Individual entrepreneurs and individuals must fulfill this requirement by May 1.

The State Tax Service has once again drawn the attention of legal entities, as well as state and municipal employees, to the necessity of submitting a unified tax declaration by April 1, 2026.

The obligation to submit the declaration applies to the following categories:

local companies, except those funded from the budget and having no tax liabilities for property tax;

foreign organizations operating in Kyrgyzstan through permanent establishments;

state and municipal employees;

members of the Judicial Selection Council, the Central Commission for Elections and Referenda, as well as members of the board of the National Bank.

For individual entrepreneurs and individuals, the deadline for submitting the declaration will end on May 1.

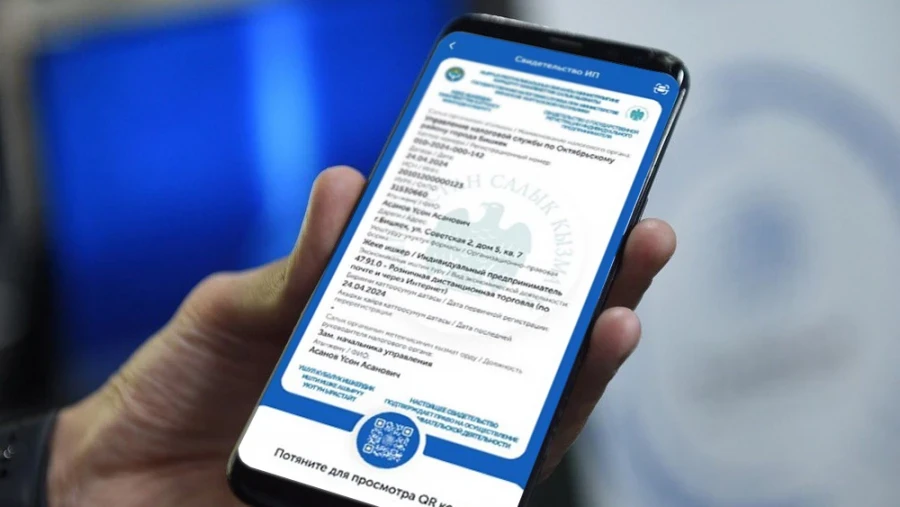

This declaration is submitted in electronic format through the "Taxpayer's Cabinet" on the website Cabinet.salyk.kg. It must include information about income and expenses, economic activities, property objects, land plots, and the total amount of taxes paid for the reporting period.

Additional clarifications can be obtained from local tax authorities, by phone at 116, or on the website www.sti.gov.kg.

Photo www