A double accounting system and concealment of financial receipts were used in the cafe

The State Tax Service reported the discovery of revenue concealment amounting to 12 million soms in the "Kuldja HOGO" cafe chain located in Bishkek.

According to tax officials, violations were found during an inspection conducted as part of a pilot project for the implementation of fiscal software that automatically transmits sales data to government authorities.

The STS noted that in three establishments owned by the same owner, unregistered programs were used for maintaining so-called "shadow" accounting, meaning that part of the sales was not reflected in official reports.

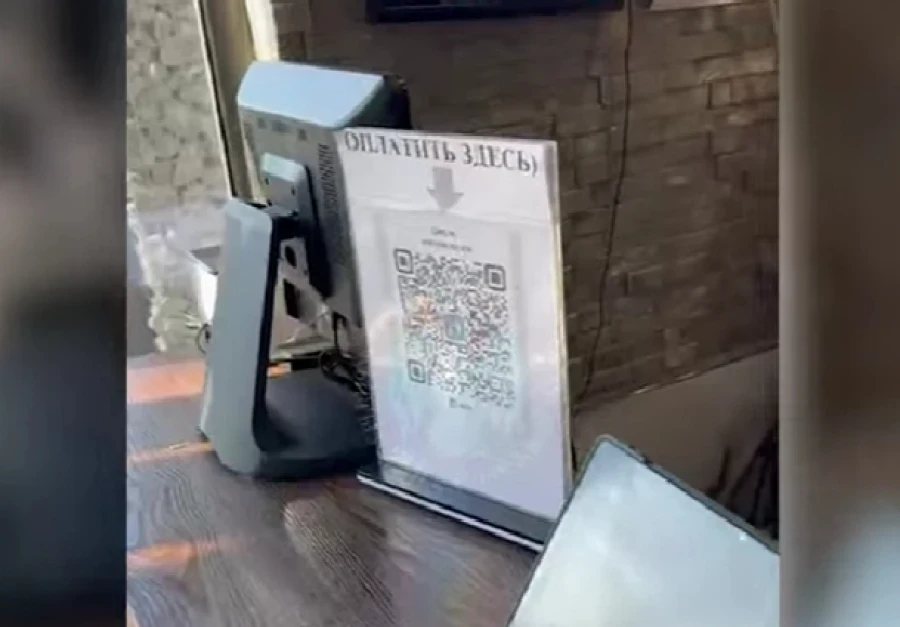

Additionally, it was established that payments were made via QR codes registered to private individuals, and cash was found in the cash register that could not be confirmed by fiscal receipts.

According to preliminary data, since connecting to the fiscal system, the unaccounted revenue amounted to about 12 million soms, and the estimated amount of unpaid taxes is approximately 648 thousand soms, the agency reported.

The STS also reminded that double accounting and concealment of income violate the law and can lead to serious consequences, including fines and criminal penalties.

Photo www