Main Proposals

The changes concern three key aspects.*****Amendments are being made to the Code on Non-Tax Revenues, allowing for the offset of overpaid amounts. Currently, only refunds are provided, and this innovation will protect taxpayers' rights and improve compliance with the Tax Code. According to the National Bank, overpayments on non-tax revenues reach 500 million soms annually, and the offset will simplify the correction process without bureaucracy.

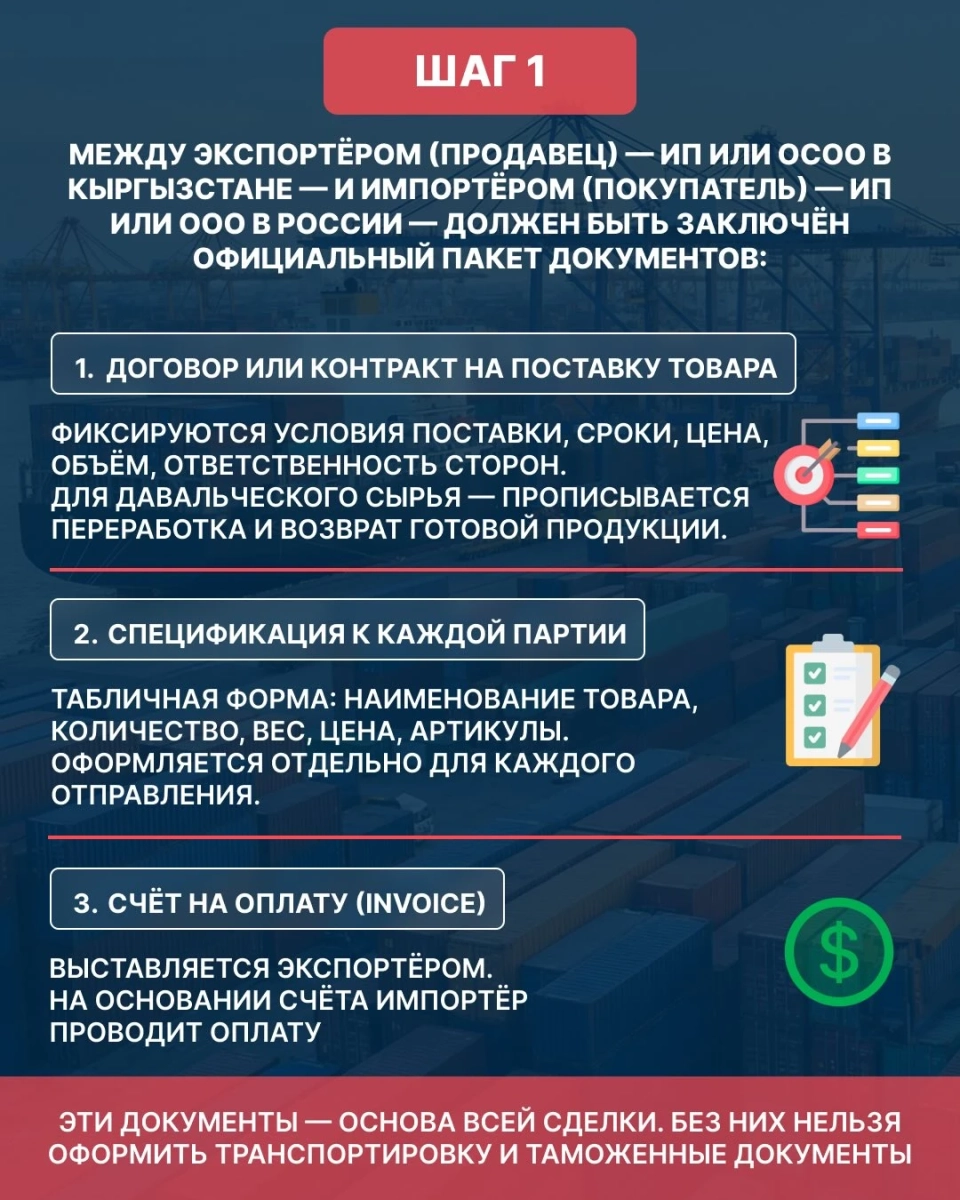

*****Tightening of liability under Article 311 of the Code on Offenses is also planned. This relates to the illegal movement of goods and vehicles across the border with EAEU without the appropriate documents. Currently, fines are up to 20,000 soms for individuals and up to 50,000 for legal entities. The new measures propose increasing fines for repeated violations to 100,000 soms and confiscation of both goods and vehicles. Developers believe this will reduce shadow imports and decrease losses, which are estimated by the customs service to be 1.2 billion soms per year.

*****The abolition of licensing for the sale of alcoholic beverages is also proposed in the new draft. The license currently costs from 10,000 soms, which creates barriers for small sellers. This change will allow producers to issue electronic invoices, improving fiscalization and helping to bring the market out of the shadows, increasing the number of sales points to 10,000.

*****Additionally, it is proposed to exempt from VAT equipment and semi-finished products used in jewelry production that are imported into the country. The Cabinet of Ministers will be granted the authority to determine the list of such goods.

*****It is also planned to exempt from VAT the sale of cars and their components produced or assembled in Kyrgyzstan. This should contribute to the development of related industries, optimize car costs, and reduce prices for finished products for consumers.

*****Finally, the changes to the Tax Code provide for the introduction of obligations for owners of state and municipal property, as well as for users of this property who are exempt from taxes, in the event of leasing objects.