Economic Situation

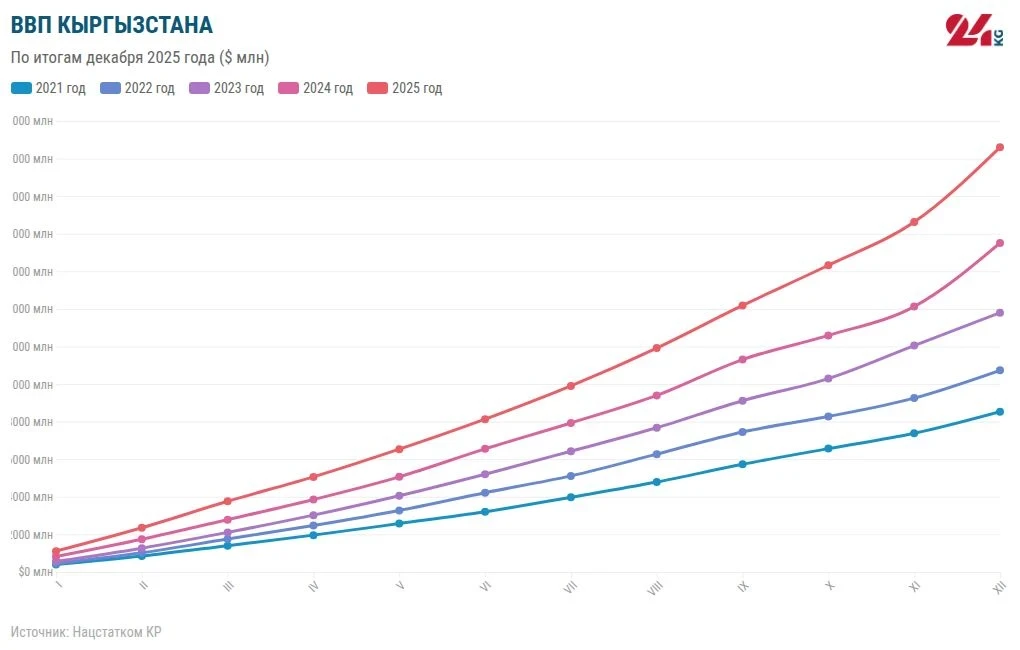

The National Bank noted that the country's economy is demonstrating high growth rates: in 2025, real GDP increased by 11.1%. The main factors contributing to this growth are the construction sector and services. Investment activity in the republic remains at a high level due to increased investments in fixed capital, which is significantly supported by the expansion of budget financing. Real incomes of citizens, the inflow of remittances, and active consumer lending contribute to the growth of consumer demand.Inflation Trends

As of January 16 of this year, inflation in Kyrgyzstan stood at 9.4%. There is a slowdown in the price growth of food products, while prices for non-food goods and services remain high, influenced by external factors. Annual tariff revisions and increased domestic demand also impact inflation.The agency emphasized that the main priority of monetary policy remains the restoration of inflation to target levels of 5-7% in the medium term, which necessitates the maintenance of tight monetary conditions.

The National Bank of Kyrgyzstan, considering the high level of liquidity in the banking sector, is actively conducting sterilization operations to regulate the money supply in the economy. In these conditions, the interbank interest rate BIR is set near the lower boundary of the National Bank's interest rate corridor, while the domestic foreign exchange market demonstrates stability.However, inflation continues to be influenced by external factors, the NB KR notes. Global food and commodity markets are characterized by high volatility, and the instability of the geopolitical situation maintains the inflationary background in several countries, including Kyrgyzstan's main trading partners, which is reflected in import prices. At the same time, internal inflationary processes are largely driven by non-monetary factors, such as planned revisions of regulated tariffs and increased domestic demand.

These circumstances require the maintenance of current monetary policy conditions until sustainable conditions for slowing inflation are established. Therefore, the discount rate of the National Bank remains at 11%.In the event of any risks to price stability, the National Bank may make adjustments to its monetary policy.