The Cabinet of Ministers begins reforming transit and trade through economic zones

In the Kyrgyz Republic, a number of new proposals regarding free economic zones (FEZ) have been presented. These initiatives have been put forward for public discussion in the form of a draft law.

The document includes the introduction of new tax rates and changes to the mechanism for conditional VAT calculation on imported goods.

For FEZ residents planning to export goods to EAEU countries, special unified tax rates are proposed when using the conditional VAT regime:

- 1% — for goods with partial processing;

- 3% — for re-export of goods without changes.

These measures are aimed at stimulating production activity and attracting foreign investments.

In addition, restrictions are being introduced for companies using the conditional VAT regime. In particular, importers will be prohibited from selling fixed assets and goods purchased for their own needs within five years (60 months) from the date of import.

If this rule is violated or goods are sold on the domestic market, the taxpayer will be required to switch to the general tax regime.

At the same time, the government plans to simplify administrative procedures. The period during which a business can reapply for a preferential regime after losing it will be reduced from one year to six months.

The procedure for refunding funds will also be revised. If an entrepreneur confirms the export of part of the goods, they will be reimbursed the conditionally accrued VAT proportionally to the volume of export. The date of registration in this regime will be considered the start date of the preferential regime.

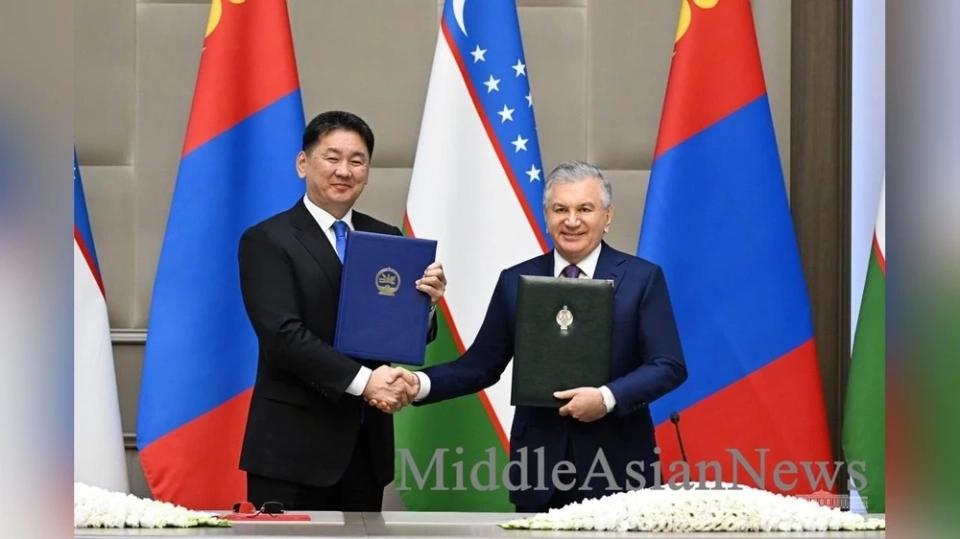

Photo www