9 million – Empire State Mines (New York): Zinc extraction and production

$11.1 million – IperionX (Virginia): Processing and production of titanium.

The Department of Energy also announced new funding and partnership opportunities for 2025, including:

$134 million for a competitive application to create a demonstration center for rare earth elements, strengthening domestic supply chains (NOFO, December 1, 2025);

$355 million to support the "Future Mine – Testbed" initiative for developing next-generation mining technologies and a pilot project for extracting critical minerals from by-products at domestic facilities (NOFO, November 14, 2025);

$50 million to create a program to accelerate the development of critical minerals and materials (NOI, August 13, 2025);

$500 million in grants for material recycling for batteries and battery production and disposal (NOI, August 13, 2025);

$40 million for reliable ore characterization using Keystone Sensing (ROCKS) (NOFO, August 25, 2025);

$20 million for the "Magnetic Acceleration Generating New Innovations" project (MAGNITO) (NOFO, August 25, 2025);

$6 million for the "Extraction and Mining Technology for Critical Materials – Gallium" project (TRACE-Ga) (PIA, September 15, 2025);

Department of Defense

Ambler Metals, $35 million equity, October 2025, Alaska;

Alcoa-Sojitz, $93 million equity, October 2025, Western Australia, $170.3 million from foreign and private investors;

Vulcan Elements, $620 million in loans, November 2025, North Carolina, $550 million equity from private investors;

ReElement, $80 million in loans, November 2025, Indiana, $200 million equity from private investors;

Korea Zinc, $1.25 billion in loans, conditionally $2.4 billion in loans in December 2025, Republic of Korea and Tennessee, $2.4 billion from private investors;

Korea Zinc, $150 million in funding, December 2025, Republic of Korea and Tennessee, $540 million from private investors;

Atalco, $150 million in funding, December 2025, St. Ann, Jamaica and Louisiana, $300 million from private investors.

U.S. International Development Finance Corporation (DFC)

During the Trump presidency, the U.S. International Development Finance Corporation invested and explored opportunities for new mining exploration deals totaling over a billion dollars, while also strengthening critical mineral supply chains for the United States and its allies, including:

$75 million in critical minerals and strategic sectors in Ukraine, which attracted an additional $75 million in government funding;

$600 million in the Orion Critical Minerals consortium for investments in critical minerals worldwide, which attracted an additional $1.2 billion in government funding;

$565 million for the extraction of heavy and light rare earth elements in Brazil;

Letter of intent to raise up to $700 million for financing the development of tungsten deposits in Kazakhstan;

Negotiations to create a joint venture with an African trading company that provided 100,000 tons of copper for the U.S. and 50,000 tons for allies, including Saudi Arabia and the UAE;

Strategic partnership to explore investment opportunities in critical mineral resources with leading companies in the Persian Gulf.

Office of the U.S. Trade Representative (USTR)

USTR presented an Action Plan for Critical Minerals with Mexico aimed at developing coordinated trade policies and mechanisms to reduce the vulnerability of critical mineral supply chains.

Additionally, USTR announced the intention of the U.S., European Commission, and Japan to create Action Plans aimed at enhancing the resilience of critical mineral supply chains.