Shadow accounting and hidden revenue of 12 million soms uncovered in a café in Bishkek

According to information from the STS, three cafés owned by the same proprietor were found to be using unauthorized programs for shadow accounting, which allowed them to conceal part of their revenue from official accounting. It was also established that employees were accepting payments via QR codes registered to private individuals, which is a violation of current legislation.

During the inspection, cash was found in the establishments' cash registers; however, confirming fiscal receipts were absent. The preliminary estimate of concealed revenue amounts to approximately 12 million soms, while the tax arrears are approximately 648 thousand soms.

The tax authority emphasizes that concealing income and maintaining double accounting are serious offenses that can lead to both administrative and criminal consequences. The inspection work is ongoing.

Read also:

In Bishkek, the CEO of "MBE Group" was detained, the founder has been put on the wanted list.

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Employees of the State Committee for National Security conducted mass arrests of participants in economic smuggling.

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Mass Arrests of Economic Smuggling Participants Conducted by the State Committee for National Security of the Kyrgyz Republic

Curl error: Operation timed out after 120000 milliseconds with 0 bytes received...

Channel for transporting contraband goods and household appliances in Batken region intercepted

In the Batken region, on the territory of the Leilek district, employees of the State Committee...

Employees of weight and dimensional control detained for extorting money from drivers

As a result of operational actions, employees of the weight and dimension control on the...

A network of webcam studios with cryptocurrency fund transfers has been uncovered in Bishkek.

In Bishkek and Kazakhstan, suspects who created a network of webcam studios have been detained....

In Bishkek, the organization of closed private parties for adults has been shut down.

In Bishkek, the activities of a group organizing closed events for adults were stopped, according...

Torture of Patients. The State National Security Committee Reveals Shocking Rehabilitation Methods at the "Path to Life" Center

The GKNB of the Kyrgyz Republic discovered facts of torture in the rehabilitation center...

Scandal with "correctional" rehabs in Russia. There may have been a teenager from Kyrgyzstan there.

In Dedovsk, located in the Moscow region, a rehabilitation center was discovered where acts of...

They Even Kick the Downed. Kamchybek Tashiev is Asked to Respond to the "System" in One of the Schools

Maria Tsareva, a resident of Karakol, appealed to the head of the State Committee for National...

Underground Workshop with Counterfeit Alcohol Discovered in Bishkek

As a result of an inspection conducted by the employees of the State Tax Service, an illegal...

The guy was turned into a homeless person, deprived of his apartment in the center. A police officer is involved in the case.

The editorial office of Kaktus.media was contacted by a resident of Bishkek, Elena Chasova, who...

Bloggers, Journalists, Officials. Who the Ministry of Internal Affairs and the State Committee for National Security Detained in 2025

The year 2025 turned out to be filled with arrests among officials, activists, and bloggers....

In Bishkek, members of an underground group providing intimate services in hotels have been detained

In Bishkek, the activities of a secret group engaged in providing intimate services have been...

In Bishkek, a karaoke bar was shut down for providing intimate services to foreigners

In Bishkek, a karaoke bar that provided intimate services for foreign clients has been shut down....

Foreign Students Detained in Osh for Presenting Drivers with Fake Checks

In Osh, employees of the service responsible for countering extremism and migration violations...

Corruption in Forensic Psychiatry: The State National Security Committee Detained Six Expert Doctors

During the investigation conducted by the State National Security Committee, an organized...

The GKNB uncovered a scheme for the sale of coal intended for social facilities.

The State National Security Committee (GKNB) reported the uncovering of a scheme related to the...

Underground Clinics and Medications Discovered in Bishkek

During tax control in Bishkek, illegal medical institutions and a significant batch of unapproved...

The police brought in 29 people in connection with a fight between residents of two villages in the Issyk-Ata district.

On January 2, 2026, the duty unit of the Main Internal Affairs Directorate of the Chui Region...

Operation "Den". More than 40 women providing intimate services were taken to the police.

From November 5 to 10 of this year, the staff of the Main Internal Affairs Department of Bishkek...

Patients were beaten with stun guns and kept in shackles at a private clinic in Bishkek

Photo by the State Committee for National Security (GKNB). The rehabilitation center where...

In cafes, workshops, and construction sites: the Ministry of Internal Affairs identified hundreds of violations among foreigners

From November to December 2025, the Main Directorate for Criminal Investigation of the Ministry of...

GKNB: The State Has Reclaimed Sold Assets and Land of the Coal Company

According to information from the press center of the State Committee for National Security,...

In the Issyk-Kul District, suspects in illegal fishing have been detained

On October 31, information was received at the Internal Affairs Department of the Issyk-Kul region...

In Bishkek, an underground workshop for producing counterfeit vodka was discovered

As a result of a raid conducted by the employees of the State Tax Service, an illegal production...

The State Committee for National Security disrupted a large scheme: 32 hospital buildings were sold illegally.

In the Jalal-Abad region, the State National Security Committee (GKNB) has uncovered facts of...

The GKNB has detained the head of the Ministry of Internal Affairs Security Service of the Kyrgyz Republic.

On December 10, 2025, employees of the GKNB of the Kyrgyz Republic detained police colonel A.T.A.,...

The State Committee for National Security revealed the fact of illegal alienation of property from the society of the blind and deaf in Bishkek.

The State National Security Committee (GKNB) continues its work to identify and prevent corrupt...

The State Committee for National Security has uncovered a corruption scheme in the admission process to a military educational institution.

As a result of the joint efforts of the State Committee for National Security (GKNB) and the...

Kamchybek Tashiev opened a new building for the special unit "Alpha"

On December 25, Kamchybek Tashiev, head of the State Committee for National Security (GKNB),...

Violations Found in the Operation of Pawnshops in Karakol

A check of pawnshops in Karakol was conducted, organized by the State Committee for National...

Drivers of three BMWs detained in Bishkek for auto hooliganism

In Bishkek, the police detained the drivers of three BMW cars on charges of auto hooliganism and...

In Bishkek, anti-cinemas have been identified that allowed children access to 18+ content

In Bishkek, law enforcement agencies conducted inspections of establishments operating in the...

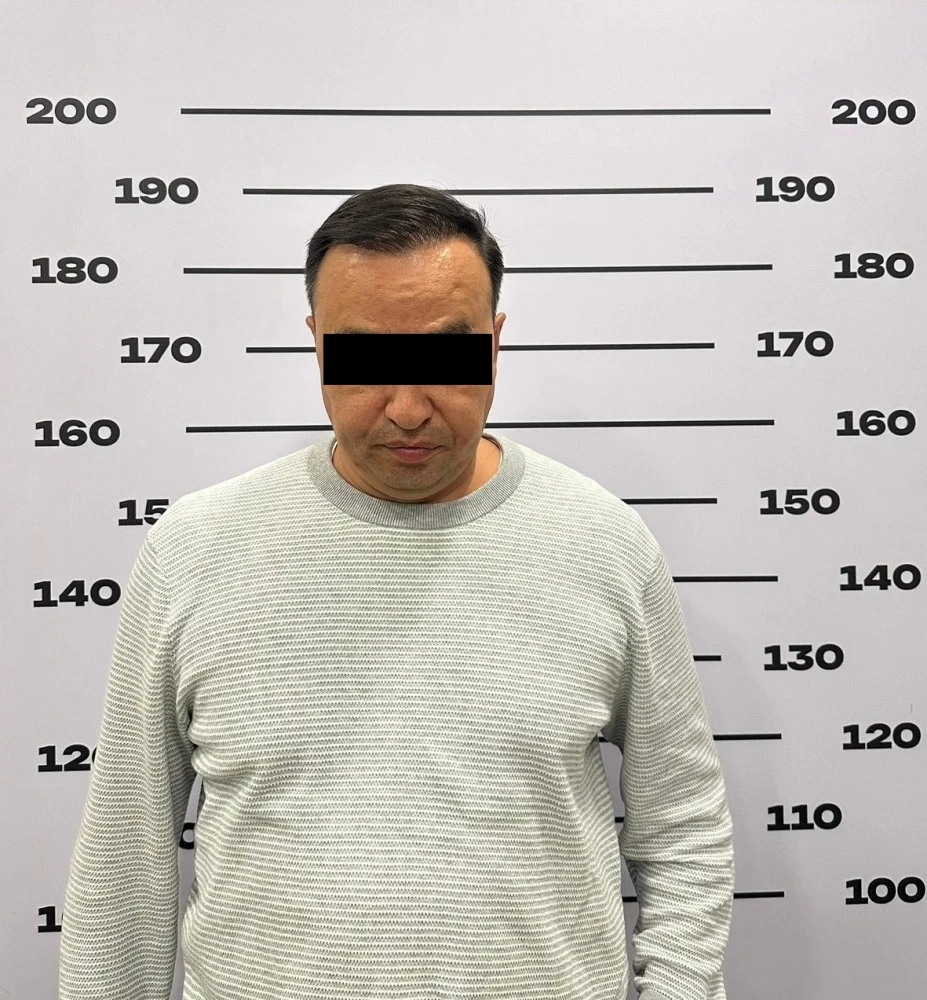

The State National Security Committee detained the owner of a pawnshop chain and displayed the pledged property of clients.

The detained suspect. Photo by the State National Security Committee. In Bishkek, S. M. A., the...

Family of 87-Year-Old Woman with Dementia Claims She Was Deceived and Her Home Was Taken

Svetlana Prokofyeva, who is already 87 years old, suffers from dementia caused by Alzheimer's...

In Osh, foreign students presenting fake tickets on buses were identified

According to the press service of the Osh Internal Affairs Department, employees of the service for...

Law enforcement reported the detention of members of the REO "Hizb ut-Tahrir al-Islami"

In the Batken region, as a result of a criminal investigation into the "Creation and Financing...

An employee of the GKNB and his friend accused of fraud. The police and the prosecutor's office are closing the case.

A resident of Bishkek, Ravshan Kanbekov, contacted the Kaktus.media editorial office with a...

In Kyrgyzstan, the organizer of a financial pyramid operating under the brand "SkyWay" has been detained.

In Kyrgyzstan, the organizer of a financial pyramid operating under the brand "SkyWay"...

In the Issyk-Ata District, lands associated with Kolbaev's organized crime group were found

During the investigation, the State Committee for National Security (GKNB) uncovered facts of...

In Batken, a citizen was detained for attempting to smuggle cattle into Tajikistan

The employees of the Border Service of the State Committee for National Security of the Kyrgyz...

The title translates to: "The 'Night at the Museum-2014' event took place in Bishkek."

Last weekend, the State Historical Museum opened its doors with a special program - a night event....