Photo 24.kg. Economist Arsen Imankulov

1. GDP Growth: 9–10% per year and 13.1% in the first quarter

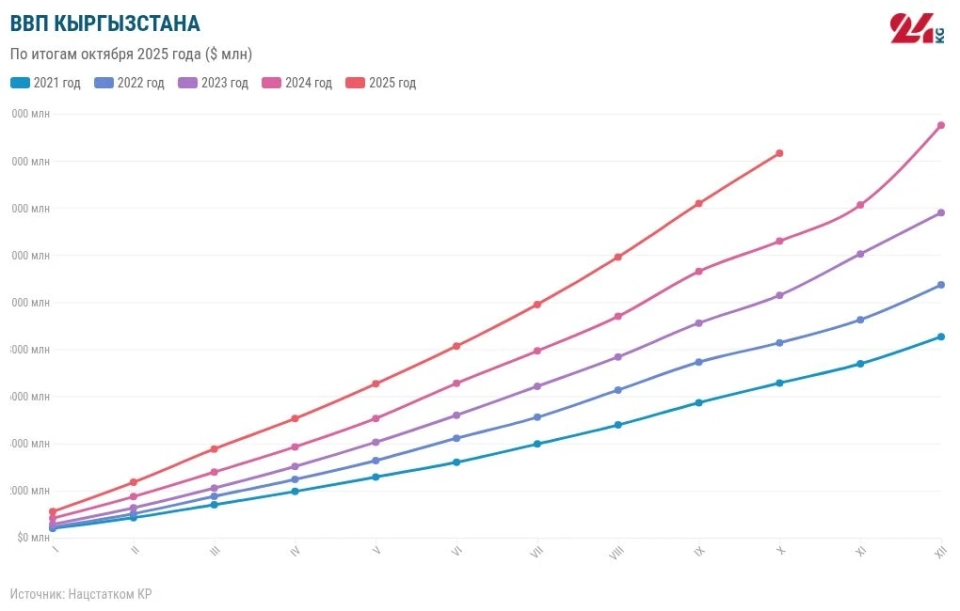

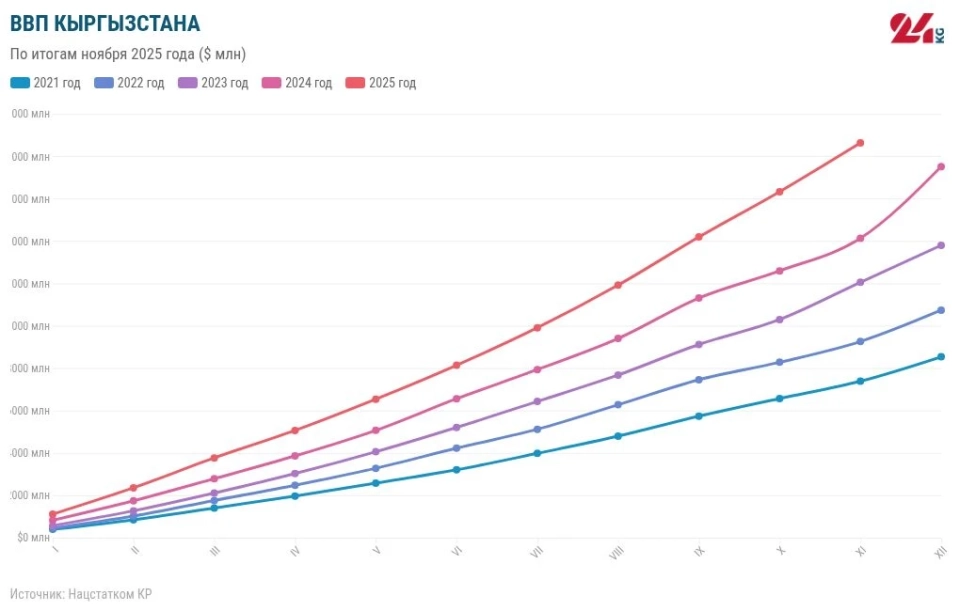

In the first quarter of 2025, the National Statistical Committee recorded GDP growth of 13.1%. This attracted the attention of regional and international media, which began to speak of a new "Asian tiger." From January to November, Kyrgyzstan's economy grew by 10%, repeating the record of 2024 and confirming the country's leadership in the EAEU in this indicator.

Opinion: The dynamic growth of the economy is a significant achievement. The main success factors are the construction sector, re-export, remittances from migrants, and processes related to the legalization of the economy. However, these drivers may be unstable, and there is a risk of slowing growth rates. It is important how the government will be able to use this situation to implement structural changes in the economy.

2. Energy Crisis: Emotions vs. Rational Consumption

The autumn of 2025 was marked by a worsening electricity deficit. Restrictions affected both businesses and government institutions due to critically low water levels in the Toktogul reservoir.

Photo from the internet. Energy crisis: emotions vs. rational consumption

Opinion: The initial measures taken by the government did not receive approval from the population. Despite widespread opinions, the interests of citizens matter, and the authorities began to show flexibility. The crisis was not resolved, but the authorities gradually started to explain the situation and introduce reasonable restrictions for businesses and government structures, establishing a dialogue with the population.

The government is actively working: Kazakhstan and Uzbekistan agreed to supply electricity to Kyrgyzstan during the autumn-winter period. This is not an act of goodwill, but a common goal—to accumulate water in Toktogul by spring.

Active work has also begun on launching small hydropower plants and alternative energy projects, modernizing previously built facilities, and considering the construction of a new 500-megawatt thermal power plant, the Kambarata hydropower plant, and others. The light at the end of the tunnel is becoming increasingly evident.

3. Record Tax Revenues – Wealth for the State and Its Citizens

The tax service has, for the first time in the history of independent Kyrgyzstan, fulfilled the tax collection plan ahead of schedule. It was expected that 268 billion soms would be collected in 2025, but 275 billion soms were collected in 11 months.

Opinion: In recent years, the growth of tax revenues has consistently outpaced economic growth rates, and their share in GDP is increasing. This indicates that along with economic growth, the shadow sector is also decreasing. Previously, many people evaded taxes; however, the government is actively working to reduce this issue.

This has its pros and cons. On the one hand, a legal economy leads to greater fairness in taxation and increased budget revenues, allowing the state to fulfill its social functions. On the other hand, the growth of tax revenues is not always associated with new businesses, but often with exiting the shadow economy, which can lead to increased tax burdens and reduced incomes for the population, especially among small and micro businesses.

It is important to consider that significant GDP growth is also partially due to not real growth, but the exit from the shadow of those companies and sectors that were previously not accounted for in statistics.

Arsen Imankulov

4. First Placement of Sovereign Eurobonds – $700 Million for the Kyrgyz Economy

In May, Kyrgyzstan issued sovereign eurobonds on international financial markets for the first time, attracting $700 million for a five-year term at an interest rate of 7.75% per annum.

Opinion: The country attracted funds from foreign investors through international markets. This differs from conventional loans, as we received funding for the first time not from state but from private investors, which is a more expensive option.

Nevertheless, this also indicates confidence in the economy of Kyrgyzstan: investors are willing to invest their funds only in projects they consider safe. Such mechanisms are widespread in the world, and the fact that Kyrgyzstan has begun to use them opens up new opportunities for financing large economic projects in the future, remaining independent from state loans.

5. Boom in Construction and Mortgage Lending

The construction sector became the fastest-growing part of Kyrgyzstan's economy in 2025. New roads, houses, and social facilities became noticeable to everyone.

Photo from the internet. Boom in construction and mortgage lending

Opinion: This is primarily related to government investments in infrastructure, social facilities, and housing. In the case of roads and infrastructure, funding comes directly from the budget, while in the real estate sector, the situation is somewhat different.

By the end of the first half of 2025, the volume of issued mortgage loans increased by almost 70%. This is a significant growth. In neighboring countries, the growth of mortgage lending has been more modest: in Uzbekistan – 37.1%, in Kazakhstan – 24.9%.

Government investments in construction are not a bad thing. This path has been taken by many developed countries and contributes to the creation of infrastructure for economic growth, stimulates tourism and trade, and has a good multiplicative effect, supporting the production of construction materials, and so on.

However, this growth tool is not infinite. Sooner or later, the population will become saturated with the supply of apartments at current prices, and it will be necessary to implement more favorable schemes and increase budget expenditures to stimulate demand.

6. US Sanctions Against Kyrgyz Companies and Banks – The End of the "Golden" Era of Re-export?

In 2025, the US Department of the Treasury imposed sanctions on commercial companies and several banks in Kyrgyzstan, accusing them of facilitating the circumvention of sanctions against Russia. The National Bank and the government are negotiating the lifting of sanctions and have officially appealed to the US for this.

Opinion: This event was a significant blow to the country's financial and credit sector. In such a situation, it does not matter whether the bank is guilty. However, thanks to the preventive measures taken by the government and the National Bank, the mention of Kyrgyzstan in the lists of violators has been reduced to zero.

It is clear that Kyrgyzstan is trying to balance between Moscow and Washington. On the one hand, there is a risk of worsening relations with the West, and on the other hand, the importance of economic cooperation with Russia.

Sanction risks have negatively affected foreign trade, with exports of goods decreasing by almost 40%. Most of this reduction is attributed to Russia. It is likely that part of the exports has gone into the "gray" zone, and some have become impossible.

7. Kyrgyzstan in the Crypto Industry: From Outsiders to Top 20 Global Leaders

The cryptocurrency turnover in Kyrgyzstan increased from less than $100 million in 2022 to $9.85 billion in the first half of 2025. Over three years, growth has exceeded 160 times! The authorities issued a license for the creation of a crypto bank, plan to create a cryptocurrency reserve, and launched a national stablecoin KGST. As a result, in 2025, Kyrgyzstan ranked 19th in the Global Cryptocurrency Adoption Index.

Opinion: What does this mean for ordinary citizens? At the moment — nothing special. According to official sources, about 96% of the turnover in Kyrgyzstan's market consists of exchange operations, which are often used for transfers between companies and international trade, including re-export transactions, for example, to Russia.

According to international rankings, in terms of the mass use of cryptocurrencies among retail players, Kyrgyzstan ranks 60th in the world. This allows us to conclude that the government's actions are more aimed at creating infrastructure for large international projects rather than popularizing cryptocurrencies in the domestic market. Nevertheless, the authorities' desire to use new technologies and tools to attract investment to the country's economy is an important positive aspect.

The prospects for the population are that cryptocurrencies will gradually be integrated into the daily lives of Kyrgyz citizens through financial infrastructure, rather than through mass interest.

Arsen Imankulov

Banks and fintech companies are developing and implementing services for buying, storing, and selling crypto assets, integrating them into banking applications and payment ecosystems. This means that users will deal not with a "wild" market environment, but with services similar to working with currency or investment products.

The key point remains the legalization and formalization of the sector. Crypto assets cease to be a gray area and become an acceptable investment tool with clear rules: requirements for participants, identification, tax obligations, and certain protections from the state. This significantly lowers barriers for cautious private investors who were previously unwilling to take risks due to legal uncertainty.

It is important to understand that this is not about a "new people's piggy bank" or an alternative to bank deposits. Cryptocurrencies are high-risk assets, sensitive to global markets, regulatory decisions, and speculative sentiments. Therefore, their gradual integration into citizens' lives is more a story about diversification and financial literacy than about quick and guaranteed profits.

What to Expect in 2026?

Despite the impressive growth indicators of the economy over the past two to three years, most experts predict a slowdown and a return to normal rates of around 5-6% per year.

Indeed, many factors related to the multiplicative effect from construction, a decrease in re-export volumes, and a reduction in the share of shadow business will sooner or later lead to a slowdown. In a negative scenario, the decline in growth rates may be accompanied by increased inflation related to rising government expenditures on infrastructure and social programs. Nevertheless, the government still has tools to curb inflation and structurally restructure the economy.