From November 1 to 7, over 19,000 people in Kyrgyzstan used the new self-restriction mechanism for...

Starting from November 1, residents of Kyrgyzstan have been given the opportunity to impose a...

Starting from November 1, 2025, citizens will be able to use the self-restriction function on...

Starting from November 1, residents of Kyrgyzstan have the opportunity to establish a self-ban on...

At the press conference, the Minister of Digital Development and Innovative Technologies of the...

Photo 24.kg Starting from November 1, 2025, citizens of the Kyrgyz Republic will have the...

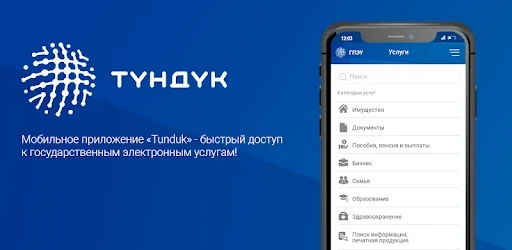

According to Aliyev, the self-ban mechanism will be activated through the Tunduk application, and...

In early November, more than 19 thousand citizens of Kyrgyzstan used the mobile application...

The Deputy Chairman of the National Bank, Bektur Aliyev, announced at a press conference in Bishkek...

To activate the self-ban mechanism on lending, you can use the Tunduk application. Starting from...

On October 30, in Bishkek, during a press conference, Deputy Chairman of the Board of the NBKR...

In order to protect citizens from fraudulent activities on the internet, the National Bank of the...

According to information from the Ministry of Digital Development, a self-ban on lending is a free...

- In a live broadcast, Anara Sabyrbek kyzy, the chief specialist of the financial literacy group at...

- The self-ban on credit can only be lifted after 12 hours. This statement was made by the Minister...

Recent reports indicate that scammers are using WhatsApp to call citizens of Kyrgyzstan, posing as...

- On the air, Rustam Sarybaev, head of the Academy of Sustainable Development at the Union of...

In the "Tündük" application, driver's licenses have the same legitimacy as their...

In Kyrgyzstan, a transition to the digitization of the process of obtaining driver's licenses...

The press service of the State Tax Service (STS) reported a significant increase in the number of...

- The National Bank of Kyrgyzstan, according to resolution No. 2025-P-12/55-3-(NPA) dated October...

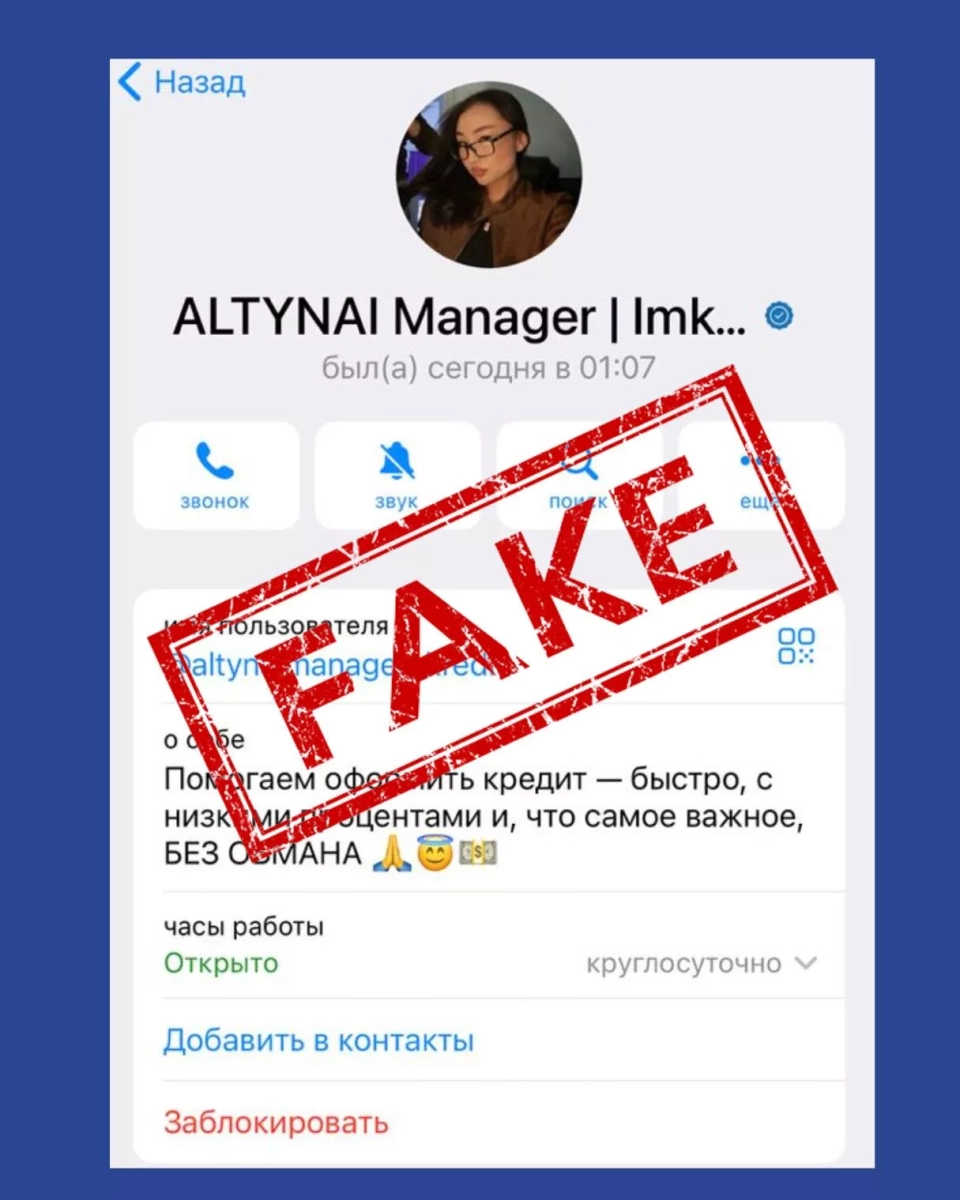

Citizens of Kyrgyzstan are receiving messages from unknown individuals via the Telegram messenger,...

- In a live broadcast on the platform of the National Bank, Ravshanbek Murzaliev, head of the group...

New features have been implemented in the electronic queue system in Kyrgyzstan, which works in...

The translation feature for the Kyrgyz language has officially appeared in the most popular online...

The Go Bus tourist service provides its clients with safe and convenient travel conditions. The...

The Ministry of Digital Development and Innovative Technologies of Kyrgyzstan has announced the...

The head of the information and technical support department of the Department of Medicines and...

The Central Commission for Elections and Referendums (CEC) informs the citizens of Kyrgyzstan, both...

The head of the information and technical support department of the Department of Pharmaceuticals...

As of today, the deadline for residents of Kyrgyzstan to check their registration on the voter...

The Ministry of Internal Affairs of the Kyrgyz Republic once again reminds about the spread of...

According to information published on the official website of the State Duma, the deadline for...

- The National Bank of Kyrgyzstan, according to the resolution dated October 23, 2025, has updated...

Mirlán Rakhmanov noted that the tax service is moving towards transforming into a service-oriented...

A new mobile application called SOS Universal has been launched, developed for women who have...

- In September 2025, more than half of the volume of bank loans in Kyrgyzstan was issued for a term...

During the opening ceremony of the residential complex "Asman Residence-4," held in the...

The Ministry of Science, Higher Education, and Innovations, in collaboration with JSC...

Unknown individuals are offering services for obtaining preferential loans with enticing...

The Central Bank of Russia plans to amend its list of fraud indicators by adding large transfers to...

The mobile application "Dary-Darmek" provides users with the ability to report inflated...