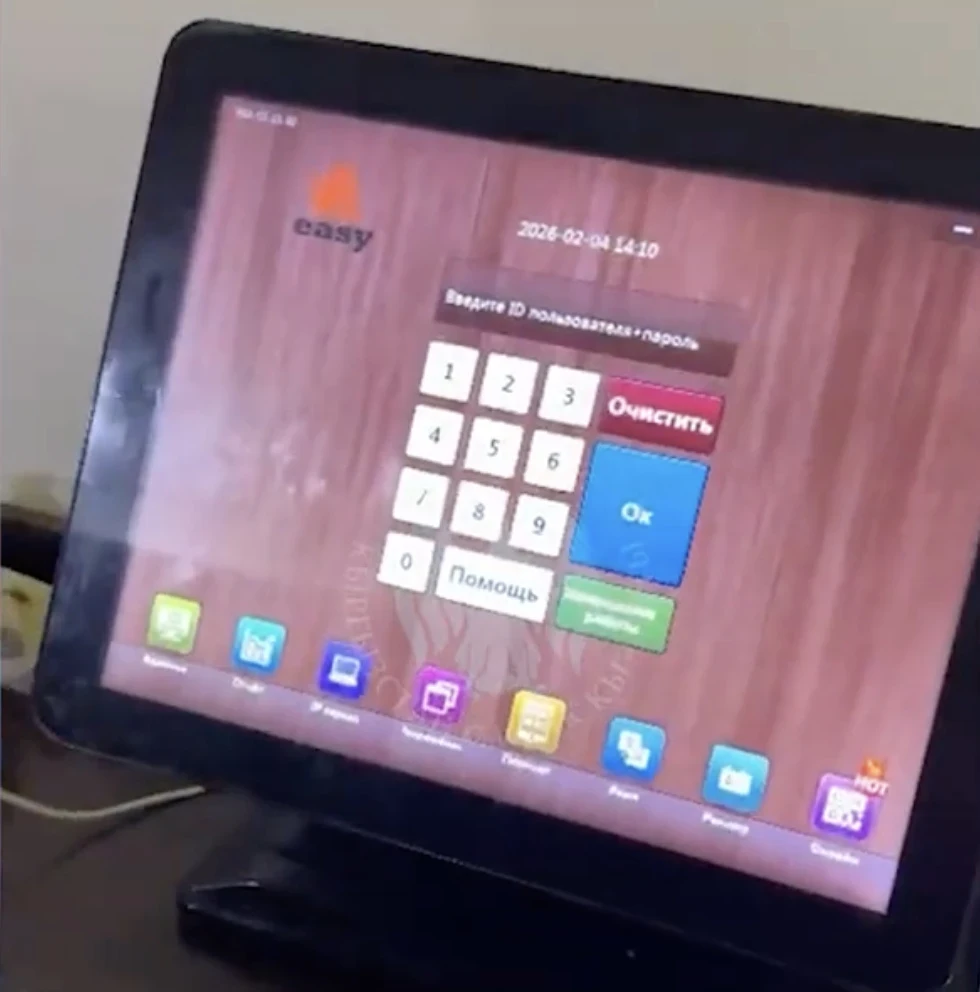

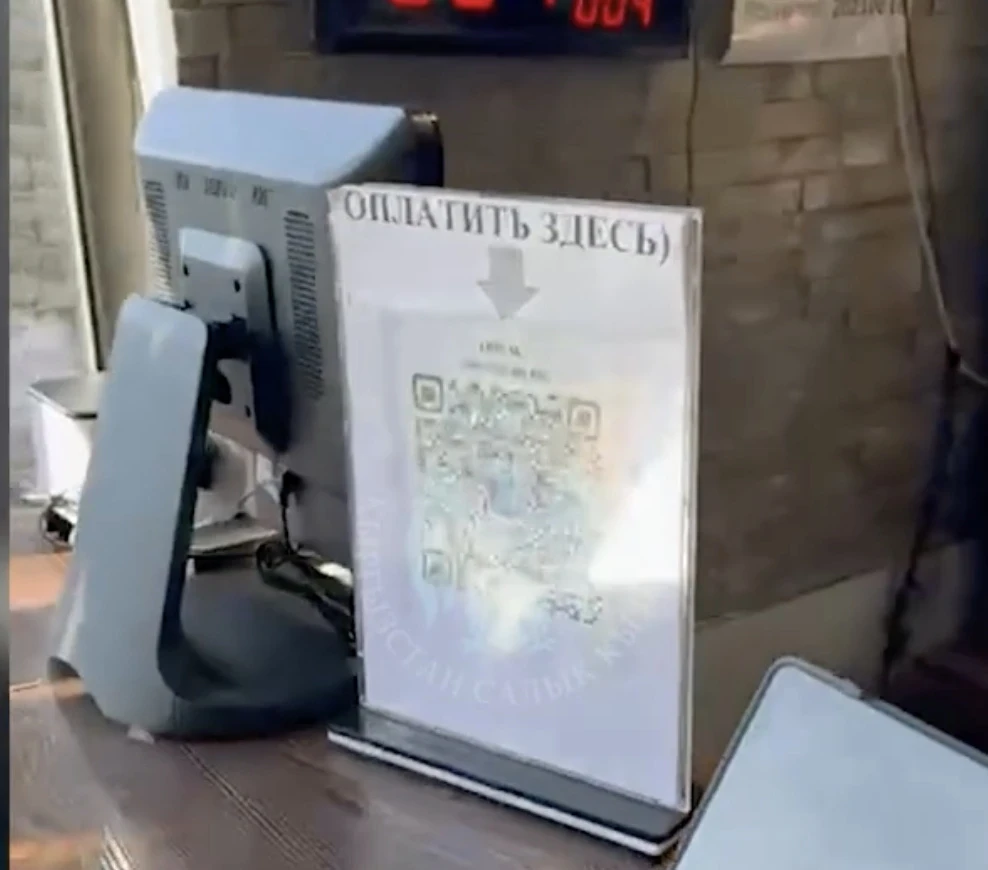

Inspections affected the café chain "Kuldja HOGO," where serious violations were found. In three establishments owned by the same owner, unregistered programs were used for so-called shadow accounting. This led to part of the sales not being recorded in the official fiscal system. Additionally, payments were made through QR codes registered to private individuals rather than to the company itself. Cash was also found in the cash registers without confirming fiscal receipts," the press release states.

The tax service intends to continue inspections and raids. The agency emphasizes that the use of double accounting and concealment of income is a violation of legislation. Such actions are subject to penalties, including fines and criminal liability in case signs of a crime are identified.